Zim sales to industry top growth company for the week, while earnings impact is seen around

alvarez/E+ via Getty Images

The week, which ended February 3, saw the Federal Reserve raise its policy rate by 25 basis points but Chairman Jerome Powell warning that the central bank still has “a lot of work to do” to reduce inflation.

industry Select SPDR industry (XLI) ended the week in the green (+1.69%). XLI was among eight, out of 11 sectors in the S&P 500, to close the week with gains. Zim topped the bulls (in our segment) this week but new earnings played a key role between most of the gainers and losers.

SPDR S&P 500 Trust ETF (spy) rose +1.64% during the week, saw ISM Manufacturing fall more than hope in January. ISM Service rose more than expected while the Manufacturing PMI showed a surprise increase in January.

The top five gainers in the industrial sector (stocks with market capitalizations over $2 billion) all rose more than +14% every week.

ZIM Integrated Shipping Service (NYSE:ZIM) +22.78%. Shares of the Israeli shipping company rose throughout the week, the most on Thursday (+7.90%). ZIM has an SA Quantitative Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Hold. The stock has a factor score of A+ for Profitability but F for Growth. Average rating of Wall Street analysts agree with one Hold own ratings, where 5 out of 7 analysts view the stock as such.

WW Grainger (GWW) +18.19%. Stocks rose the most on February 2nd +12.96% after product distributor maintenance and repair forecast continued growth for 2023. The company’s Q4 adjusted EPS beats consensus but revenuealthough developing Y/Y, was almost missed.

The SA Quantitative Rating on GWW is Hold, with a score of C+ for Momentum but D- for Valuation. Average rating of Wall Street analysts agree with Hold The same goes for ratings, where 9 out of 17 analysts view the stock equally.

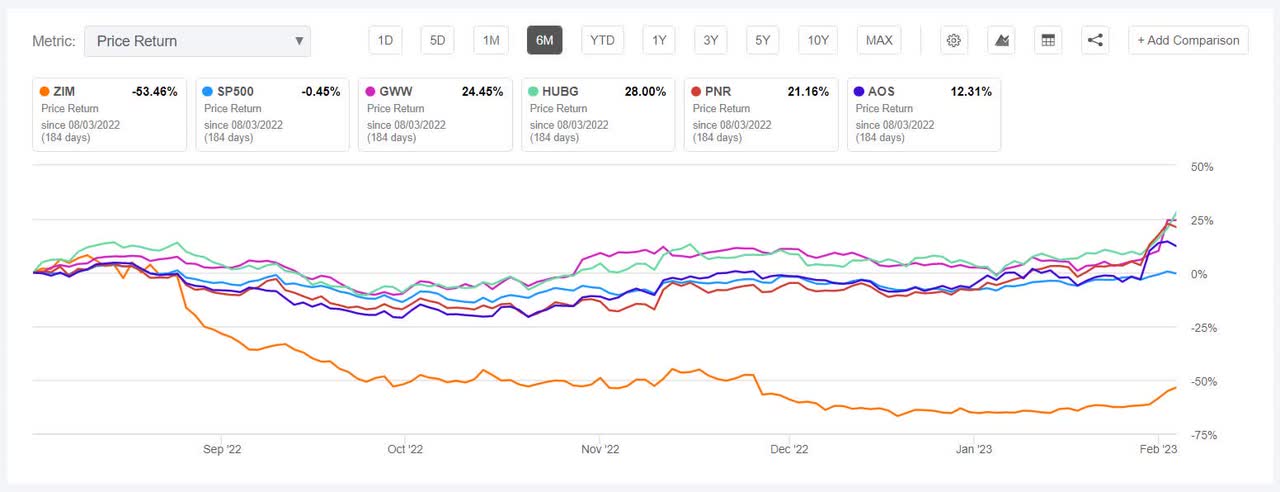

The chart below shows the last 6 months return price Movements of the top 5 gainers and SP500:

Center group (HUBG) +16.58%. Trucking service provider based in Oak Brook, Ill. income results (February 2 after market) as GAAP EPS beat estimates and stocks rallied on Friday (+6.05%).

SA Quant rating on HUBG is Buy, with a score of B+ for both Profitability and Momentum. The average rating of Wall Street analysts has Buy own rating, where 8 out of 18 analysts rate the stock as Strong Buy.

The Pentagon (PNR) +15.21%. Shares of the water solutions provider spiked on Tuesday (+9.23%) after adjusting for EPS Q4 and revenue exceeded analyst estimates. The London-based company has an SA Quantitative Rating of Holdwhile the Average Rating of Wall Street Analysts is Buy.

Shirt Smith (AOS) +14.40%. Water heater product developer Q4 results exceed Expect to send stocks increase +13.67% on Tuesday. SA quantity AOS Rating and Wall Street Analyst Average Rating, both with Hold Rating.

The top five losers this week among industrial stocks (market capitalization over $2 billion) all lost more than -6% each.

Kanzhun (NASDAQ:BZ) -12.52%. Shares of the Beijing-based online recruitment platform have risen volatility throughout 2022 with significant ups and downs. This week stocks fell the most on Fridays (-6.17%).

The Quantitative Rating of SA on BZ is Hold with a B for Profitability and a C+ for Growth. Rating in stark contrast to Wall Street Analysts’ Average Rating of Strong buywhere 9 out of 13 analysts view the stock that way.

Industrial industrialization (CNHI) -8.36%. Agricultural and construction vehicle developer shares plunge -8.83% on Thursday despite Q4 result beat the estimates. The company also notes that it will erase from Euronext Milan.

The SA Quantitative Rating on CNHI is Strong buy, with an A for Momentum and a C for Valuation. The average rating of Wall Street analysts is Buywhere 10 out of 18 analysts rate the stock as Strong Buy.

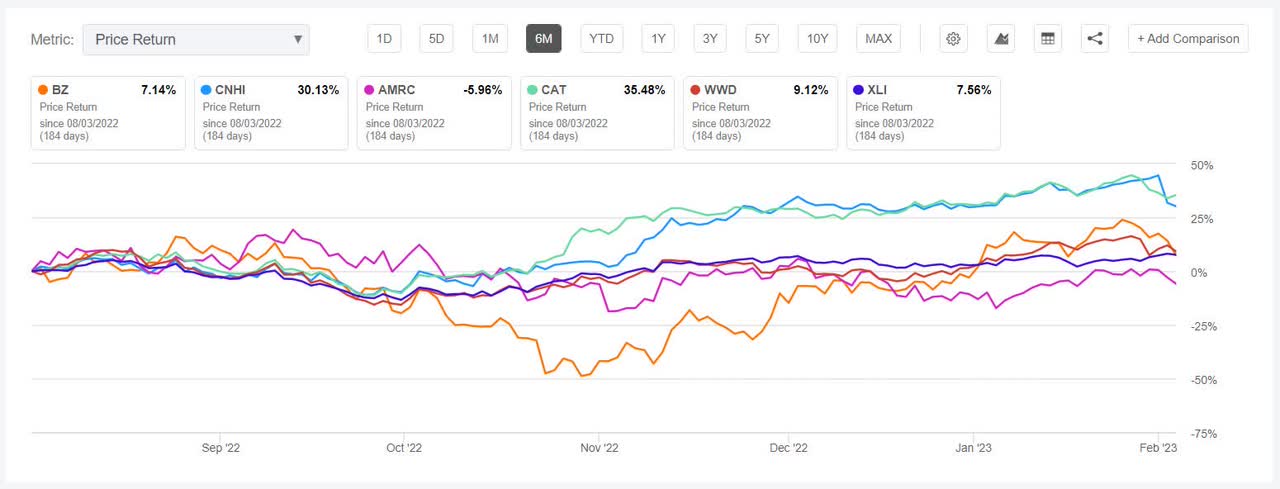

The chart below shows the last 6 months return price movements of the 5 worst losers and XLI:

Ameresco (AMRC) -6.84%. Stocks fell the most on Thursday (-3.45%). Renewable energy supply solutions provider with SA Quantitative Rating of Hold, with a D+ for Profitability but A- for Growth. Wall Street analysts’ average ratings differ from Strong buy ratings, with 9 out of 12 analysts seeing the stock that way.

caterpillar (CAT) -6.34%. Stocks fell -3.52% on Tuesday after the company said quarterly profit negatively affected by changes in the value of the US dollar, relative to currencies in other countries. Q4 is not GAAP EPS Analysts’ estimates are missed. The SA Quantitative Rating on CAT is Strong buywhile the Average Rating of Wall Street Analysts is Buy.

wood direction (WWD) -6.15%. Q1 of aerospace product manufacturer revenue beat estimates but non-GAAP EPS missed estimates leaving stocks in the red on Tuesday (-6.47%). The SA Quantitative Rating on WWD is Sellin contrast to Wall Street Analysts’ average rating of Hold.