This recession indicator is close to the point of no return. But stocks will rise historically if the Fed cuts and the economy stays up.

It is still too early to declare a Goldilocks environment, even if the major asset classes are at least pointing to better opportunities for it. S&P500

SPX

is up 5% this year, and the Nasdaq Composite is tech-heavy

CALCULATOR

is up 8%, even with the seemingly daily influx of job cuts. Stay tuned for Thursday with a bunch of economic data.

Veteran Wall Street strategist Joe Lavorgna is certainly in the camp of expecting a recession.

“The main indicators we track are all recession-hit, such as leading economic indicators, home starts and Treasury yield curve, etc. Lavorgna , now chief economist at SMBC Nikko Securities America, and former chief economist for the White House National Economic Council, said:

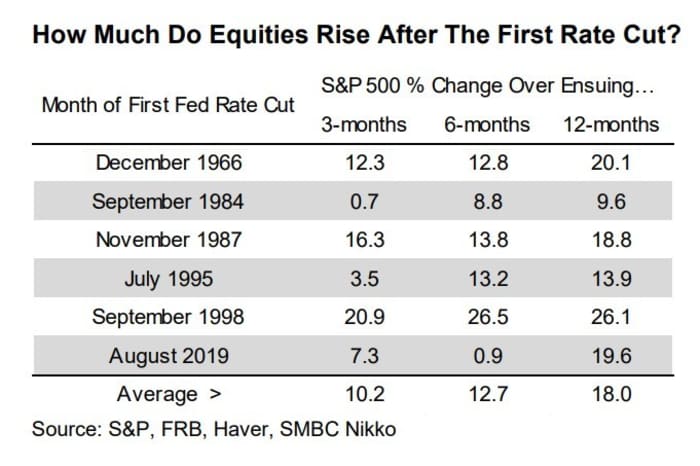

But Lavorgna accepted the possibility that the economy would come out of recession. And, in analyzing the numbers, he found an impressive historical record. For every period in which the Fed cuts rates initially and avoids a recession, the S&P 500 will be higher in three, six, and 12 months.

The best time period was after the Russia default/LTMC crisis in July 1998 – after the Fed cut rates in September of that year, stocks rallied nearly 26% in 12 months. As the chart shows, the market averages double-digit gains after a drop.

“But for the stock market to produce such impressive results, the economy needs to avoid a hard landing. Otherwise, the probabilities will favor lower prices sometime in the coming months. Given this binary situation – recession or no recession – it is understandable why market participants are so focused on macroeconomic data,” he said.

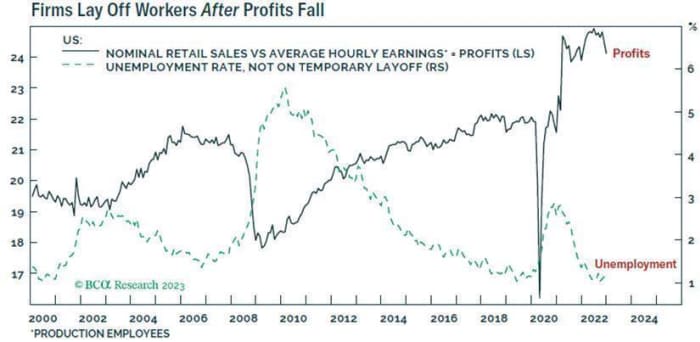

Dhaval Joshi, chief strategist at BCA Research’s Counterpoint, said the problem for investors is knowing if the economy is in a recession, because gross domestic product is released so many weeks after that period. mid-quarter point.

Instead, he prefers to use US retail sales divided by average hourly earnings, as a proxy for company profits. Whenever the ratio between them falls 3.5% from the peak, the unemployment rate will continue to rise by at least 0.6% — and once the unemployment rate rises at least 0.6%, the end it will never stop growing above 2% 75 years.

That rate is approaching a point of no return — just over 3% off its peak.

He added that the job market’s resilience so far makes sense, because companies wait until profits fall to start cutting jobs. In an industry where profits are falling, which is technology, they are literally laying off workers.

Joshi advises staying on the defensive for a 6 to 12 month period, by weighting bonds against equities, healthcare versus tech, gold versus oil and the Japanese yen against the dollar. euro. And he said February 15 will be an important date — when the next retail sales report is released.

Market

US stock futures

ES00

indicated a stronger start. Yield on 10-year Treasury note

BX:TMUBMUSD10Y

is 3.51%. Oil

CL

traded at just over $81 a barrel.

For more market updates plus possible trading ideas for stocks, options and cryptocurrencies, Sign up for MarketDiem by Investor’s Business Daily.

rumor

A key day for economic data saw fourth-quarter GDP rise 2.9%, above forecasts, with durable goods orders up 5.6% in December. weekly employment dropped to 186,000.

After opening, new home sales data will be released.

Tesla

TSLA

Stocks rise after electric vehicle maker Earnings report better than forecast as CEO Elon Musk has said that production of the Cybertruck will begin this year.

Dow

down

said it would cut 2,000 jobs as the chemical company reported earnings below forecasts.

IBM

IBM

Stocks slide, as the tech giant misses its cash-flow target and says it will cut 3,900 jobs. German SAP database manufacturer

SAP

said it was cutting 3,000 jobs.

letter V

CVX

announce a $75 billion share buyback.

Meta . Platform

META

say it will end the suspension of former President Donald Trump in the coming weeks.

The best of the web

alphabet

GOOGLE

Google prepares for the second antitrust war.

taken by

SNAP

Snapchat accused of propaganda fentanyl poisoning crisis.

Morgan Stanley

TEACHER

fines workers up to $1 million for use WhatsApp for company business.

Great Britain on about to become an economic basket (registration required).

top stocks

These are the most active stock market stocks on MarketWatch as of 6 a.m. ET.

Random reading

The “miracle” is come in poop categoryKimberly-Clark CEO said.

A hacker named every person in Austria Strong discount.

One Teenage Egyptian mummy inlaid with gold was discovered after 2,300 years.

Need to Know starts early and is updated until the opening bell rings, but Register here to send it once to your email inbox. An emailed version will be delivered around 7:30 a.m. Eastern time.

Listen Best new ideas podcast about money with MarketWatch reporter Charles Passy and economist Stephanie Kelton.