Vanguard says 401(k) hardship withdrawals hit ‘concerning’ all-time high

Amid persistently high inflation, a record percentage of Americans are turning their 401(k) accounts into emergency piggy banks, according to Vanguard.

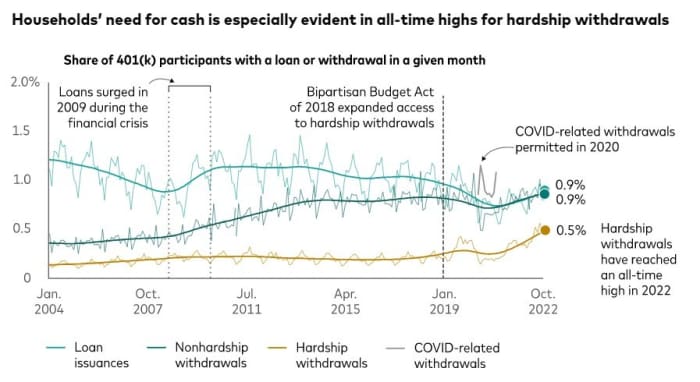

Analyzing data from a sample of the approximately 5 million employer-sponsored 401(k) accounts that Vanguard handles, the researchers found that 0.5% of account holders had difficulty withdrawing funds in the past year. October.

Vanguard, a retirement savings and wealth management expert, whose view stretches back to 2004 said it was a “worrying” all-time high.

By comparison, 0.3% of accounts experienced withdrawal difficulties last October, and in October 2020, the rate was 0.2%, Vanguard data shows. In October 2019, it was 0.4%.

At the same time, Vanguard data shows that 401(k) loans and no-hassle withdrawals are also increasing. In October, 0.9% of 401(k) plan participants had a loan and another 0.9% had a no-hassle withdrawal.

Pioneers

Fidelity Investments is also seeing an increase in the number of more than 22 million participants in the 401(k) plan it serves.

According to Mike Shamrell, the company’s vice president of thought leadership, last year 1.9 percent of Fidelity’s 401(k) fund participants withdrew their funds in hardship. He noted that from January to October 2022, the percentage of people with difficulty withdrawing was 2.2% — a number that, while “remaining relatively stable,” is the highest rate since 2020, and Inflation is one of the contributing factors.

It’s easy to guess why more and more Americans are resorting to 401(k) hardship withdrawals, analysts say. Whether the economy peaks with inflation or not, the cost of living remains high. Meanwhile, the savings interest rate decline and Credit card debt climbing.

Stock portfolios also do not provide shelter. Dow Jones Industrial Average

DIA,

has fallen more than 7% year-to-date, while the S&P 500

SPX,

fell more than 17% and heavy technology Nasdaq Composite

COMPUTER,

fell by more than 29%.

“However, the recent increase in the number of households using an employer-sponsored retirement account could be a factor,” said Fiona Greig, global head of research and investor policy at Vanguard. signs that the financial health of U.S. consumers is deteriorating.

Tax consequences

That might be putting it gently. Some of the tax language, potential tax consequences, and administrative process required to make a hardship withdrawal show how difficult it must be for a household to get on with the idea.

According to the Internal Revenue Service, for a hardship withdrawal, 401(k) account holders need to show their employer that they have an “urgent and immediate financial need” for the money. It could be due to expenses such as medical expenses, tuition and funeral expenses, IRS said.

The amount requested must be limited to the amount necessary to cover the financial need, Pay attention to tax authorities.

Generally, there is a 10% tax penalty for early withdrawals before age 59 and a half. That fee can be waived on difficult withdrawals, but distributions are still subject to income tax. What’s more, a hardship withdrawer cannot pay back their 401(k) and also cannot put it into another 401(k) plan or IRA, the tax agency noted.

The financial pressure facing US households is strongly concentrated on Capitol Hill. Senators Cory Booker, Democrat from New Jersey, and Todd Young, Republican from Indiana, are hoping for traction on one bill makes it easy for employers to set up an emergency savings account employees, just like they do with a 401(k).

The scarcity of rainy-day savings among Americans is creating a scenario where people have to switch to their retirement accounts too often, says the author and personal financial advisor. Suze Orman said at an event on Tuesday with Booker and Young.

“We don’t want a situation where people, when they need money, something happens and they need money, they go to 401(k)s, or 403(b)s, or [Thrift Savings Plan] to borrow money,” Orman said. “That would be one of the biggest mistakes they make, but that’s where they go for the emergency funds.”