The hunt for stocks with rising dividends: These fund managers have a strategy to keep your payouts growing

The broad stock-market rally so far in 2023 might make it easy to forget what a rough ride investors faced last year. It was a time when some active strategies focused on dividends, good cash-flow trends and other quality attributes held up better than popular indexing strategies.

The Federal Reserve isn’t done making moves to lower inflation. There are signs that rising interest rates have helped to cool inflation, but Nick Getaz and Matt Quinlin of Franklin Templeton expect pressure on corporate profits as we move through 2023.

“The impact of inflation on market valuation has driven the market’s correction thus far, rather than the impact of rising interest rates on corporate profitability,” the fund managers wrote in this year-end report.

During an interview, Getaz and Quinlan discussed how they select dividend stocks and how investors can see warning signs that can help them steer clear of companies showing poor long-term trends.

Quinlan said: “We have just now seen softer demand for goods and services, with people buying less, trading down and savings rates coming down.”

Getaz co-manages the $25.5 billion Franklin Rising Dividends Fund

FRDAX,

which seeks to maximize total returns by investing mainly in companies that have been raising dividends consistently and significantly, and are deemed likely to continue doing so, irrespective of current dividend yields. The fund has a four-star rating (the second-highest) within Morningstar’s “Large Blend” fund category. It held 55 stocks as of Dec.31.

Quinlan is the lead manager of the $3.8 billion Franklin Equity Income Fund

FEIFX,

which has more of an emphasis on stocks with higher current dividend yields of companies that have consistently raised payouts. The fund is also managed for long-term growth. It rated four stars by Morningstar, within the investment information provider’s “Large Value” category. It had 69 holdings at the end of 2022.

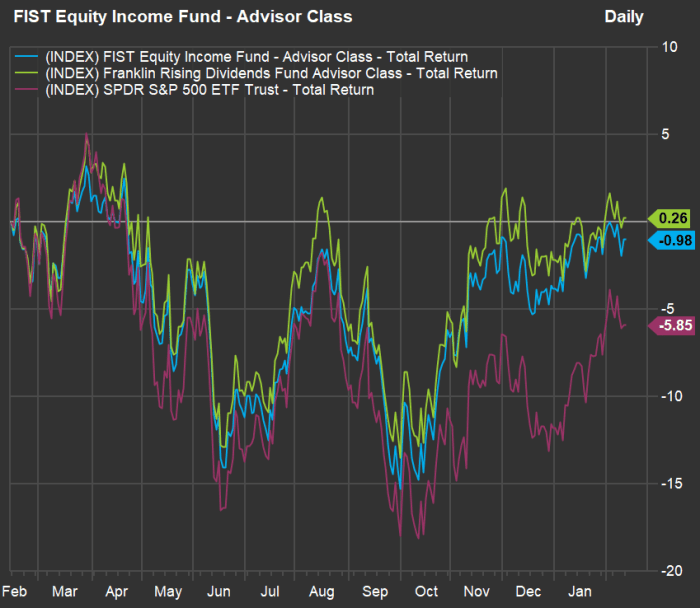

While dividend-focused strategies have underperformed broad indexes during bull markets, things change when times are tough. This one-year chart shows how the funds have outperformed the SPDR S&P 500 ETF

SPY

with dividends reinvested:

FactSet

A comparison featuring Intel and three other tech companies

Before Intel Corp.

INTC

reported weaker-than-expected fourth-quarter results and provided dismal guidance for the first quarter, a comparison of all 30 companies held by the iShares Semiconductor ETF

SOXX

provided a stark warning. Intel stood alone as the only company in the group for which analysts expected free cash flow to run negative for 2023 and 2024.

A company’s free cash flow is its remaining cash flow after capital expenditures. That’s money that can be used to pay dividends or for other corporate purposes.

With free cash flows expected to run in the red for two years while paying out about $6 billion a year for common-stock dividends and also laying off workers to cut expenses, there’s no shortage of warnings for Intel.

When asked about Intel, Quinlan said: “In any situation like that, it is a fair question as to whether or not the dividend is sustainable.”

Getaz said Intel would not qualify for the Franklin Rising Dividends Fund, because it wasn’t raising payouts significantly enough, long-term. He suggested a comparison with Texas Instruments Inc.

TXN,

which is held by both Franklin funds. Here’s the comparison, bringing in Analog Devices Inc.

ADI

and Microsoft Corp.

MSFT,

which are held by the Franklin Rising Dividends Fund:

| Company | Ticker | Five-year dividend CAGR | Most recent dividend increase | Most recent dividend increase amount | Current dividend yield | Total Return – 5 Years | |

| Intel Corp. | INTC | 4.0% | 1/26/2002 | 5.2% | 5.3% | -27% | |

| Texas Instruments Inc. | TXN | 14.9% | 9/15/2022 | 7.8% | 2.8% | 100% | |

| Analog Devices Inc. | ADI | 11.1% | 2/15/2022 | 10.1% | 1.7% | 134% | |

| Microsoft Corp. | MSFT | 10.1% | 9/20/2022 | 9.7% | 1.0% | 217% | |

| Sources: FactSet, company filings | |||||||

The third column shows five-year compound annual growth rates (CAGR) for dividend payouts, based on the sum of regular dividend payments over the past year.

Intel has the highest current dividend yield by far, which partly reflect the decline of its share price. The low current yields for the other four companies reflect their stocks’ good performance, while also emphasizing the importance of capital growth for these two funds’ strategies.

Taking this analysis further, let’s look at the four stocks again, focusing more narrowly on dividend yields:

| Company | Ticker | Current dividend yield | Dividend yield – five years ago | Dividend yield on shares purchased five years ago |

| Intel Corp. | INTC | 5.25% | 2.73% | 3.32% |

| Texas Instruments Inc. | TXN | 2.82% | 2.47% | 4.94% |

| Analog Devices Inc. | ADI | 1.70% | 2.14% | 3.62% |

| Microsoft Corp. | MSFT | 1.03% | 1.91% | 3.08% |

| Source: FactSet | ||||

The right -most column shows how high the dividend yield would be on shares you purchased five years ago. Only Intel shows a higher current dividend yield than it does for five-year old shares. And in Texas Instruments we have a fine example of how you can build a significant income stream over time with a stable company that increases its payouts as its free cash flow increases.

Getting back to the Intel example, Getaz said decelerating dividend growth was a “signal for us to pay attention and engage in conversations.” A slower rate of dividend increases might be temporary after an acquisition, for example, but a decline in payout increases could also be “an indicator things are getting tougher” for a company, he said.

Quinlan said “the trajectory of free cash flow, and the the stability, resilience, reliability of it are really important for our strategies.”

Getaz also said he wasn’t looking merely for higher dividend payouts. In other words, he doesn’t want to see the ratio of dividends to free cash flow increasing — he wants payouts to increase because free cash flow is increasing.

One more note about the Intel comparison is reflected in the nature of its business. Getaz favors Texas Instruments and Analog Devices in part because of the lower-tech and lower-cost nature of analog semiconductors, which “take the physical world and translate it into the digital world.” Analog semiconductor components include power control devices and accelerometers, which are less capital-intensive than the type of cutting-edge processing chips Intel develops.

For a higher-tech designer and manufacturer such as Intel, there’s always the risk of “missing a generation” if product development goes wrong,”Getaz said. “With analog, you have longer cycles. You can be engineered for five or 10 years. For automotive it is even longer.”

Other favored dividend growers

Here are some other companies mentioned by Getaz and Quinlan:

-

Getaz listed Mondelez International Inc.

MDLZ

and PepsiCo Inc.

PEP

as two consumer brands that he will “trim and add to” over time, as both companies bring “quality, resilience and balance” to the Franklin Rising Dividends Fund. -

Quinlan said that although he was focused on the long-term, market volatility had given him and Getaz the opportunity to scoop up Astrazeneca PLC

AZN

for both funds at attractive prices. He cited the company’s “good pipeline” for medications to treat cancer and cardiovascular ailments. -

UnitedHealth Group Inc.

UNH

is held by both funds, with the managers citing the company’s good free cash flow trajectory and favorable demographic trends. Another stock held by both funds and cited by both managers for consistent dividend increases is Lowe’s Cos.

LOW.

Top holdings

Here are the top 10 stocks held by the Franklin Rising Dividend Income Fund as of Dec. 31:

| Company | Ticker | % of portfolio |

| Microsoft Corp. | MSFT | 7.7% |

| Roper Technologies Inc. | ROP | 3.7% |

| Linde PLC | LIN | 3.5% |

| Stryker Corp. | SYK | 3.3% |

| Accenture PLC Class A | ACN | 3.0% |

| UnitedHealth Group Inc. | UNH | 2.9% |

| Air Products and Chemicals Inc. | APD | 2.9% |

| Raytheon Technologies Corp. | RTX | 2.8% |

| Analog Devices Inc. | ADI | 2.8% |

| Texas Instruments Inc. | TXN | 2.7% |

And here are the top 10 investments of the Franklin Income Fund as of Dec. 31:

| Company | Ticker | % of portfolio |

| JPMorgan Chase & Co. | JPM | 3.9% |

| Johnson & Johnson | JNJ | 3.8% |

| Chevron Corp. | CVX | 3.4% |

| Morgan Stanley | MS | 3.4% |

| Raytheon Technologies Corp. | RTX | 3.1% |

| Procter & Gamble Co. | PG | 3.0% |

| Bank of America Corp. | BAC | 2.8% |

| Duke Energy Corp. | DUK | 2.7% |

| HCA Healthcare Inc. | HCA | 2.5% |

| United Parcel Service Inc. Class B | UPS | 2.4% |

| Source: Franklin Templeton | ||

Click the tickers for more about each company or ETF.

Click here for Tomi Kilgore’s detailed guide to the wealth of information for free on the MarketWatch quote page.

Don’t miss: These 20 AI stocks are expected by analysts to rise up to 85% over the next year