JD.com shares rise slightly after announcing $5 billion share buyback

JD.com has established an Innovative Retail division, which houses its grocery business 7Fresh.

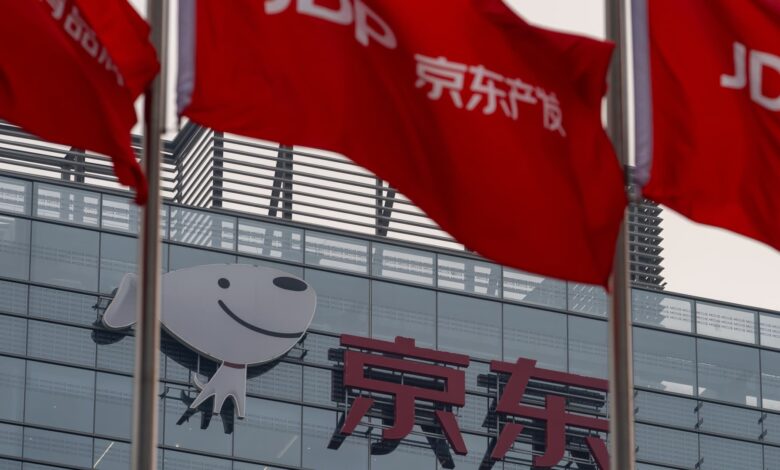

Bloomberg | Bloomberg | Getty Images

Hong Kong-listed shares of Chinese online retailer JD.com rose 1.2% on Wednesday, outperforming the decline Hang Seng Index after the company announced a $5 billion share buyback plan late Tuesday.

The company’s U.S.-listed shares rose 2.24% on Tuesday following the announcement. Both JD.com’s Hong Kong and U.S. shares are down about 20% year to date.

Meanwhile, Hong Kong’s benchmark Hang Seng index fell about 0.82% on Wednesday, but is up about 4% year to date.

This is JD.com’s second share buyback this year, following a $3 billion share buyback announced in March.

Responding to the move, Chelsey Tam, senior equity analyst at Morningstar, said the decision to announce a share buyback was “not surprising.” “This is a common situation in China where stock prices and growth are low,” she explained.

Tam also pointed at VIP StoreAnother Chinese e-commerce company has increase its own stock buyback program last week.

China’s e-commerce industry is being hit by a slowing domestic economy.

Earlier this month, Alibaba’s second-quarter results missed expectations on both revenue and profit. On Monday, Temu-owner Pinduoduo saw its worst session ever after its second-quarter results missed expectations on both revenue and earnings per share.

Back in February, Alibaba announces $25 billion stock buyback after missing its revenue target for the fourth quarter of 2023.