US stocks could drop 10% on ‘painful trade’ before rebounding later in the year

Next year promises to be tough for investors as the threat of a recession looms, but Bank of America is offering some advice on when things could get easier.

The bad news is that things could get tougher than before, even after global stocks got off to a strong start to the year.

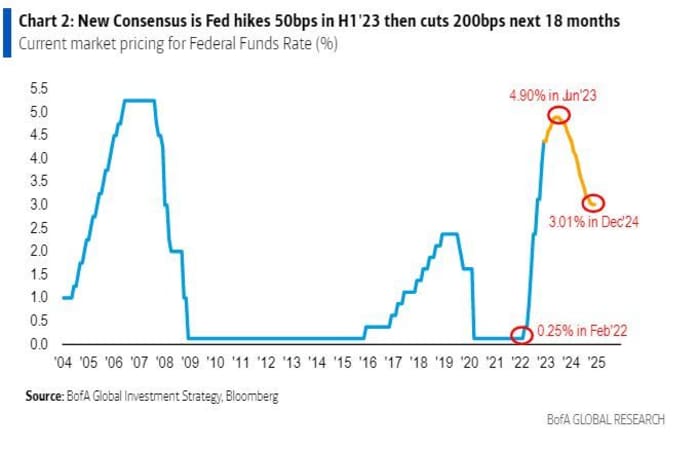

A group of strategists led by Michael Hartnett told clients in a note on Friday that US stocks could fall 10% from current levels before rebounding later this year as investors Investors began to expect a less aggressive policy stance from the Federal Reserve.

Stocks could slide as the US economy slows and corporate earnings weaken. But there may be a light at the end of the tunnel.

“Trading a recession requires patience,” he said in a note to clients on Friday.

He described the move as a “painful trade,” meaning the stock market risks losing ground until the Federal Reserve finally signals that it will begin cutting interest rates.

BofA/Bloomberg Global Investment Strategy

“The pain trade will be up until the Fed rate forecasts, yields, credit spreads bottom out Goldilocks,” he said.

Market strategists sometimes use the term “goldilocks” to refer to an economy that is neither too hot nor too cold that continues to grow without triggering violent bouts of inflation. Such an environment is often ideal for risky assets, as investors did in the decade following the financial crisis.

After economic data released on Thursday, which showed the labor market wobbling as inflation continued to fall, Hartnett said it doesn’t get much more “gold” than that.

Hartnett sees S&P 500

SPX,

is positioned to trade between 3,600 and 4,200 but expect the former to outperform the latter. That’s actually the opposite of what Barry Bannister, Stifel’s Chief Strategy Officer, said earlier this week.

Bannister sees an opportunity for a stock market recovery in the first six months of this year, but then struggles in the second half of the year. One of his concerns is a return of inflation later in the year, forcing the Fed to tighten financial conditions.

A reminder that all is really not rosy from JPMorgan JPM Chief Executive Officer Jamie Dimon, who rocked markets on Friday with a warning that “headwinds” over geopolitics and inflation are real concerns and “they may not go away” “.

Hartnett also highlighted notable inflows to investment-grade bond funds as well as emerging market bonds and stocks in her note. On the other hand, US funds were withdrawn. The European market has outperformed the US so far this year, with Euro Stoxx 50

FESX00,

rose 6.2% during that time, compared with 3.5% for the S&P 500.