Mortgage refinancing falls to 22-year low

Mortgage rates edged higher even higher last week after the Federal Reserve signaled continued aggressive action to cool inflation. That, and increased uncertainty in the housing market as a whole, led to a 3.7% drop in mortgage applications from the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

After an uncanny recovery last week, applications to refinance a home loan fell 11% for the week and 84% lower than the same week a year ago. They are now at a 22-year low as there are very few borrowers who can benefit from refinancing at higher interest rates today.

The average contract rate for 30-year fixed-rate mortgages with matching loan balances ($647,200 or less) increased to 6.52% from 6.25%, with a point going up to 1.15 from 0.71 (including principal) for loans with 20% down payment. That was the highest level since mid-2008.

“After a brief pause in July, mortgage rates have risen by more than one percentage point over the past six weeks,” said Joel Kan, MBA’s vice president of economic and industry forecasting. “Continued uncertainty about the impact of the Fed’s reduction in MBS and its Treasury holdings is adding to volatility in mortgage rates.”

Mortgage applications for a home fell 0.4% for the week and were 29% lower than the same week a year ago. Potential buyers today are still competing for high prices, despite a year-over-year price increase of is now shrinking at a record rate.

Due to the recent spike in rates, adjustable rate mortgages reach 10% of applications and close to 20% of dollar volume as ARM offers lower interest rates and can be fixed for up to 10 years.

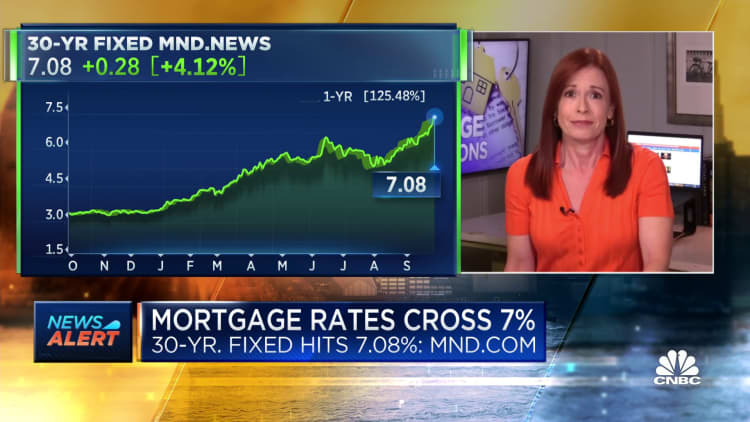

Mortgage rates continued to climb higher this week, surpassing 7% in a 30-year flat to 7.08%, according to a separate survey by Mortgage News Daily. That’s the highest rate in less than 20 years.