With This Simple Year-End Change to Your Retirement Account, You Can Get a Substantial Tax Bonus

If you are a middle income earner, you may be in a much better position to be tax wise than you think.

That’s good news: You can leverage that better position to strengthen your retirement income plan for years to come. With a simple change in your retirement account structure, you can reap potentially significant long-term rewards.

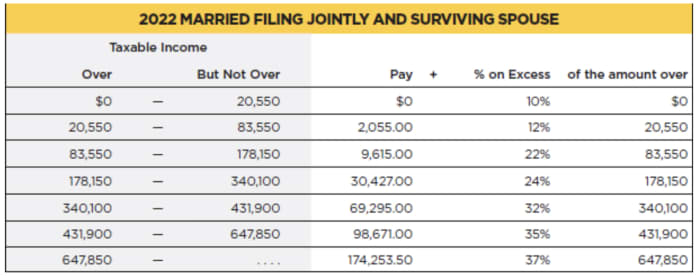

Before going into details, let’s define “middle income person”. We are focusing on 22% and 24% frames. Under current tax law — changes made since the Tax Cuts and Jobs Act of 2017, which expires after 2025 — these tax rates fall around the middle of the brackets as below:

Think of the tax bracket as a bucket

Let’s take a moment to explain how marginal tax rates work. Think of each increasing tax bracket like a bucket that is filled to the top with income taxed at that rate. When the group with the lowest speed is filled, you will fill the next group at an increasing rate.

This continues until you reach your total earnings. For example, with an annual taxable income of $178,150, the first three buckets will be filled (groups 10%, 12%, and 22%) and you will owe $30,427 in income taxes. Although $178,150 is the top of the 22% bracket, this represents an average tax rate of 17%. The math goes like this: $30,427 ÷ $178,150 = 17%.

The average tax rate is significantly lower than most people realize: If you are one of those people, congratulations on this good news! By historical comparison, 22% is low for incomes in this range.

For example, under the latest tax law — the U.S. Taxpayer Relief Act of 2012 — a married couple with an annual taxable income of $178,150 would be in the 28% marginal bracket.

Convert Roth IRA

Now, back to the simple change mentioned earlier. It’s called: Roth IRA Conversion.

A Roth IRA is an Individual Retirement Account in which contributions are made after taxes, growth is tax-free, withdrawals are tax-free, and there is no required minimum distribution (RMD).

A Roth IRA is different from a traditional IRA, in that contributions are made before taxes, growth is tax-deferred, withdrawals are considered taxable income, and withdrawals must be made through an RMD.

In other words, with a Roth IRA, you pay your taxes now — and never again. With a Traditional IRA, you get tax relief now, but pay taxes later.

Roth IRA Conversions take a Traditional IRA and convert it to a Roth. You pay tax on the conversion now, then leave the account tax-free forever.

Roth conversion can be timely with three current conditions:

1. Historically favorable tax rates in the middle bracket (22%-24% marginal rate).

2. The stock market goes down.

3. Lots of cash on the sidelines.

Convert Roth IRA

There are two simple situations where we would like to use a Roth IRA conversion. A Roth IRA conversion makes sense if certain conditions exist, the most important of which is that taxes are paid on non-IRA assets and should only be done with your tax advisor’s approval.

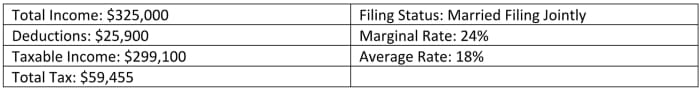

Example 1: Husband and wife 38 years old; $500,000 in a Traditional IRA. $200,000 a year in household income.

Strategy: Make an annual Roth IRA rollover of $125,000 for the next four years (until current tax law expires in 2025). After five years, all IRA assets will be tax-free. This strategy brings household income closer to the upper threshold of the 24% bracket, thus “filling” it.

Obviously, tax would be owed on all those annual conversions at a marginal rate of 24%.

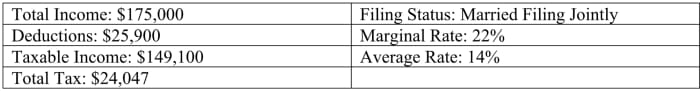

Example 2: Husband and wife 60 years old; $1 million in a traditional IRA and $75,000 a year in household income.

Strategy: Do an annual Roth conversion of $100,000 until the current law expires, (for the next four years). This allows taxes to be paid now at historically low levels and will reduce taxes owed on RMD in the future.

This strategy brings household income closer to the upper end of the 22% bracket, thus “filling” it.

Again, the conversion tax will be owed at 22%.

In a nutshell, if you’re running out of cash and fall in the middle of the tax bracket, look closely at converting a Roth IRA by December 31st.

Kevin Caldwell is the principal at Golden Road Advisor in Tampa, Fla.