Schlumberger stock could go up 45% from here

Shareholders and analysts have received a nice report from SLB, formerly known as Schlumberger (SLB), on Friday morning when the company posted better-than-expected fourth-quarter results on the back of strong demand for oilfield services.

Let’s dive into the charts.

In SLB’s daily bar chart, below, I see an uptrend over the past 12 months. The price is trading above the bullish 50-day moving average and above the bullish 200-day line.

Trading volume has been more active since June, and the Daily Balance Volume (OBV) line has been moving higher along with price over the past year. The rising OBV line helps confirm the bullish price. The Oscillator Moving Average Convergence Divergence (MACD) is in a bullish direction above the zero line.

In SLB’s weekly Japanese candle, below, I see a strong long-term rally still underway. Prices have more than tripled in the past three years. SLB trades above the rising 40-week moving average.

The weekly OBV line shows strength from July. The MACD Oscillator is bullish. The candlesticks do not show the top reversal pattern.

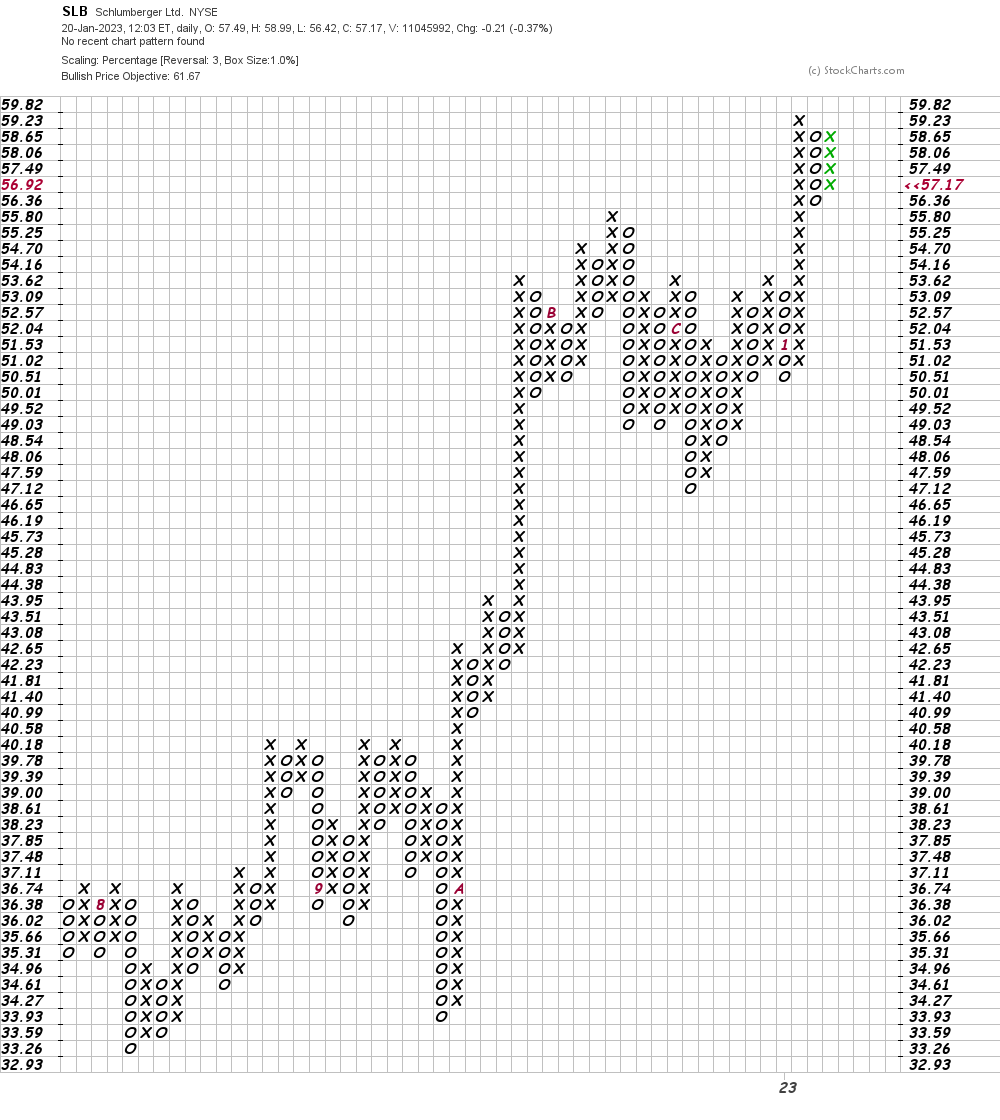

In this SLB daily Point and Figure chart, below, I see a nearby price target of $62.

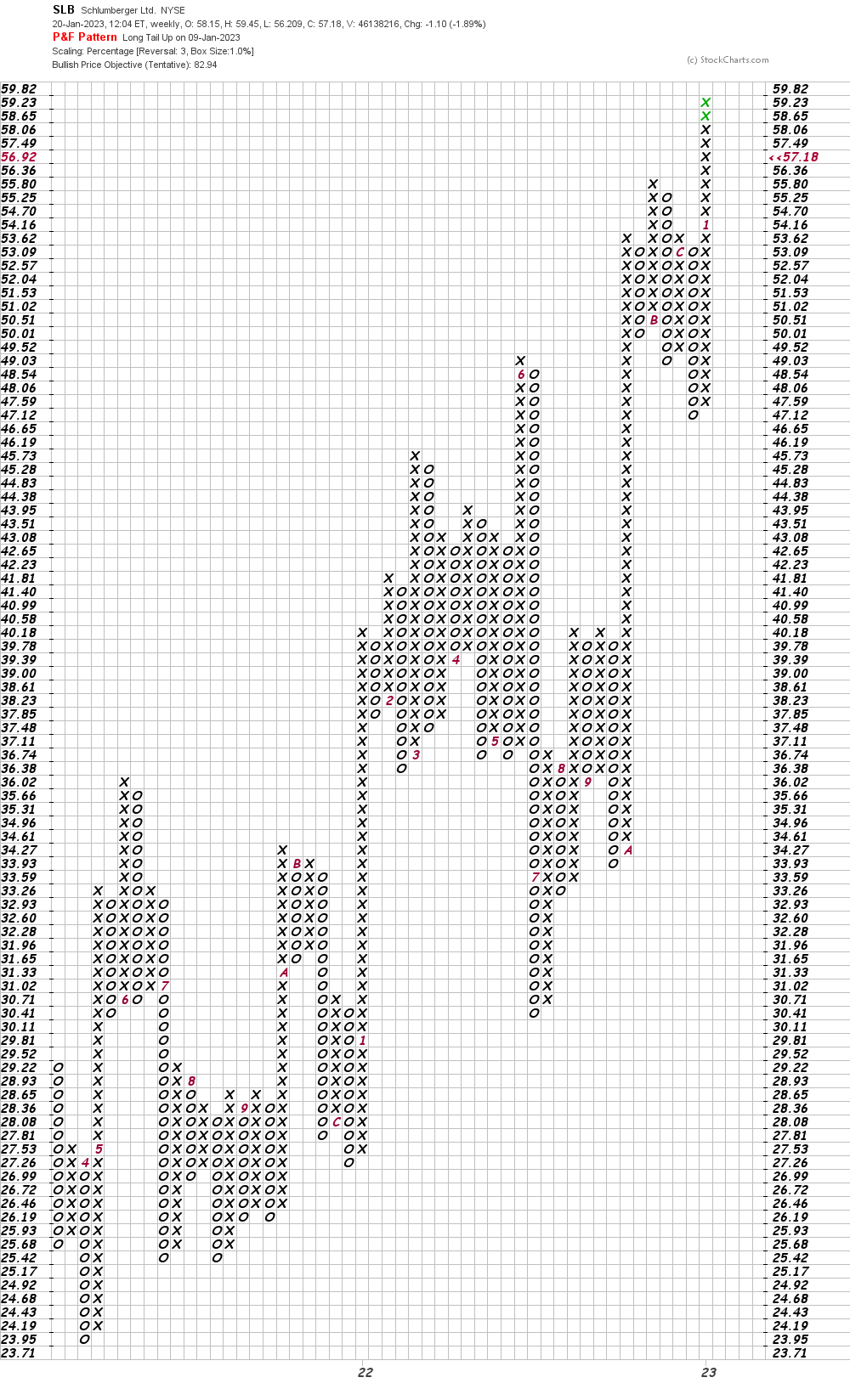

In this weekly SLB Point and Figure chart, below, I see a potential price target in the $83 region.

Final strategy: Traders can buy SLB close to $56 if there’s a risk up to $52. The $83 area is our price target.

Get an email notification every time I write an article about Real Money. Click “+Follow” next to my name for this post.