Nvidia says its Blackwell chip is fine, nothing to see here

Much of Nvidia’s growth this quarter was driven by data center revenue, which totaled $30.8 billion in the quarter, up 112% year over year. The company’s gross margin was 74.5%, essentially flat from a year ago. But analysts expect that Nvidia’s profit margins could decline as the company moves to produce more Blackwell chips, which have higher production costs than their less advanced predecessors.

Nvidia’s earnings report is considered an important milestone for the AI industry. Chip architect’s advanced GPU, powering the assemblies neural network processing, is what made the current generation AI explosion possible. As Silicon Valley giants raced to build new chatbots and visualization tools over the past few years, Nvidia’s revenue exploded, helping it surpass Apple as a valuable public company. world’s best. Since the launch of ChatGPT in November 2022, Nvidia’s stock price has increased nearly tenfold.

Almost every major tech company is working on AI, even corporations build their own processing unitsrelies heavily on Nvidia GPUs to train their AI models. For example, Meta has said that it is building its latest AI technology on a cluster more 100,000 Nvidia H100s. Meanwhile, smaller AI startups have none enough AI computing power as Nvidia struggles to keep up with demand.

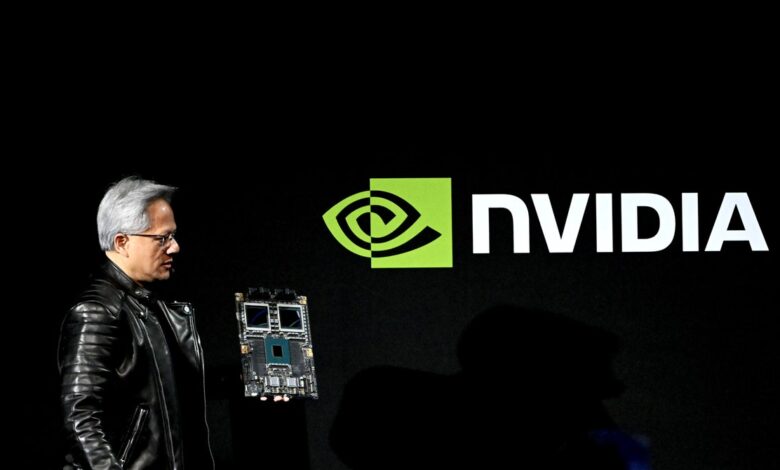

Blackwell, Nvidia’s latest GPU, is made up of two pieces of silicon, each about the same size as the previous Hopper chip, combined together into a single component. This design has resulted in a chip that is said to be four times faster and more than twice as fast. number of transistors like its predecessor.

But Blackwell’s launch was not smooth sailing. Initially scheduled to ship in Q2, the new chip encountered production hiccups, is said to be delaying implementation after a few months. Huang took responsibility for the matter and called it quits “design error” That “causes low yields.” Huang told Reuters in August that Nvidia’s longtime chipmaking partner, Taiwan Semiconductor Manufacturing Co Ltd, helped Nvidia fix the problem.

Moorhead told WIRED that he remains bullish on Nvidia and is confident that the overall AI market will continue to grow for at least the next 12 to 18 months, despite some issues. recent report shows that AI progress is starting to slow down.

“I think the only way there could be a shareholder rebellion is if they’re concerned about the cost of capital or the profitability of hyperscale companies,” Moorhead said, referring to large technology companies such as Amazon, Google, Microsoft and Meta are heavily invested in AI Cloud Services. “But I think they will continue to buy Nvidia until that day actually comes.” He added that enterprise AI remains a growth area for Nvidia.

During today’s earnings call, Nvidia chief financial officer Colette Kress said Nvidia’s enterprise AI tools are “full throttle,” including an operations platform that allows businesses to Other businesses build their own AI co-pilots and agents. She said customers include Salesforce, SAP and ServiceNow.

Huang repeated the same thing later on the call: “We’re starting to see enterprise adoption of agent AI,” he said. “It really is the latest rage.”