TransUnion studies the risks associated with increasing credit card balances (NYSE: SYF)

mphillips007 / E + via Getty Images

Consumers are returning to pre-pandemic forms of payment, and while credit card delinquency rates are generally lower than they were before the pandemic, Transunion (NYSE:MINUS) said in a recent study it has initial signs identified when a credit card holder is in trouble.

The study looked at how early changes in payment behavior could be identified in the weeks and months leading up to the first serious bank card breach, and whether risk levels could be differentiated based on changes in liquidity signals or not. It found that the decline in liquidity of those who ended up falling more than 90 days later occurred as early as 9 to 12 months before falling into serious delinquency.

During the height of the pandemic, credit card delinquency rates remained unusually low as government relief programs helped consumers keep up with their bills. In addition, card issuers are offering waivers for cardholders affected by the pandemic. But those programs have stopped working. The only major moratorium still in effect is the suspension of student loan payments, which is due to the end on December 31st.

In August, the card issuer’s law-breaking rate and fee reduction continued slowly increase. Wall Street analysts have warned that the first signs of danger could come from Bread Financial (NYSE:BFH) (formerly Alliance Data Systems) and Capital One Financial (NYSE:COF), both of which have a large exposure to consumers with low credit scores.

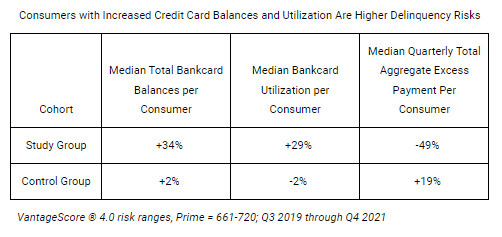

TransUnion’s research tracked the liquidity situation of 5.9 million consumers from Q3 2019 to Q4 2021 and divided the population into two groups – current consumers during the study period ( control group) and those who had more than 90 days of delinquency reduction at some point in the time frame of the analysis (study group). Source: TransUnion

Source: TransUnion

Throughout the study period, total credit card balance and total usage remained relatively flat among the control group. And while consumers in the control group made larger payments to their card balances than the minimum due, payments from those in the study group shrunk.

Paul Siegfried, senior vice president and head of card business and banking at TransUnion (MINUS). “By identifying these risk segments based on liquidity attributes, lenders can better assess their current account management strategies and credit line-up programs for growth.” develop low-risk consumers while minimizing losses from high-risk segments.”

Over the past three years, out of the five pure credit card issuers American Express (NYSE:AXP) stocks that gained the most, 22%but still lagging the S&P 500’s 24% gain. Bread Financial (BFH) the worst-performing stock, down 69%. Financial Discovery (NYSE:DFS) the stock is up 20% during this period, Capital One Financial (COF) rose 8.8% and Synchrony Financial (NYSE:SYF) decreased by 4.9%.

SA’s Quant System has a Strong Buy rating on Discover (DFS) and a Buy rating on Synchrony (SYF). AXP and COF are rated Hold, while Bread Financial (BFH) is rated Sell. See comparison stats here.

SA contributor Andrew Cournoyer explains why he is not a Discover buyer (DFS)