Retail inflation moderates to 11-month low of 5.9% in November

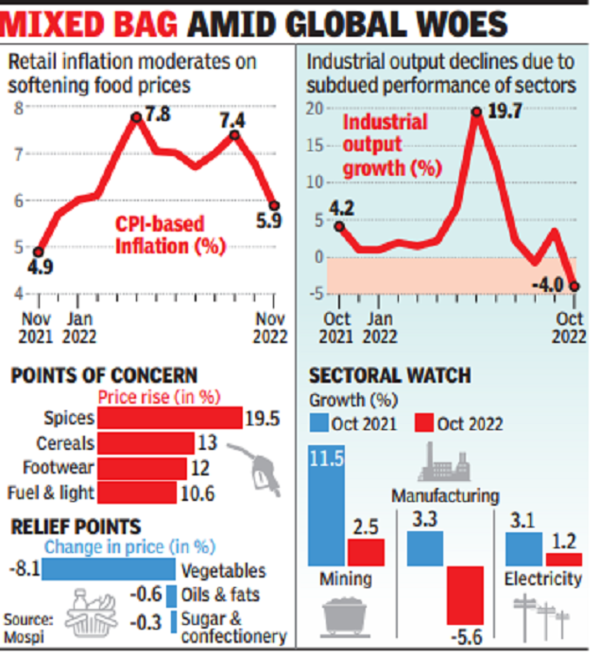

Data released by National Bureau of Statistics (NSO) on Monday showed retail inflation, as measured by the Consumer Price Index (CPI), increased by 5.9% year-on-year in November, slower than the 6.8% in October and higher than the previous level. 4.9% of last November. The food price index fell to 4.7% in the month from 7% in October. Inflation in rural areas was higher at 6.1%, while in urban areas it was 5.7%.

Retail inflation has been controlled below Reserve Bank of IndiaThe above tolerance range is 6% after 10 months. The finance ministry said measures taken by the government to rein in food prices had helped bring inflation below the central bank’s tolerable limit. In a series of tweets, the ministry said the impact of trade-related measures aimed at lowering the prices of grains, beans and cooking oils is expected to be more pronounced in the coming months.

“Following various resistances and pressures, we expect headline CPI inflation to drop lower for the remainder of FY23. Dec 22 CPI inflation could fall further. Given the positive seasonality of food and housing prices for FY23, our expectations are in line with RBI2023 CPI inflation expected at 6.7%,” economic thought QuantEco Research said. “From a monetary policy perspective, in our recent post-policy report we called for the possibility of a 25bp repo rate hike on February 23 and a pause thereafter. According to a note from QuantEco, today’s stronger-than-expected drop in inflation further reinforces our view that space for additional and aggressive tightening may be limited due to the risks of growth re-emergence. appearance and the possibility of a strong downtrend in inflation in non-core inflation, which is already underway,” noted QuantEco.

Separate data showed industrial output fell in October due to a contraction in the main manufacturing sector. Capital goods, consumer durables and nondurables also fell.

Data released by the NSO on Monday showed the Index of Industrial Production (IIP) fell 4% in October, compared with an upwardly revised 3.5% gain in September and below the growth of 4. 2% in the same period last year. The manufacturing sector shrank 5.6% in October compared with a 3.3% gain in October last year.

“It is certain that the global recession will significantly affect the industrial outlook next year, as sharply rising interest rates and rising inflation weigh on growth in advanced economies. The recovery in domestic demand has been uneven,” said DK Joshichief economist at Crisil.