The ‘surprise’ that Americans now blame for their credit card debt

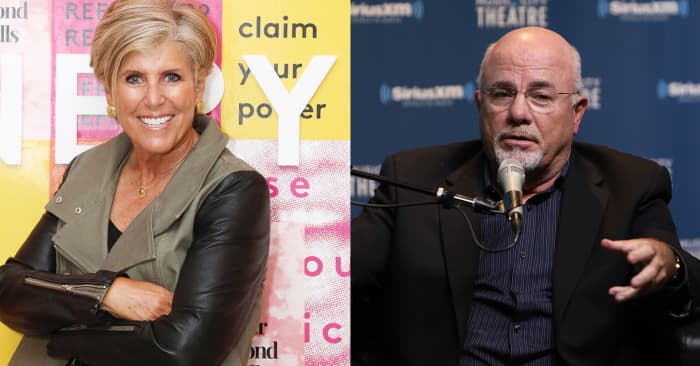

Experts like Suze Orman and Dave Ramsey stress the importance of an emergency fund — and it can help prevent you from getting into credit card debt.

beautiful pictures

Americans’ credit card debt rose to $887 billion in the second quarter of 2022, according to the Federal Reserve Bank of New York. And the #1 reason they cite for this debt? Urgent or unexpected expenses, with 46% of debtors citing urgent or unexpected expenses – including medical bills, home repairs, car repairs or some other urgent/unexpected expenses – is the reason they balance their monthly balances, according to a new CreditCards.com report.

The solution to this is a tried and true rule espoused by most personal finance bigwigs: build an emergency fund. And there’s good news on that front – Savings accounts like this are now paying more than they were last year.

While experts differ on the exact amount of savings, the general rule of thumb is to spend 3 to 12 months. For her part, Suze Orman is at the age of 12 months camp, says, “You know, my hope is that you work your way up to enough money to cover 12 months of essential living expenses. And you also know that I realize that can take time.” Dave Ramsey’s general rule is that everyone needs an emergency for 3 to 6 months save. “The more stable your income and household, the less emergency funds you need,” says Ramsey. The purpose is to soften the blow or cover up an unforeseen cost total. (See the best savings account rates you can get here.)

| Reasons for credit card debt | % of people |

|

Covering emergencies and unexpected expenses |

forty six% |

|

Daily expenses like groceries, childcare and utilities |

24% |

|

Retail like clothing and electronics |

11% |

|

Expenses for vacation and entertainment |

11% |

Melissa Lambarena, credit card expert at NerdWallet, recommends preparing for the unexpected by setting up an emergency fund of at least $500 to get started. “Even saving $5 per week. After finding your financial backing, choose a shovel-like balance transfer credit card or a debt management plan at a nonprofit credit counseling agency to find your way out. “Lambarena said.

How to get out of credit card debt

-

Register for a 0% interest transfer card

Rossman recommends signing up for a 0% balance transfer card. “These promotions last up to 21 months. This is my favorite repayment tactic because the average credit card charges a 16.73% fee and a 0% balance transfer card can save you hundreds or thousands of dollars in interest,” said Ted Rossman, homeowner. senior industry analyst at CreditCards.com said. (You can find some of the best 0% transfer cards here.) When used successfully, a transfer credit card can significantly reduce the amount you pay over the life of your balance and shorten the time it takes to get out of debt. “You’ll need to have a decent amount of credit, but if you do, you’ll find them widely available,” says Matt Schulz, lead credit analyst at LendingTree. That said, it is important to be disciplined about paying off in 0% time and not using the card to make any new purchases as interest rates will skyrocket once the promotion ends. end.

-

Do the snowball method

One way to tackle credit card debt is to stick to the snowballing method, which Rossman recommends if you’re overwhelmed by all of your debt. “Clearing down the account with the lowest balance, like gaining momentum like a snowball rolling downhill, is psychologically beneficial,” says Rossman. (Of course, always pay the minimum on all debts.) By eliminating the smallest debt first, you feel like you’re making progress and build motivation to stay on task. While it may not make the most mathematical sense, it can help kickstart the repayment process. - Credit card consolidation “You do that by taking out a new loan, like a personal loan or a balance transfer credit card, and then you use that loan to pay off some other loan,” says Schulz. Doing this can save you a significant amount of interest and can also simplify your finances as you will only have to manage payments for one loan. (See some of the best personal loans you can get here.)

How to control your spending

Nick Ewen, director of content at Points Guy, recommends analyzing the total income you expect to earn each month. “Then map out all the necessary payments each month – housing, groceries, and utilities. Finally, be mindful of your discretionary spending. Cut out the really unnecessary things like Starbucks every day and have lunch with co-workers several times a week,” says Ewen.

The advice, recommendations or ratings presented in this article are those of MarketWatch Picks and have not been reviewed or endorsed by our trading partners.