This trader sees a 43% drop in the S&P 500 and says take shelter in these ETFs instead.

A day after the Dow

DJIA

climbing out of bear territory on hopeful comments by Fed Chair Jerome Powell, stocks look poised to rethink that optimism, even after fresh inflation data shows prices falling light.

The Fed chief’s proposal to raise 50 basis points from 75 bp in December is not new, but investors are excited nonetheless, the Fed’s founder and CEO said. BullAndBearProfits.com, Jon Wolfenbarger. But his dovish tone could lead to looser financial conditions, leading to higher inflation and more rate hikes to keep that in check, he told MarketWatch in an interview. .

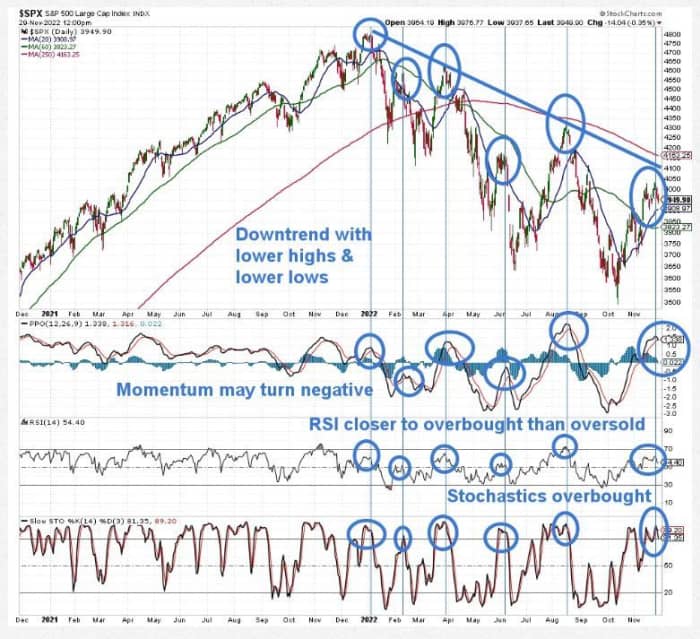

in us call of the dayThe former Wall Street investment banker warns that the cards are stacked against the stock market for the foreseeable future and offers charts to support that.

in us call of the dayThe former Wall Street investment banker warns that the cards are stacked against the stock market for the foreseeable future and offers charts to support that.

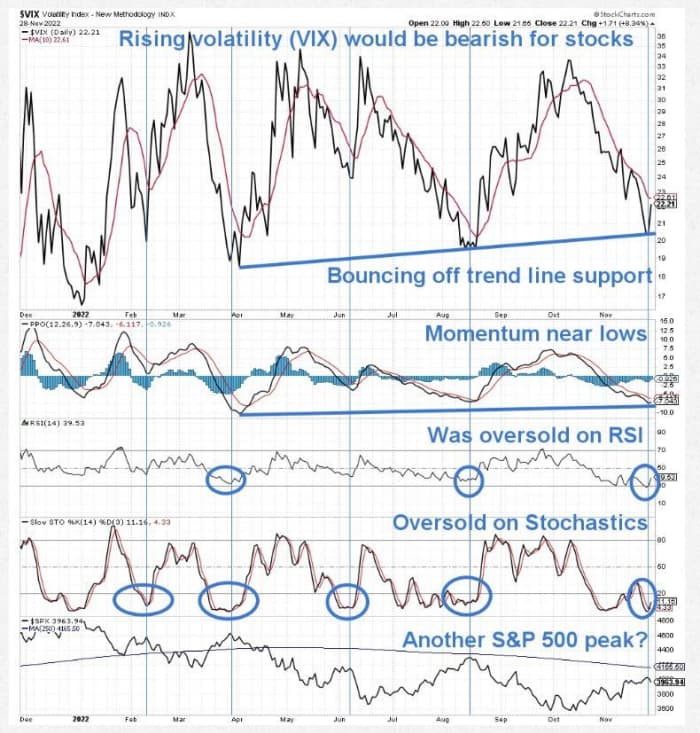

From Him latest blog post this shows CBOE Volatility Index or VIX

VIX,

bounced off a trendline that in the past had shown that index’s previous lows and this year’s tops in the S&P 500:

BullandBearProfits.com

He said:

BullandBearProfits.com

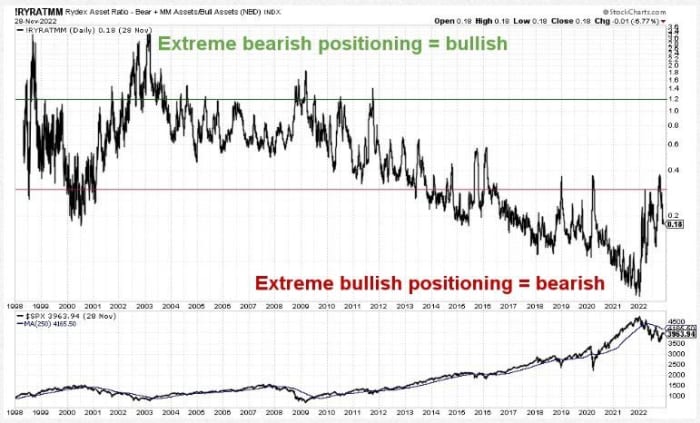

Then there’s all that upside, despite a bear market that lasted nearly a year, that Bull/bear Ratio reached historic price gains at the market top in early 2022 and is still in the middle of nowhere. in the region is very optimistic, he said.

BullandBearProfits.com

“This bearish technical setup for the stock market, combined with the over-optimistic investor sentiment as the Fed raises rates leads to a recession, suggests that the stock market could be on to a new start soon. another big bear market sell-off,” said Wolfenbarger. That recession begins on any given day and ends sometime in late 2023 or early 2024.

Far from the more upbeat forecasts seen elsewhere on Wall Street, the money manager is targeting 2,250 for the S&P 500, down 43% from current levels, although bottoming out in mid-2023 That bear market will last a total of 18 months, not far from the 17-month bear market seen during the Global Financial Crisis.

But don’t rush to speed up the shopping carts. Based on current stock market valuations close to the peaks of the 2000 and 1929 Tech Bubbles, the S&P 500 is likely to be at least 25% lower over the next 10 to 12 years, he predicts. .

His advice? Sell “risky” assets such as stocks, commodities (including energy stocks, which will drop with oil when the recession kicks in) and cryptocurrencies – highly correlated with public stocks turmeric. Treasuries will be riskier than usual during a recession due to high inflation, he added.

“For those who are risk averse and want to wait for this bear market to pass until the next bull market begins, you can buy Treasuries and safe floating-rate bonds and relatively high yields,” said Wolfenbarger, a proponent of an ETF, such as SPDR. Bloomberg’s 3-12-month T-bill ETF

RECEIPT

and WisdomTree Floating Rate ETF

USFR.

For aggressive investors looking to make more substantial gains from bear markets, he suggests inverse ETFs that rise when stocks fall, such as the ProShares Short S&P 500 ETF

SHOW

and ProShares Short QQQ

PSQ.

Those who want to be even more active can buy double inversion ETFs, such as the ProShares UltraShort S&P 500

SDS

and ProShares UltraShort QQQ ETF

QID.

An investor looking to profit from falling oil prices can buy the dual inverse oil ETF ProShares UltraShort Bloomberg Crude Oil

SCO.

“Once the Fed starts cutting rates and the recession stabilizes, we will look for stocks that become oversold (we focus on key technical indicators for this such as the weekly RSI). weekly and monthly and Bollinger Bands) to profit from this bear market and then position for the next bull market with individual stocks and leveraged long and long term ETFs,” he said. speak.

Read: One of Wall Street’s biggest bulls now sees stocks fall early next year as Fed ‘tightens’

market

share

DJIA

post data is flat to slightly lower. Dollar

DXY

under pressure and oil

CL

has gained a foothold on profits. Read more in MarketWatch’s live blogs.

Read: Deepest Treasury Curve Inversion in More Than 4 Decades Offers an Upbeat Spot for Investors

For more market updates plus possible trading ideas for stocks, options and cryptocurrencies, subscribe MarketDiem by Investor’s Business Daily.

rumor

PCE price inflation modestly increased by 0.3% in October, indicating Easier in pricingand consumer spending rebounded, but at a cost savingwhile weekly jobless claims withdraw. Still next is the Institute of Supply Management’s construction spending and manufacturing index. And more Fedspeak: February Governor Michelle Bowman at 9:30 a.m. and Fed Vice President of Supervisors Michael Barr at 3 p.m.

Salesforce stock

CRM

falling behind disappointing revenueIdol. The customer relationship cloud software giant also lost another CEO. Software maker Splunk

SPLK

climbing optimistic forecastand Okta

OKTA

is up after software security group promises to be profitable in 2023.

Orthofix Medical Stocks

OFIX

came after the manufacturer of the back surgery medical device said it had a $23 a share repurchase offer unsolicited from two private equity firms.

Netflix

NFLX

Co-founder and CEO Reed Hastings acknowledges the streaming giant should have added ads years ago.

Tesla

TSLA

will introduce the 18-wheeler heavy vehicle on Thursday. Its first customer will be PepsiCo

PEP

Legislators are likely to step in and stop what might happen a strike paralyzes the railways.

In an effort to prevent further unrest, Beijing will report allowing people at low risk of infection to isolate at home, but they must first commit to not leaving in writing, aided by magnetized sensors mounted on their doors.

The best of the web

Sam Bankman-Fried says he is most interested in helping humanity in trying to explain the collapse of FTX.

Elon Musk says his Neuralink brain implant could be ready for human testing in six months. Cure polio is one of the goals.

The benefits of “free liberty” – find happiness in the luck of others

chart

stocks

These are the most searched stocks on MarketWatch at 6 a.m. ET:

|

share |

security name |

| TSLA |

Tesla |

| NIO |

NIO |

| GME |

game stop |

| AMC |

AMC Entertainment Corporation |

| AAPL |

Apple |

| XPEV |

Xpeng |

| AMZN |

amazon.com |

| ape |

Preferred shares of AMC Entertainment Holdings |

| MULN |

Mullen car |

| COSM |

Space organization |

Random reading

Kanye West’s monthly child support bill? 200,000 USD

UNESCO Heritage Status has finally arrived French bread

Need to Know starts early and is updated until the opening bell rings, but Register here to send it once to your email inbox. An emailed version will be delivered around 7:30 a.m. Eastern time.

Listen Best new ideas podcast about money with MarketWatch reporter Charles Passy and economist Stephanie Kelton.