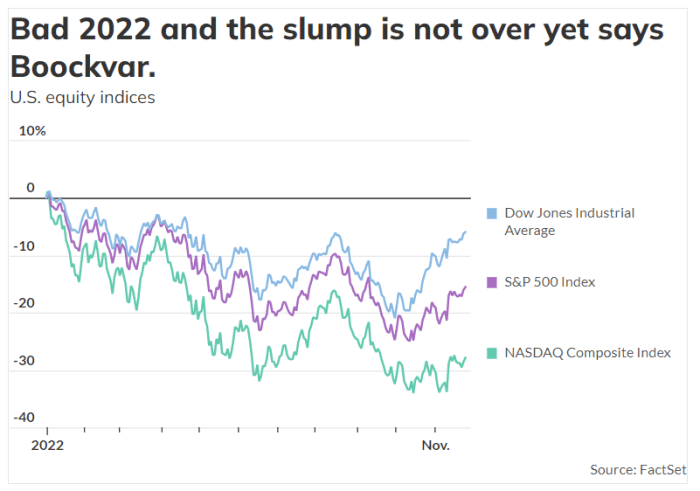

The bear market has three phases; and we’ve only just started our second,” said the veteran analyst.

Stocks will start the Black Friday half-session near 10-week highs, having recovered in part on hopes the Federal Reserve will slow the pace of rate hikes as it waits to see the extent of previous tightening subsides. impact on the economy.

As a result, investors are looking forward to the moment when the Fed will finally pivot and borrowing costs may start to fall again. For now, they are expressing few concerns about how much damage any economic downturn could do to corporate earnings.

Peter Boockvar, chief investment officer of Bleakley Financial Group, thinks it’s all too rosy. In an interview with Magnifi+, an AI trading and investment platform, the veteran analyst warned that stocks will fall next year and that we still haven’t seen the bottom of the bear market still in its infancy. Between.

“Bear markets typically have three phases. The first is that we take a lot of the vanity and euphoria out of the market about the sexy names we’ve seen in 2021 and we lower the PE rate. We did that, we went from 22 times earnings, let’s say 16 to 17,” Boockvar said.

In the second stage, he added, investors begin to calculate the economic and earnings consequences of the company’s continued rise in interest rates…” and then in the third stage, everyone take risks. Nobody wants to own a stock anymore, and that’s your bottom and that’s when you need to buy stocks with your fist.”

“I feel like we’re really just starting the second phase,” he said.

However, there will be opportunities. According to Boockvar, it all depends on your time scale.

“If you have a big purchase that you have to make within the next year or two, whether it’s a kid in college or it’s a wedding, a bar mitzvah or some other expense. like a house that you have saved up to buy, you should not participate in the stock market. It should be in the bank, it should be in the form of a short-term treasury bond. It has to be cash equivalent because the next few years will be challenging for those with short-term vision,” he said.

So what are the properties he is interested in? Bonds are attractive, but it is important to ensure quality.

“You have an investment grade bond that yields 6%, and you can do that without much risk in terms of maturity by buying a shorter term….And you can buy a two-year Treasury note. year and get interest of four and a half percent and get some nice Munis too. So I believe fixed income land, with shorter term, will be more attractive. The longer the trading term, the more skeptical I am,” Boockvar said.

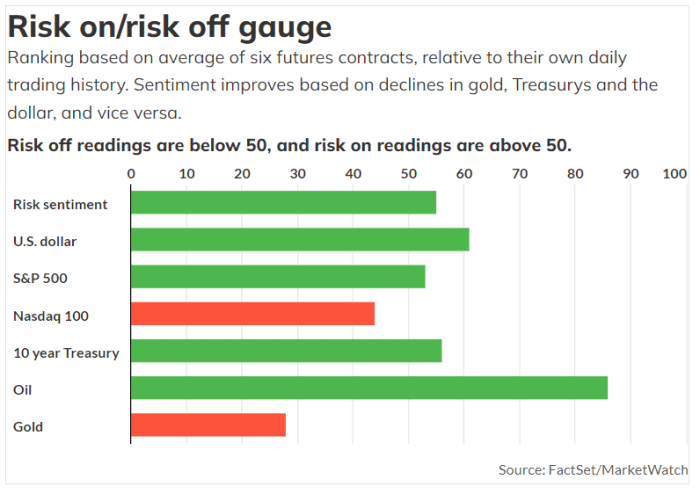

And in stocks? “Value stocks are much more attractive than growth tech stocks. I think commodity stocks are much more attractive than they have been in the last five years. Definitely energy, precious metals, even industrial metals like copper stocks.”

If the dollar has peaked and fell back as the Fed nears the end of its rate hike cycle, then Boockvar prefers the look of overseas markets, especially in Asia, and gold and silver as the central bank kicks in. interest rate cuts.

Finally, one thing he definitely doesn’t care about is former techies. “Just buy Google

GOOGL,

and Amazon

AMZN,

and apple

APL,

while they are all great companies, that ship has sailed and the baton of market leadership will be passed on to other parts of the market,” the analyst said.

market

Stocks are lining up to start the week’s final trading favorably, with S&P 500 futures

ES00,

up 0.2% to 4039 and 10-year Treasury yields

TMUBMUSD10Y,

little change at 3.709%. US crude oil futures fell 0.7% to $79.50 a barrel.

For more market updates plus possible trading ideas for stocks, options and cryptocurrencies, subscribe MarketDiem by Investor’s Business Daily.

rumor

This is a half-day of Wall Street trading as many traders also extend the Thanksgiving holiday. Expect very thin volumes.

However, analysts and investors are looking for guidance on how the Black Friday sale will play out. How do US consumers stand up in the face of high inflation and soaring borrowing costs? Shares in Amazon

AMZN,

and Walmart

WMT,

has been relatively stable.

Shares in Tesla

TSLA,

about 2% increase in premarket action despite car company news China recalls about 80,000 cars.

Shares of Activision Blizzard

ATVI,

is down more than 3% following a report late Wednesday that Federal Trade Commission may block Microsoft’s purchase of video game maker.

Fed’s Bullard is set to talk inflation, interest rates in a MarketWatch Q&A session on Monday. Sign up here to watch the show and ask questions.

central bank of china loosen monetary policy as the country grapples with further COVID-19 outbreaks.

The best of the web

China is investing billions of dollars in Pakistan but its workers there are under attack.

At the Mar-a-Lago court, ‘King’ Trump still reigns supreme.

Activists exacerbating art insurers’ climate headache.

chart

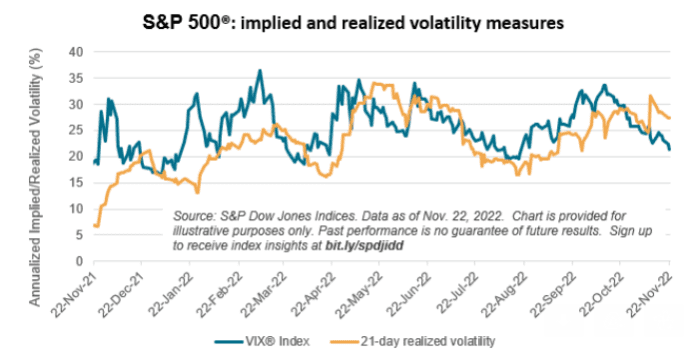

Here’s an interesting observation on stock volatility from Benedek Vörös, director of Index Strategy at S&P Dow Jones Indices.

Vörös wrote in his latest newsletter: “It has been a tumultuous year, but the US stock market has returned to a relatively calm level over the past few weeks and options market participants look even more comfortable than their cash traders.” “The VIX, which has averaged volatility 3 points above the S&P 500 volatility determined over the past 21 days over the past year, has fallen 6 percentage points below this level as of yesterday’s close. Historically, that has had some predictive power for lower volatility to come.”

Source: S&P Dow Jones Index

top stocks

These are the most active stock market stocks on MarketWatch as of 6 a.m. ET.

|

share |

security name |

|

TSLA, |

Tesla |

|

GME, |

game stop |

|

AMC, |

Entertainment AMC |

|

NIO, |

NIO |

|

COSM, |

Space organization |

|

APL, |

Apple |

|

ape, |

Prioritize entertainment AMC |

|

BBBY, |

Outdoor shower bed |

|

AMZN, |

amazon.com |

|

MULN, |

Mullen car |

Random reading

Japanese fans show the world how it was done.

Coin study shows ‘false emperor’ is real.

Need to Know starts early and is updated until the opening bell rings, but Register here to send it once to your email inbox. An emailed version will be delivered around 7:30 a.m. Eastern time.

Listen Best new ideas podcast about money with MarketWatch reporter Charles Passy and economist Stephanie Kelton