S&P 500 up +5% in November, longest streak of monthly gains since August 2021

The S&P 500 Index (SP500) add 5.38% for November, the final figures were released on Wednesday, which was the third consecutive month of gains. This is the benchmark index’s longest monthly rally since last August. SPDR S&P 500 Trust ETF (NYSEARCA:spy) also 5.56% more for the month, with the ETF currently falling 14.17% YTD.

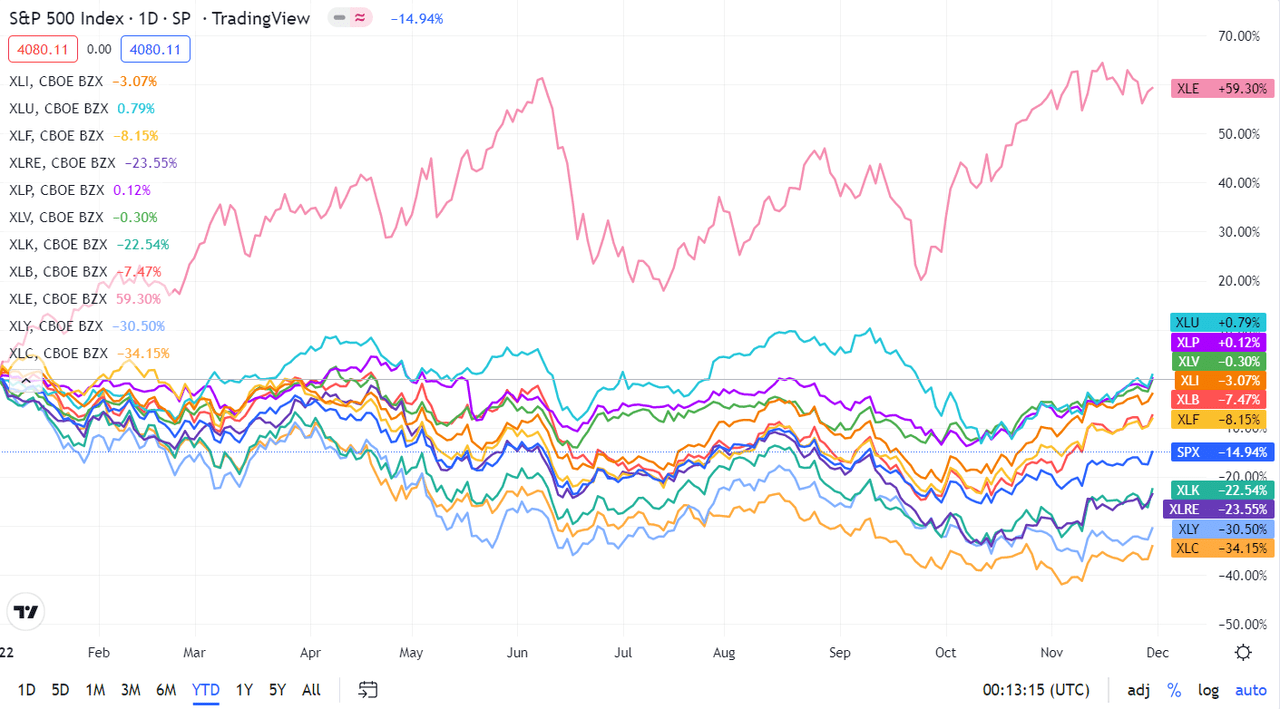

The monthly performance has helped the S&P 500 move further out of bear market territory, with the index now down 14.94% from its record high closing in early January.

November got off to a rough start after the Federal Reserve increase its key policy interest rate equal to 75 basis points for the fourth consecutive meeting and enactment hawkish comment on the road ahead of it. But weaker-than-expected inflation data caused a Memorable mid-month rallythen continued on hoping the Fed would slow down its aggressive rate hikes – that hope was confirmed by central bank chair Jerome Powell in a speech on Wednesday as he pointed out that censorship could happen right after the policy meeting in December.

Investors for the month also learned about US midterm elections, in which Republicans took control of the House of Representatives but Democrats retained control of the Senate. The focus is also on the chaos in the crypto market caused by the crash of FTX. Additionally, November saw the end of the third quarter earnings season.

It’s been a busy month in terms of economic data, though the October CPI report is no doubt the star of the show. Cooler inflation numbers helped the S&P 500 (SP500) posted its best day in more than two years when it was released on November 10, while also submitting the main index to the Nasdaq Composite (COMP.IND) spiked more than 7%.

Most economic data for the month refers to the unemployment rate, with investors analyzing through October and November ADP employment report, September and October job opportunity data.

Market participants will await a decision on the Federal Reserve’s policy meeting in late December. According to the CME FedWatch tool, markets are currently pricing the probability of a 50 basis point increase at 79, 4%.

All 11 sectors in the S&P 500 (SP500) ended November in the green, led by Materials and Industry. Energy and Consumer Discretionary increased the least. See below a breakdown of the eleven sectors and their monthly performance. Also, see how the attached SPDR Select Sector ETF performs from October 31 to near November 30.

#1: Materials +11.50%and SPDR Sector Selective Materials ETF (XLB) +11.70.

#2: Industry +7.57%and the Industrial Options SPDR ETF (XLI) +7.81%.

#3: Communication Service +6.85%and the SPDR Sector Select Communications Services Fund (XLC) +6.85%.

#4: Finance +6.83%and the financial options industry SPDR ETF (XLF) +6.86%.

#5: Real Estate +6.76%and the SPDR Sector Select Real Estate ETF (XRE) +6.83%.

#6: Utilities +6.51%and the SPDR Utilities Sector Selection ETF (XLU) +6.96%.

#7: Consumer staples +6.20%and the Consumer Staples Select Sector SPDR ETF (XLP) +6.12%.

#8: Information Technology +5.84%and SPDR Sector Selective Technology ETF (XLK) +6.33%.

#9: Take care of your health +4.66%and the Healthcare Sector SPDR ETF (XLV) +4.72%.

#10: Consumer discretion +0.81%and the Consumer Discretionary Sector SPDR ETF (XLY) +1.49%.

#11: Energy +0.65%and SPDR sector select energy ETF (XLE) +1.28%.

Here’s a chart of the year-to-date performance of 11 sectors and how they stack up against the S&P 500.