Opinion: One of the most reliable stock market indicators – short interest rates – is near record highs and it’s a bearish harbinger

Joe Raedle / Getty Images

The bulls are catching on interest as they celebrate the recent increase in short selling volume.

They mistakenly believe that short interest – the percentage of company shares sold short – is a contrarian indicator. If that’s the case, it would be good to see short-term interest rates as high as they are now. In fact, short sellers, who make money when a company’s stock falls in price, are more often right than wrong.

So the recent spike in short interest is a worrying sign. That’s according to research conducted by Matthew Ringgenberg, a finance professor at the University of Utah and one of the academy’s leading experts on explaining short seller behavior.

In his in-depth research on this topicHe reports that, when interpreted reasonably, the short selling rate is “arguably the strongest known predictor of a stock’s aggregate return” over the next 12 months, outperforming any other Any popular metric used to forecast returns – such as price-earnings or price-to-book ratio.

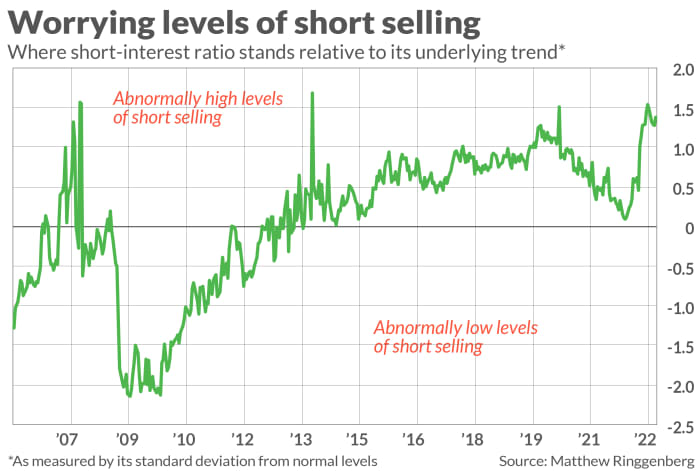

My mention of the “proper interpretation” refers to Ringgenberg’s finding that raw short-selling data becomes a better predictor by showing where the short-sell ratio stands relative to the underlying trend. its copy. The raw ratio represents the number of shares sold short as a percentage of the total number of shares outstanding. Ringgenberg’s harmful version of this short selling rate is plotted in the accompanying chart, below.

Note from the chart that, but for the one-month spike in 2013, this worrying short-term interest rate is almost as high today as it was before the 2007-2009 bear market that followed the Depression Global Finance and during the rapid decline accompanying the first lockdowns of the Covid-19 pandemic. That’s concerning enough, of course, but Ringgenberg in an interview also drew attention to this rate increase over the past year – one of the steepest increases in years.

This sharp increase is a particularly worrisome sign as it means that short sellers have become more bearish as prices fall. That means they believe the stock is even less attractive today than it was earlier this year.

However, it is worth emphasizing that no indicator is perfect. I focus on the odds in favor of Ringgenberg for one last March column, when it was much lower than today and close to neutral. However, the S&P 500

SPX,

9.2% lower today than then.

So there are no guarantees, as there never were.

Why are short sellers right rather than wrong?

According to Adam Reed, a professor of finance at the University of North Carolina at Chapel Hill, the reason short sellers are more right than wrong is that there are formidable barriers to short selling stocks. Because of those barriers, short sellers must be exceptionally committed and confident. While that doesn’t mean they will always be right, it does mean the odds are in their favor rather than investors merely buying the stock.

Reed gave several examples of the hurdles short sellers face, including the cost and difficulty of borrowing stocks to sell short (sometimes formidable), the potential for short-selling losses ( is infinite), the up rule prevents short selling at a discount if the market falls, etc.

Key point? The recent short interest advance is worrisome. Even if you don’t think the market has much more of a downside, you’re kidding yourself if you think the bull run is actually bullish.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be contacted at [email protected].