There is still too much risk in the stock and bond markets. Earn this easy 4.5% profit while you wait for stability, says the trader who hit 2 big calls in 2022.

Ahead of the big tech earnings that followed, the Meta results are lighting up the Nasdaq Composite

CALCULATOR

for Thursday. S&P500

SPX

also increase when investors have a full view of the halves federal meeting.

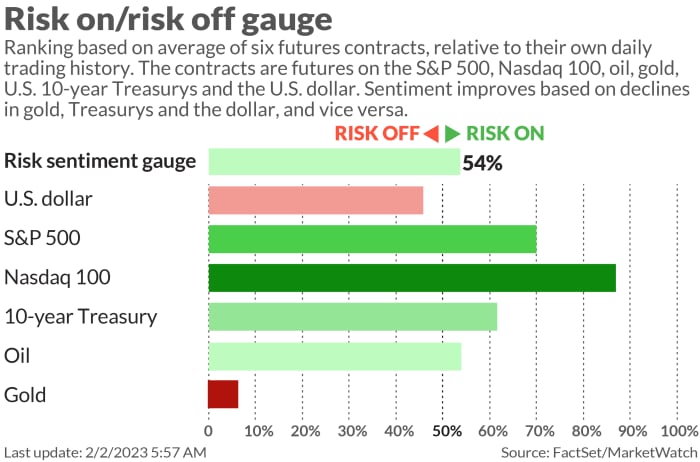

Worried that investors are in control of a Fed that misunderstands the founder LaDucTrading.com, Samantha La Duc. “The market is not pricing in higher terminal fees or slowing growth or recession. One or more of these assumptions is false. My bet: The Fed will go higher in the long run. They don’t cut back in 2023, unless they have a reason,” she said.

MarketWatch last spoke to LaDuc, who specializes in timing major market movements, last May when she guess The S&P 500 will end 2022 around 3,800 – it ends at 3,859. Another call she nailed was her early 2022 warning of a “Technology corpse” is coming predicts Nasdaq to drop 20% in 2022 – it ended the year down 33%.

in us call of the dayCash is where to go, LaDuc said, and investors “get paid to wait. They are getting very favorable 4.5% on their cash sitting.”

Even though the dollar has depreciated 8% in the past 12 weeks, “the money you put in a money market fund is making 4.5% right now, where it was previously making 0.4% or 0.5%,” she said in an interview Wednesday.

“So the Fed rate hike has fostered a pay-to-wait pattern while the market stabilizes. I don’t think Treasuries are a safe bet this year. I don’t really see any bond outperforming and I think stocks are more of a downside risk than bullish,” LaDuc said.

She’s particularly worried about technology, saying Nasdaq may have a long way to go before the sell-off ends.

She explained that analysts are predicting an earnings recession through the fourth quarter of 2023, not a recession. “Literally, they expect fourth-quarter earnings to grow by about 10% due to a favorable profit comparison to the previous year.

“The problem with that is that the earnings analysis doesn’t look at recessions in any way, shape or form, and it implicitly assumes moderate growth,” LaDuc said. “So we still have Goldilocks priced in shares and priced into earnings.”

The growth-to-value rotation has been a key prediction for LaDuc since July 2020 when she started calling for “things on paper,” predicts a shift to oversold, cyclical and large-cap commodities that act as bottom interest rates.

While that rotation is “absolutely superior” in both 2021 and 2022, she said it will trade worse this year as inflation expectations have softened.

Key point? Instead of buying when the stock market is falling, she said, investors should sell short at higher levels.

Her last observation is tied to gold

GC00

— and she says she’s not a big fan of gold, but her trend indicators are now “igniting” for the precious metal for the first time in years.

Gold can be a tough choice as it has to be “perfectly timed” and is not usually a superior, except for rising higher in the 1970s as a hedge against inflation. What has changed is that last year central banks bought the most gold last year since 1967.

“The lack of counterparty risk is fueling the central bank’s desire to have more control over gold, which needs to be watched right now,” LaDuc said.

market

Nasdaq Composite

CALCULATOR

growing on the Boat Lift Meta, with S&P 500

SPX

also higher, but the Dow

DJIA

slightly. bonds

BX:TMUBMUSD10Y

stable, oil

CL

flat, with gold

GC00,

the silver

SI00

and other metals

HG00

go up.

GBP

GBPUSD

bounced off the low after Bank of England raises interest rates by 50 basis points as expected. The European Central Bank also made a similar move, and said it would repeat that rally in March.

For more market updates plus possible trading ideas for stocks, options and cryptocurrencies, Subscribe to Investor’s Business Daily’s MarketDiem.

rumor

share meta

META

up 19% after Facebook’s parent company misses out on earnings, but issued upbeat 2023 revenue guidance and promised to buy back more.

Opinion: Zuckerberg and Intel are moving their layoffs straight to Wall Street

And the big names will report after the bell – Apple

AAPL,

Alphabet

GOOGLE

and Amazon.com

AMZN,

Ford

F,

Gilead

GILD,

Starbucks

SBUX

and Qualcomm

QCOM.

See preview for: Apple , Alphabet and Amazon

Merck

A

the stock fell after Disappointing profithoney

FEMALE

is falling into a decrease in revenueEli Lilly

LLY

To be fell for the same reason and Bristol Myers

BMY

many words revenue expectations decreasebut the stock is still stable..

Baidu shares

BIDU

higher after rising in Hong Kong with news on Thursday that BlackRock had increased its stake in the Chinese internet search giant to 6.6% by the end of 2022.

Adani . Group companies market capitalization loss of up to 105 billion dollars after the Indian conglomerate canceled a $2.5 billion share sale, as a result of a scathing report from US short-seller The Hindenburg report continues to take its toll.

Weekly jobless claims were lower than expected at 183,000, while unit labor costs rose 1.1% in the fourth quarter, below expectations for a 1.5% increase. Factory orders will arrive at 10am

The best of the web

‘The Last of Us’ in real life? Rising temperatures can infect fungi, study says

As both China and the US entice Indonesia, which is rich in resources, Beijing has the advantage.

college board AP course modification in African American studies brought to the attention of Florida Governor DeSantis.

chart

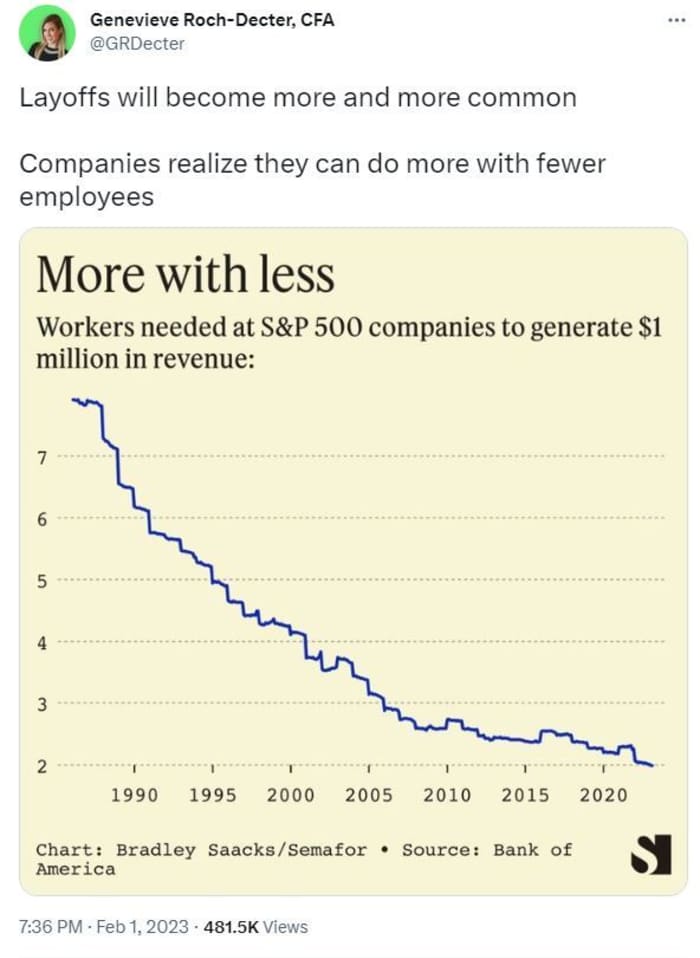

Get used to the company laying off workers?

@GRDecter

stocks

These are the most searched stocks on MarketWatch at 6 a.m. ET:

|

share |

security name |

| TSLA |

Tesla |

| META |

Meta . Platform |

| BBBY |

Outdoor shower bed |

| AMC |

Entertainment AMC |

| GME |

game stop |

| ape |

Preferred shares of AMC Entertainment Holdings |

| AMZN |

Amazon.com |

| CVNA |

carvana |

| AAPL |

Apple |

| NIO |

NIO |

Random reading

Reporter’s Deadly Praise for Surviving a bleak February spread.

No more king…Australia stripped of Charles III out of its paper money

How Punxsutawney Phil could be a stock market index

Need to Know starts early and is updated until the opening bell rings, but Register here to send it once to your email inbox. An emailed version will be delivered around 7:30 a.m. Eastern time.

Listen Best new ideas podcast about money with MarketWatch reporter Charles Passy and economist Stephanie Kelton.