S&P 500 drops more than 3% for the week as markets absorb the bulls and Fed comments

S&P 500 (SP500) ended Friday’s session solid in the green. However, the late rally didn’t help the weekly performance benchmark as it dropped loss 3.35%.

The Federal Reserve dominated the headlines during the five-day session. On Wednesday, it raised its key policy rate by 75 basis points for a fourth meeting in a row, as is widely expected. But it’s Fed Chairman Jerome Powell’s comments at the conference after the decision that proved to be the catalyst for part of the week selling.

Powell pointed out that the central bank has not yet implemented tightening policy and there is still plenty of room to continue. He signaled that policymakers could adjust to the pace of future increases, but also said interest rates could eventually “move to higher levels” than previously expected. Market participants interpret this message as not dovish enough, with the S&P 500 (SP500) 2.5% off on Wednesday following the Fed chief’s comments.

Sentiment was also weighed down by economic data for the week that showed continued strength in the labor market. Job opportunity unexpectedly increased in September, October ADP Employment Report came stronger than anticipated and the number of Americans applying for weekly jobless claims fall. Also, Friday is highly anticipated October Nonfarm Payroll Data shows a significant increase in employment and an increase in average hourly earnings, although the unemployment rate has increased.

In other economic data, October Chicago PMI go under consensus and Dallas Fed Manufacturing Index worsen.

Earnings news was also in the spotlight for the week, with companies like Pfizer, Amgen, Eli Lilly, PayPal, Starbucks, Uber and Warner Bros. Discovery reported their quarterly results.

Next week will be an eventful week, with more earnings, US midterm elections and CPI on the radar.

SPDR S&P 500 Trust ETF (NYSEARCA:SPY) on Friday down 3.26% week with the benchmark index. ETFs are -20.76% YTD.

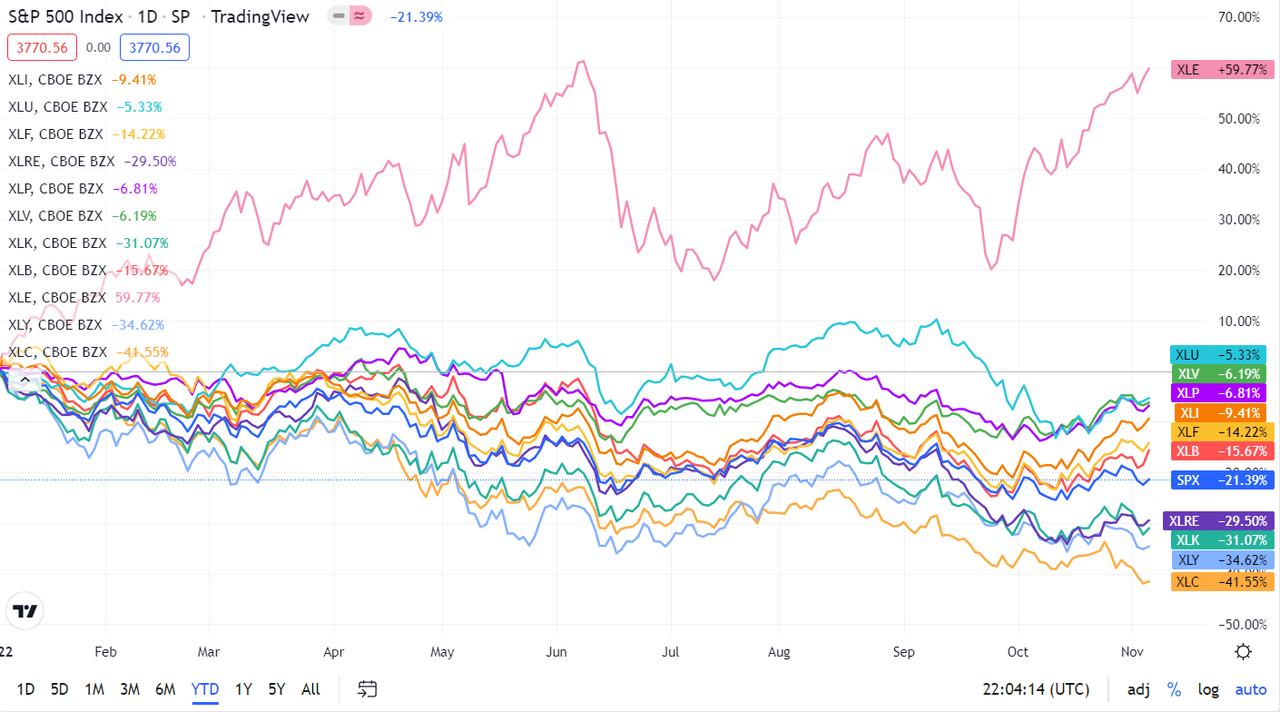

Of the 11 S&P 500 indexes (SP500) industry group, eight industries ended the week with a decrease, in which the heaviest group of industries was Communication Services and Information Technology which was the group that lost the most points. Energy is the top gainer when oil prices rise. See below a breakdown of the weekly performance of the sectors as well as the performance of their associated SPDR Select Sector ETFs from October 28 to near November 4.

#1: Energy + 2.37%and the SPDR ETF for the Energy Options Industry (XLE) + 2.43%.

#2: Materials + 0.86%and the Selective Materials Sector SPDR ETF (XLB) + 0.90%.

#3: Industries + 0.44%and SPDR ETF for the industrial sector (XLI) + 0.48%.

#4: Utilities -0.55%and the utility sector SPDR ETF (XLU) -0.47%.

#5: Finance -0.83%and the SPDR ETF for the financial sector (XLF) -0.82%.

#6: Take care of your health -1.59%and SPDR ETF for the healthcare sector (XLV) -1.54%.

#7: Real Estate -1.78%and the SPDR ETF for the real estate sector (XLRE) -1.71%.

#8: Consumer staples -1.83%and the SPDR ETF for the Consumer Goods Industry (XLP) -1.80%.

#9: Consumer discretion -5.78%and the SPDR ETF for the consumer discretionary sector (XLY) -5.15%.

#10: Information Technology -6.89%and the SPDR ETF for the technology sector (XLK) -6.63%.

#11: Communication Services -7.44%and SPDR Fund Select the region of Communications Services (XLC) -6.75%.

Here’s a chart of the year-to-date performance of 11 industries and how they compare to the S&P 500. For investors looking to the future of what’s happening, take a look. Search Alpha Catalyst Watch for a breakdown of next week’s featured actionable events.