S&P 500 posts are up ~4% weekly even as technologists big disappointment; Fed’s focus meeting

S&P 500 (SP500) on Friday add 3.95% for the week ended at 3,901.06 points, the highest close since mid-September. The benchmark index has now posted a two-week winning streak.

The rally has arrived a week of massive earnings dominated by quarterly numbers from megacap tech stocks. Sentiment was also boosted by hopes that the Federal Reserve might slow down its aggressive interest rate hike campaign, centered on the central bank’s policy meeting starting next Wednesday. Many expect a rate hike by 75 basis points, and policymakers’ comments will be closely watched for clues to the Fed’s way forward.

FAANG Meta Platforms, Alphabet, Amazon and Apple companies reported a mixed range of results for the week. Google’s parent company post reduced advertising revenuewhile the e-commerce giant gave a dismal holiday sales forecast, sending its shares lost a trillion dollar market cap position. Investors are particularly unhappy with Facebook Meta owners. Share by the social media giant rated 25% higher on Wednesday after a quarterly report and dire outlook.

Apple is the standout performer, with stocks rise after the result was better than expected and lift all three major Wall Street indexes on Friday.

Microsoft and Intel are among other tech giants that have reported results. Several other well-known companies have published the numbers, including industry bellwether Caterpillargiant fast food McDonald’sapothecary Merckaerospace parts manufacturer Honeywell and aircraft mechanic Boeing.

Economic news also contributed to the S&P 500 index (SP500) increase weekly. One downsizing US business for the fourth month in a row and the decline was higher than expected house price suggests that there is some progress being made in the Federal Reserve’s effort to cool the economy. Investor sentiment is also supported by GDP data that shows that the US economy recovered in the third quarter.

In addition, market participants parsed a larger-than-expected drop in Conference Board Consumer Confidence Indexa narrower than expected season in new house for saledecrease in personal consumption expenditure, lower than expected declared unemploymentDurable goods orders, up Core PCE Price Indexa slide in pending home sale and Employment cost index in the third quarter.

SPDR S&P 500 Trust ETF (NYSEARCA:SPY) on Friday up 3.91% week with the benchmark index. ETFs are -18.12 % YTD.

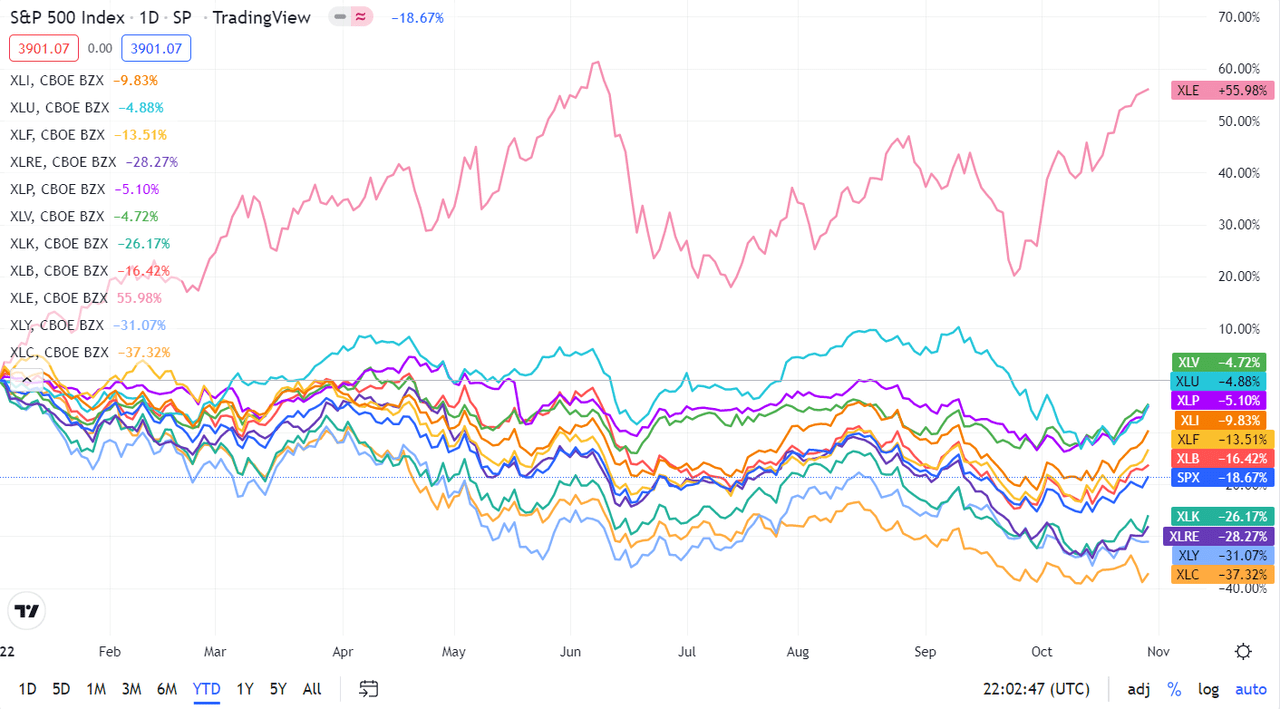

With the exception of Information Services, all 11 S&P 500 (SP500) sectors ended the week higher, led by Industry and Utilities. See the breakdown below for the weekly performance of the sectors as well as the performance of their associated SPDR Select Sector ETFs from October 21 to near October 28:

#1: Industries + 6.73%and SPDR ETF for the industrial sector (XLI) + 6.69%.

#2: Utilities + 6.48%and the utility sector SPDR ETF (XLU) + 6.48%.

#3: Finance + 6.19%and the SPDR ETF for the financial sector (XLF) + 6.21%.

#4: Real Estate + 6.17%and the SPDR ETF for the real estate sector (XLRE) + 6.20%.

#5: Consumer staples + 6.09%and the SPDR ETF for the Consumer Goods Industry (XLP) + 6.18%.

#6: Take care of your health + 5.00%and SPDR ETF for the healthcare sector (XLV) + 4.99%.

#7: Information Technology + 4.28%and the SPDR ETF for the technology sector (XLK) + 4.21%.

#8: Materials + 3.34%and the Selective Materials Sector SPDR ETF (XLB) + 3.36%.

#9: Energy + 2.75%and the SPDR ETF for the Energy Options Industry (XLE) +2.67%.

#10: Consumer discretion + 0.71%and the SPDR ETF for the consumer discretionary sector (XLY) + 1.78%.

#11: Communication Services -2.85%and SPDR Fund Select the region of Communications Services (XLC) -2.23%.

Here’s a chart of the year-to-date performance of 11 industries and how they compare to the S&P 500. For investors looking to the future of what’s happening, take a look. Search Alpha Catalyst Watch for a breakdown of next week’s featured actionable events.