‘Patience will pay off.’ Here’s Why Wall Street Doesn’t Panic From Amazon’s Earnings Drop

Amazon.com Inc’s Worst Annual Loss Ever. caused a slight jump in investors’ exits on Friday, but Wall Street analysts were steadfast, calling for patience for the long-term value the giant e-commerce giant brings.

Stocks of Amazon

AMZN,

fell more than 4% early on Friday, a day after the company reported a holiday quarter lowest profit since 2014 and also give disappointing instructions. According to FactSet, the annual net loss of $2.7 billion for 2022 is the largest loss on record.

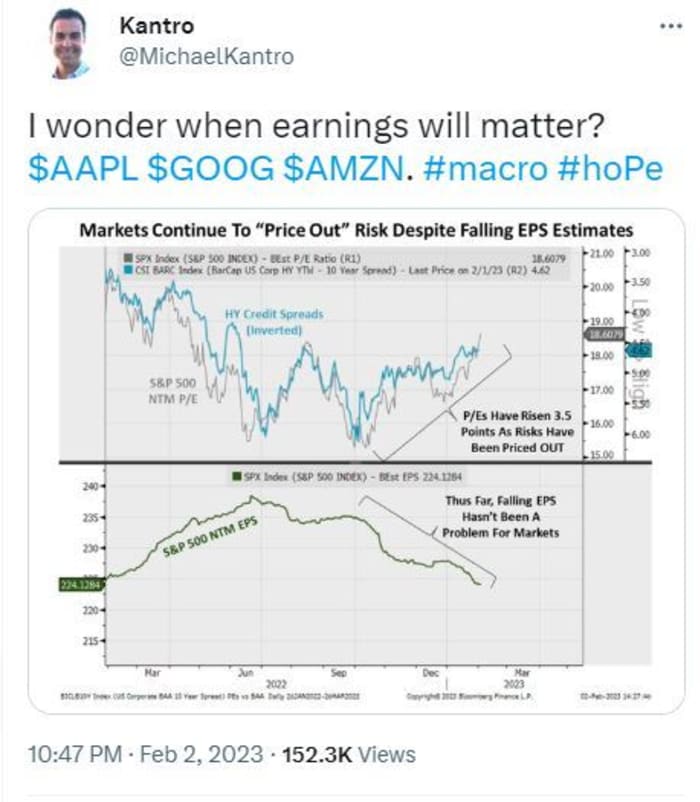

@MichaelKantro

The tune from Wall Street seems to be resilient, as Amazon shares sell off along with shares of Google’s Mother Alphabet

GOOGL,

and Apple

APL,

also reported relatively dismal earnings for the holiday quarter.

“Uncertainty remains, but we believe patience will pay off,” said a team of analysts at MoffettNathanson, led by Michael Morton, who has kept Amazon’s out-of-the-box ratings alongside the price. The target for the stock is $117.

“The public cloud address market has not changed as it is one of the biggest opportunities in all of technology with Amazon as the industry leader. As Amazon negotiates larger and longer-term deals with customers to lower prices, it puts pressure on [Amazon Web Services] profitable in the short term, but profitable for the company in the long term,” he said.

Morton said the retail business was also “unavailable and appears to be moving towards profitability”. But other segments of the business, especially advertising, may have become so large that they are becoming cyclical and exposed to macro headlines.

Morton also said Amazon’s first-quarter guidance on operating earnings implies a 200 basis point drop in operating margins at the midpoint, which seems “bigger than historical trends.”

But Morton stands out for not raising Amazon’s stock price target. Analysts at Jefferies raised their price to $135 from $125, keeping their buy rating unchanged on the stock. “We believe AWS customers are pausing rather than canceling their spending, which represents a rapid turnaround as macroeconomic uncertainty continues,” said a team of analysts led by Brent Thill. tissue settles”.

Analysts at Oppenheimer raised their price target from $130 to $135, saying Amazon’s e-commerce margins showed improvement in the quarter and would benefit from the cuts. the number of upcoming employees of the company. Amazon announced at the beginning of january that 18,000 employees will be laid off globally, adding to the 10,000 layoffs announced in December.

Read: Amazon to cut jobs for the first time in 2022 since the dot-com bust 20 years ago

And at SIG Susquehanna, Shyam Patil raised her target for Amazon stock from $140 to $150, blaming disappointing first-quarter guidance on a “tough macro.”

Patil, a positive reviewer of the company, said: “While the future may still be difficult, we continue to see Amazon as a long-term growth company underpinned by our operations. their strong advertising, cloud, and e-commerce businesses.”

Analysts at Benchmark removed some more “bright spots” in the results, while also raising their price target. They highlight “smaller pieces” of comments from management on profitability, operating expenses and capital expenditures that, “depending on revenue volume, can lead to positive outcomes.” [free cash flow] results for the year.” That’s an outcome that analyst Daniel Kurnos said he had not previously found feasible.

“So while we do anticipate some weakness today, although not the clearing event many had hoped for unless there is a warning from other big tech companies affecting to the market, we are raising our price target to $130 [from $125] on a slightly higher multiple because we believe the value proposition has gradually improved,” he said. Benchmark Amazon buy rates.

And from Evercore, has made an assessment that investors need to sit still and wait for the macroeconomics to improve and efficiency to increase. A team led by Mark Mahaney said that all four of the company’s segments, North American retail, international retail, AWS, and advertising have seen “strong deceleration in growth”, the company said. the first of which still gains market share.

“Amazon has clearly cut back on its work in terms of cost management in a deteriorating demand environment,” said Mark Mahaney.

“Amazon has a clear track record of performing across economic cycles and has been tightening its belts ever since. [the first quarter of last year]so investors can have some comfort that [the company] will protect profits,” he said, maintaining an outsized rating and changing his stock price target from $150 to $160.

Meanwhile, investor patience can be a completely different game.