Nvidia Will Win the Race to $4 Trillion Market Cap, Experts Say

A surprisingly resilient and profitable economy AI explosion is pushing US tech giants toward a milestone that seemed unattainable just a few decades ago. Nvidia, Microsoft, Apple all crossed the $3 trillion market cap mark and Google And Amazon is close behind at $2 trillion.

These five tech giants alone are now worth more than $14.5 trillion and account for about 32% of the S&P 500. For reference, in 2002, after the dot-com bubble burst, the total market capitalization of each US stock was $11.1 trillion, according to Siblis Research. data. The performance of major tech companies has been particularly impressive this year, with Nvidia, for example, soaring from a $2 trillion market cap to $3 trillion in just under 100 days.

That begs the question: Which tech giant will reach the next big milestone, a $4 trillion market cap, first? Some pessimists say the streak of record-breaking performance by big tech companies can’t continue forever, given their high valuations and a slowing economy, while optimists believe this is just the beginning of an AI-fueled winning streak for big tech.

“I think, a year from now, we [will] There are three companies with $4 trillion market capitalizations: Nvidia, Apple, Microsoft,” said Wedbush tech analyst Dan Ives. Luck.

He argued that many of his Wall Street peers continue to underestimate the AI revolution and the health of the US economy. “If you don’t have a telescope, you can’t see a recession. What about the Fed? Their next move is to cut, not raise. So to me, all signs are bullish,” he said. “It’s 9 p.m., and the party’s going to last until 4 a.m. … Haters are gonna hate, keep saying this is a bubble.”

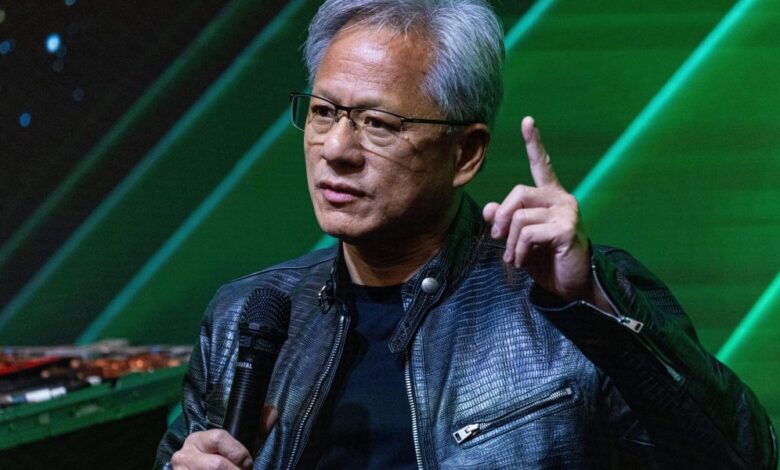

Nvidia

Of course, there are varying views on where big tech companies are headed, but many experts believe chip giant Nvidia will be the first to hit a $4 trillion market cap, thanks to the seemingly never-ending demand for AI-powered hardware.

“The first person to get there could be AI Jensen’s godfather. [Huang] and Nvidia, because they’re the only company in town—their GPUs are the new oil or gold in the tech world with no real competitors,” Ives said.

Nvidia shares have surged about 160% this year and more than 3,000% over the past five years, prompting some analysts to warn that the tech giant’s valuation is stretched and doesn’t account for growing competition in the semiconductor market.

As David Trainer, founder and CEO of research firm New Constructs, puts it, LuckShawn Tully of last month: “Nvidia’s valuation is ridiculous. It’s facing the same curse as Tesla. But as Tesla became profitable, a lot of competitors entered the electric vehicle space, cutting into profit margins and slowing sales. The same will happen to Nvidia.”

But Ives notes that while Nvidia’s stock has soared, so have its revenue and earnings. Nvidia posted a record $26 billion in revenue and $14.8 billion in net income in the quarter ended this April. In 2021, the company had $5.8 billion in revenue and $1.9 billion in net income in the same quarter.

Louis Navellier, founder and chairman of family-owned firm Navellier & Associates, also dismissed the competition argument, claiming Nvidia essentially has a “monopoly” on key AI chips that will lead to steady sales and earnings growth for years to come. “And, you know, Jensen is like the new Elon, he has a sort of cult status,” he said, adding that this will continue to drive retail investors into the stock.

Nvidia market cap as of July 5: $3.14 trillion

Microsoft

Microsoft’s booming cloud business and a big investment in OpenAI, the creator of ChatGPT, have boosted the company’s stock over the past few years. But it’s the company’s diverse and sustainable revenue streams that will propel it to a $4 trillion market cap, according to Tim Pagliara, founder and chief investment officer of independent asset manager CapWealth.

He said Nvidia could hit the $4 trillion mark first in the short term due to what he called the current AI “craze,” but Microsoft would be the “more sustainable” $4 trillion company.

“They’re embracing AI, but they also have a lot of things in the pipeline. And I know as a small business owner, we’re just happy to pay them more per user per month for everything from Azure to some of the add-ons they’ve created for security and things like that,” he added, referring to Microsoft’s Azure cloud computing business.

Pagliara argues that Microsoft’s big tech rivals also have riskier business models. He says Apple relies on consumers buying new iPhones every few years, and Nvidia is benefiting from a lack of competition in the near term. Meanwhile, Microsoft has multiple avenues for steady revenue growth from its Azure and Office 365 cloud businesses to Windows and LinkedIn.

Market capitalization: $3.48 trillion

Apple

When it comes to long-term prospects, Apple tops many analysts’ lists because of its potential to use AI to get customers to upgrade their current phones and attract more iPhone buyers. It may not be the first company to reach a $4 trillion market cap, but it will get there soon, these optimists say.

“I think in the next two, three years, the biggest market cap we’re going to see is Apple, because they have 2.2 billion iOS devices,” Ives predicts. “Consumer AI is going to break through the walls of Cupertino—they’re just at the beginning of an AI-driven supercycle.”

Louis Navellier is also optimistic about Apple’s future, but he said the company will need a few “small breakthroughs” to get more customers to buy new iPhones.

He points to new AI tools and the potential of a foldable iPhone as examples. “I don’t know if they’re going to announce it in September, but if they do, it’s going to be a $2,500 phone, and it’s going to sell like crazy and send the stock skyrocketing.”

Market capitalization: $3.46 trillion

What about Alphabet and Amazon?

Google’s parent company’s market cap is now $2.36 trillion, well short of the $4 trillion mark. Analysts say Alphabet will be able to capitalize on the AI revolution, but missteps with psychedelics have left the company behind, and its cloud business isn’t doing as well as others. But the search giant is poaching talent from its competitors in an effort to catch up, recently. report showed.

It’s a similar story for Amazon, which just passed the $2 trillion mark and whose stock price is expected to nearly double in the near future, according to experts. Wedbush’s Ives argues that Amazon’s cloud business, AWS, has also lost ground to Microsoft. “I think there’s some arrogance in underestimating what Nadella and Microsoft are doing, and with competitors in the same city and in that 2-0-6 area code, Amazon got punched in the gut a little bit,” he says.

And when it comes to AI, Amazon is also “falling behind,” according to the veteran tech analyst. However, Ives notes that CEO Andy Jassy has made changes to the company’s cloud business, and with its massive customer base, Amazon will benefit more from AI in the future.

Sure, every tech giant on this list faces risks. Antitrust regulations, cyberattacks, a slowing economy, and cuts in AI spending all need to be considered. But for now, the optimists remain optimistic—and they think you should be, too.

“The tech bears with their spreadsheets and valuations will be in hibernation,” Ives said. “But when everyone meets for breakfast at 6 a.m. after this AI party. The bulls [will have] won and the bears sound smart.”