New algorithm shows how nested financial services can cause dominoes

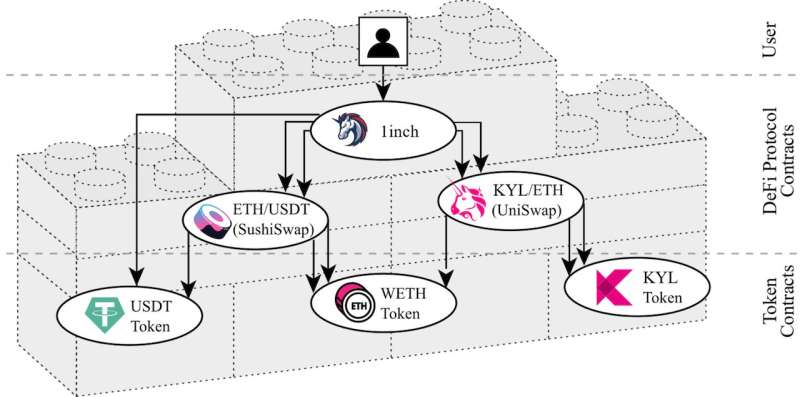

The illustration shows how the proposed algorithm splits financial services (DeFi protocol) to swap USDT into KYL cryptocurrency. End users interact with 1inch services, but the service uses internally with two Decentralized Exchanges (DEXs) and wETH tokens, as an intermediary cryptocurrency. Credits: Vienna Center for Complex Science and TU Berlin

It has been an extremely tumultuous year for the crypto world. In particular, the collapse of stablecoin Terra at the beginning of the year and of crypto exchange FTX two weeks ago stunned many investors. New research from CSH Vienna shows how hypothetical crypto-asset failures could affect other financial services on Ethereum.

“After the demise of the algorithmic stablecoin TerraUSD and its sister coin Luna earlier this year, other stablecoins have come into the spotlight. It is important to understand them, because they are the interface with the traditional financial sector and can spread failure.” Bernhard Haslhofer, head of the crypto-finance research group at the Center for Complex Science Vienna (CSH Vienna).

Stablecoins are cryptocurrency whose value is believed to be tied to some other asset, such as the US dollar. However, a series of coordinated speculative transactions broke these relationships and TerraUSD and Luna suddenly became worthless.

Stablecoins are an essential building block

While analyzing several Decentralized Finance (DeFi) services, CSH researchers found that many people rely on stablecoins like Tether. “Personal financial service providers use Tether in more than 14% of their transactions, leading to a relatively high reliance on this particular asset class,” said CSH researcher Stefan Kitzler. . If Tether loses value for any reason, many other DeFi services will be affected.

Besides this incident, in 2022 almost every month there are hacks, mining or collapse of crypto-related projects. With a record of about $760 million stolen in October, it’s not called Hacktober for no reason. “While the Bitcoin blockchain only allows the transfer of bitcoins between users, new blockchains like Ethereum also allow for more complex financial operations such as lending or trading multiple cryptocurrencies that reflect their financial resources. assets outside of the blockchain,” Kitzler said.

New algorithm sheds light on financial services on the Ethereum blockchain

For the end user, the internal mechanisms of these financial services remain hidden, and they often don’t know what other services are being used in the background.

Fortunately, CSH researchers have now elucidated the structure and House of financial services on the Ethereum blockchain. They have developed an algorithm that analyzes these financial transactions and shows how the services are intertwined.

What they found were tightly intertwined structures. “Here we are dealing with financial products that are complex, very confusing and contain risks that are not fully understood,” Kitzler said.

Strong dependencies and unknown risks

The internal structure of these financial services can be visualized as a structure made up of many building blocks. Kitzler said: “The building blocks above depend on the blocks below. Because of this structure and the repetitive use of certain blocks, the entire system relies heavily on the underlying service blocks. very specific”. If such a building block is broken, it will affect other blocks that are building on it.

Decentralized Finance (DeFi) services — this entire complex of financial services related to crypto-assets — typically offer easy access through their website, much like a bank. electronically provided by traditional banks. This low barrier to entry, or even gamification, has led to the popularity of DeFi and billions of dollars invested in the market.

Recent events in the crypto space and these research findings clearly show that crypto assets are risky investments and failures can affect financial services in the money. electronically and possibly in the traditional financial world. “The first thing we needed to do was create transparency and awareness,” says Kitzler. Users need to understand exactly what is behind a given crypto financial service and what risks are involved.”

Bernhard Haslhofer concludes: “In light of recent events, it is clear that understanding the potential systemic risks associated with cryptocurrencies and decentralized financial services must also become a top priority for managers and policy makers”.

The work was published in the journal Trading ACM on the Web.

Stefan Kitzler et al, Decentralized finance (DeFi) debugging works, Trading ACM on the Web (2022). DOI: 10.1145/3532857

Provided by

Center for Complex Science Vienna

quote: Cryptocurrencies: New algorithm showing that nested financial services can cause dominoes (2022, Nov 29) retrieved Nov 29, 2022 from https://techxplore.com/ news/2022-11-cryptoassets-algorithm-financial-domino-effects.html

This document is the subject for the collection of authors. Other than any fair dealing for private learning or research purposes, no part may be reproduced without written permission. The content provided is for informational purposes only.