The market is getting a wake-up call in 2023, said Morgan Stanley.

According to Fed Governor Christopher Waller and some strategistsLast week’s lighter-than-expected October CPI sent the S&P 500 index to its overdue five-month best.

His words may have come through as stock futures get off to a softer start as the final week before Thanksgiving begins. We will also receive retail sales data this week.

And it’s that time of year when Wall Street starts churning out market projections for 2023, a task that’s certainly impossible. Ours call of the day from Morgan Stanley, where a team led by top US strategist Mike Wilson looked at the S&P 500 index

SPX

ending next year almost on par with the current one, at 3,900.

While that may seem a bit unusual, the time between would be anything, but once Wall Street received a wake-up call on earnings hopes were still too optimistic, the bank said.

“We are still highly convicted that the bottom-up consensus income in 2023 is

It is materially too high,” said Wilson and team, which have revised their 2023 earnings-per-share forecast down another 8% to $195, 16% below consensus, and 11% lower annually.

“Following what remains of this current tactical rally, we see the S&P 500 index reducing earnings risk ’23 at some point in Q123 through a ~3,000-3,300 price bottom. We think this precedes the final bottom in EPS, which is typical of an earnings recession,” Wilson said.

“Stocks should start to process their previous good run and rebound strongly to end the year at 3,900 in our base case,” he said.

As for portfolio moves, Wilson said they remain defensive until those estimates “reflect bankruptcy.” They upgraded staples to overweight and cut real estate to balance, leaving overweight also in healthcare, utilities and defense

directional energy stocks. Consumer discretionary hardware and technological hardware remain unchanged for the sake of light weight.

It’s worth noting in the end that a tumultuous 2023 could give way to a better 2024, where Wilson et al. saw a strong rebound as operating leverage grew positively — revenue grew faster than costs — “i.e. the next boom.”

Regarding the current market position, Wilson warns investors to be flexible a change in bullish tactic Four weeks ago.

He said: “After a 12-month period when the stubborn decline has paid off spectacularly, we think we are now entering the final phase of a bear market where the two dimension must be respected”.

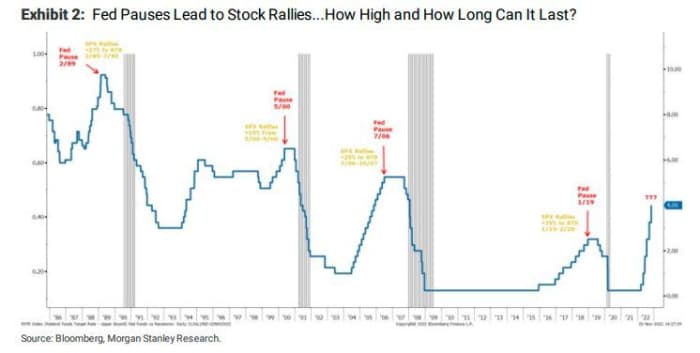

He sees an “opportunity where long-term interest rates typically fall before the extent of the decline is reflected in earnings estimates and the economy,” identifying it as the end-of-cycle period between the last hike and recession. same by the Fed.

Morgan Stanley / Bloomberg

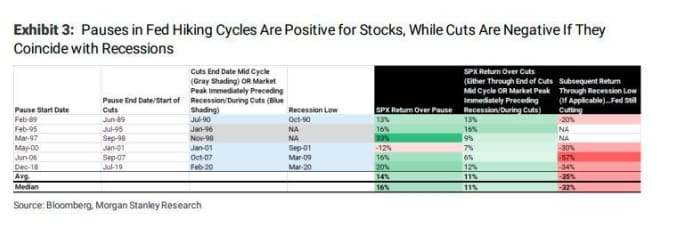

But keep in mind that they are just talking pause here. “So while we think there’s a chance for stocks to run late into the year when the market dreams of a pause, a Fed cut could be a bad sign that the recession is over,” Wilson said. come (negative payroll),” Wilson said. His chart shows that the stock doesn’t react well to that:

Morgan Stanley / Bloomberg

Market

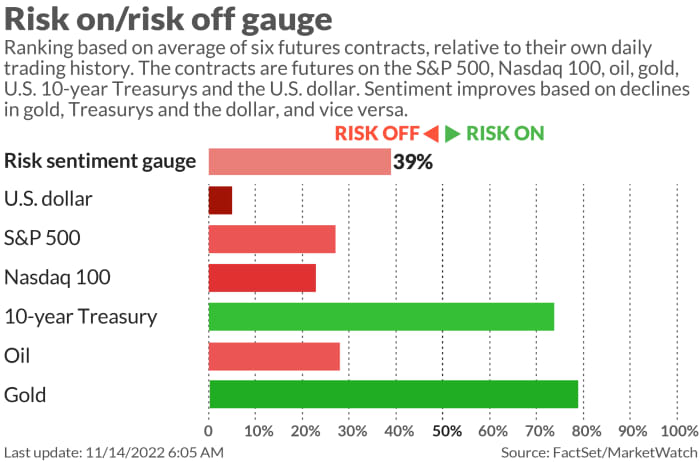

Stock futures contract

ES00

modestly lower, with oil prices

CL

flat, while the dollar

DXY

higher, perhaps a hint from the Fed’s Waller comments. It’s been a mixed Asian session, with gains in Hong Kong

HK: HSI,

loss in Tokyo

JP: NIK.

Buzz

Retail sales, manufacturing in New York and some housing market data are in the headlines this week. The New York Fed’s 1- and 5-year inflation expectations will be released on Monday.

Tyson Foods

TSN

Will report results on Monday, with retailers also in focus like Walmart

WMT

and Home Depot

HD

reported on Tuesday, with Target

TGT

on Wednesday, with Cisco

CSCO

and Nvidia

NVDA.

Disney

DIS

– Marvel’s sequel “Black Panther: Wakanda Forever” sees second-best opening week of 2022, and AMC’s share

AMC

rising in the previous market.

“Fix your companies. Or Congress will,” said Senator Ed Markey Against Tesla

TSLA

Director Elon Musk before the insult of the Twitter owner. Musk, meanwhile, told a G20 forum that he has “Too much work” on my plate.

On the midterm front, Nevada and Arizona win means Democrats will cling to the Senatewith Republicans winning less than 10 victories over control of the House of Representatives.

Former CEO of FTX Sam Bankman-Fried sent some cryptic tweets as investors continue to watch for further losses from Cryptocurrency exchange goes bankrupt. Bitcoin

BTCUSD

slightly higher is $16,775.

And: You need to understand what’s going on at FTX, even if you don’t have crypto

US President Joe Biden is holding his first face-to-face meeting with Chinese President Xi Jinping on Monday on the sidelines of the G20. And shares of Chinese real estate stocks jumped on Monday after Beijing signed off on aid measures for the congested sector.

The best of the web

Growing concern about Health impact of puberty blockers.

Elderly workers need Stop complaining about your younger co-workers.

Tesla found vulnerabilities in states that ban dealers: Tribal land.

Chart

Will the stock market continue to recover? Take a look at the 200-day moving average on the S&P 500, let’s say a few things.

“That created very tough resistance in March and August. Therefore, if it can meaningfully break above that line, it will signal that the Q4 rally could/will last through year-end,” said Matt Maley, market strategist at Miller + Tabak . said.

Miller + Tabak / Bloomberg

Codes

These are the most searched tokens on MarketWatch as of 6 a.m. Eastern time:

|

Ticker |

Security name |

| TSLA |

Tesla |

| GME |

GameStop |

| AMC |

AMC Entertainment |

| NIO |

NIO |

| DWAC |

Digital World Acquisition Corp. |

| AAPL |

Apple |

| AMZN |

Amazon.com |

| MULN |

Mullen car |

| APE |

AMC Entertainment Holdings |

| BBBY |

Outdoor shower bed |

Random reading

Man finds Haribo’s missing $4.7 million check awarded with supple bears.

Diver Get a hug of the rare octopus.

Need to know start early and be updated until the opening bell, but Register here so that it is sent once to your email inbox. The emailed version will be dispatched around 7:30 a.m. Eastern time.