Vertiv climbs to top bull industry, bleak outlook makes Generac the #1 loser

piranka

The week ending Oct. 21 saw a strong bounce from the industrial sector as the broader market also rallied. SPDR S&P 500 Trust ETF (SPY) is back in green (+ 4.66%) supported by hopes that although the Federal Reserve may price increase 75 basis points in November there could be discussions about the pace of tightening after that. YTD, SPY has dropped -21.20%.

Vertiv led the charge among gainers (in our segment), while earnings and outlook played a key role among the five worst performers this week. SPDR for industrial selection field (XLI) is too good (+ 4.66%) after a loss last week. However, YTD XLI is -16.18%.

The top five gainers in the industrial sector (stocks with market capitalizations over $2 billion) all rose more than + 14% every week. However, since the beginning of the year, only 1 out of 5 stocks kept the green color.

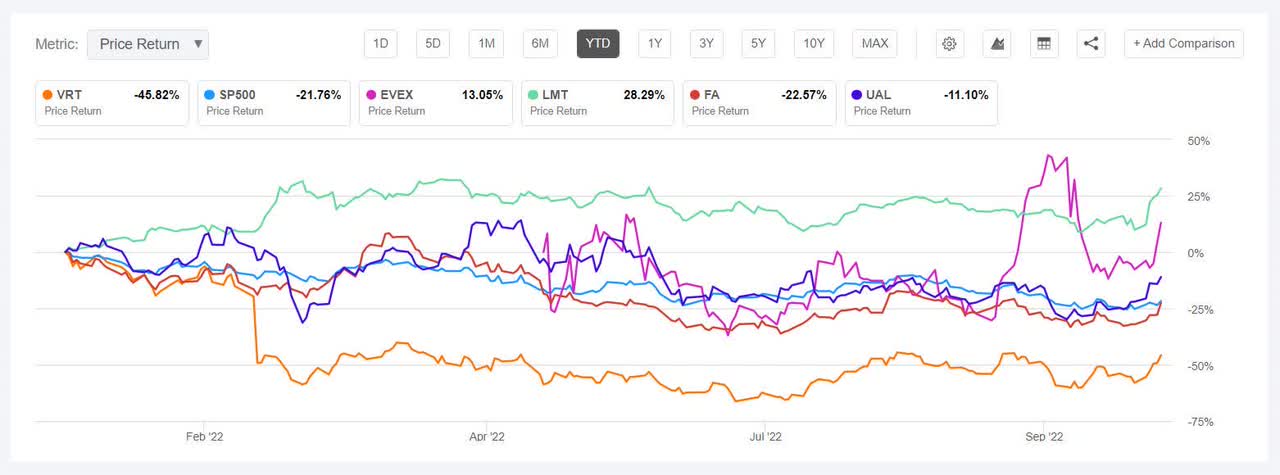

Vertiv (NYSE:VRT) + 29.26%. Stocks rise throughout the week amid Starboard activist investor disclosure 7.4% share of the Ohio-based company provides equipment/services to data centers. However, since the beginning of the year, the stock has dropped -47.10% – the most of this week’s top five gainers for the period. Vertiv is the worst industrial stocks (in this segment) in H1 (-67.12%) and also among the five person who refuses about a month ago.

The Quantum SA rating on VRT is Organization, which takes into account factors such as Momentum, Profitability, and Valuation among others. VRT has a D+ multiplier rating for both Profitability and Growth. Wall Street analysts’ average ratings differ from Buying ratings, where 4 out of 10 analysts consider the stock a Strong Buy.

Night (EVEX) + 22.53%. Shares of the Florida-based company rose the most on October 20 (+ 9.85%). The aircraft manufacturer eVTOL (electric vertical take-off and landing) has seen some profit in the past three months. Stock command industry riser (in this segment) for three consecutive weeks and in the top five riser in Q3 (+ 40%). But stocks also have some volatility due to it landing of the five worst Performers twice after a three-week increase. YTD, the stock has fallen -3.83%.

The SA number rating on the stock is Organizationwith Momentum owning a factor score of A- but Valuation with an F. Wall Street analysts’ average ratings differ from Buying rating, where out of 4 analysts, 2 are tagging the stock as Strong Buy while the other two consider the stock a Hold.

The chart below shows YTD return price performance of the top five gainers and SP500:

Lockheed Martin (LMT) + 16.74%. Defense stocks witnessed The biggest obtained a day (+ 8.69%) on October 18 as of March 2020, after Q3 EPS beat estimates and the company raised its stock repurchase authorized by $14 billion. Lockheed also top list of Pentagon contract recipients at $39.2 billion in 2021. Lockheed also there is ink contract with NASA for three Orion spacecraft and another with Our Army.

YTD, the stock has surged + 27.91%, the only one of this week’s top five gainers in green this time around. The results also appeal to Wall Street re-evaluate LMT review. The average Wall Street analyst rating of LMT is Organization with 12 out of 20 analysts tagging the stock as such. Rating SA Quant agrees with Organization ratings on its own, with an A for Motivation but an F factor for Growth.

First advantage (FA) + 14.06%. The Atlanta-based company, which provides workforce screening solutions, saw its shares rise throughout the week. However, YTD, FA refused -22.90%. The SA number rating on the stock is Organization, with a C rating for Valuation and a B+ for Profitability. This rating contrasts with the Wall Street Analyst’s Average Rating of Buyingwhere 5 out of 9 analysts consider the stock a Strong Buy.

United Airlines (UAL) + 14.01%. Shares of the Chicago-based company rose after the third quarter result Exceeded analyst and company expectations motioned continued to be confident in Q4. United CEO suggests that combined work has helped tourism request ‘permanently higher.’ SA Quant rating on UAL is Strong buy, with a factor score of A for Profitability and B for Growth. The average rating of Wall Street analysts is Buying with 6 out of 20 analysts tagging the stock as Strong Buy. YTD, stock is down -7.63%.

The top five losers this week among industrial stocks (market capitalization over $2 billion) all lost more -8% every. At the beginning of the year, all 5 stocks were in red.

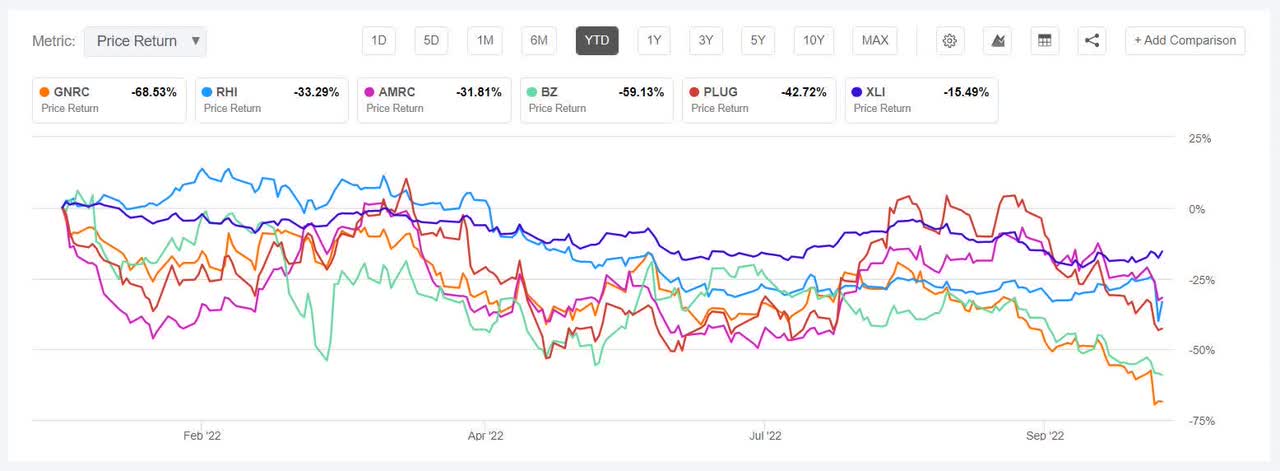

Generac (NYSE:GNRC) -20.05%. Stocks plummeted on October 19 (-28.24%) after the Wisconsin-based generator maker cut operations for the whole year opinion and Q3 revenue guidance. Falling forecasts have seen Wall Street take over work and bring a bunch low class.

GNRC has now made person who refuses list for the third week in a row. YTD, the stock has plummeted -68.89%, the most of the five worst performing artists this week for the period. The SA number rating on the stock is Organization, with a C for Valuation and an F for Momentum. Wall Street analysts’ average ratings differ from Buying ratings, where 12 out of 22 analysts consider the stock a Strong Buy.

Robert Half International (RHI) -9.86%. Shares of the California-based staffing company fell after 3rd quarter earnings and lower-than-estimated revenue. Missing Q3 results in a low class of shares to Neutral at JPMorgan. The SA number rating on the stock is Organization, with a factor score of A for Profitability but D- for Growth. Average rating of Wall Street analysts agree with Organization own ratings, where 5 out of 13 analysts view the stock as such. YTD, the stock has fallen -34.53%.

The chart below shows YTD return price performance of the five worst losers and XLI:

Ameresco (AMRC) -8.90%. Stocks have had a lot of volatility over the past few months. Framingham, a Mass.-based company that provides renewable energy solutions, is among the top five Performers for Q3 (in this segment) + 44.93%but one of the worst list in Q2. AMRC is also among the five person who refuses two weeks ago. YTD, the stock has fallen -31.25%. The average rating of Wall Street analysts is Strong buy, where 10 out of 13 analysts view the stock as such. Rank as opposed to SA Quantity Rating of Organizationwith factor grades A+ for Momentum and D- for Valuation.

Kanzhun (BZ) -8.78%. The Beijing-based company is eyeing an IPO in Hong Kong and has applied to the exchange for dual primary listing status. SA collaborator Bamboo Works wrote that the online recruitment platform is not alone in search security of a second stock exchange amid any potential regulatory challenge in the US, or any unpleasant change in Sino-US relations.

Kanzhun’s stock has also been volatile this year. BZ is in the top 5 person who refuses in Q3 (-38.60%) and witnessed its rate of ups and downs. YTD, the stock has dropped -59.20%. The SA number rating on the stock is Strong selling, with F for Valuation and D+ for Profitability. The rating is in stark contrast to the Wall Street Analyst’s Average Rating of Strong buywhere 8 out of 12 analysts tagged Strong Buy stock.

Plug in the power (PLUG) -8.54%. Shares fell the most on October 19 after the Latham, New York-based company cut operations for the whole year forecast to produce hydrogen. PLUG has landed among discount codes for the second week in a row and, compared to the beginning of the year, has fallen -41.59%. Wall Street analysts’ average rating of PLUG is Buying, where 15 out of 30 analysts consider the stock a Strong Buy. SA number ranking different from Organization ratings, with a B- for Growth and a C- for Motivation.