Investor says Nvidia stock split 10-1 is mostly ‘cosmetic’

After the market closed, Nvidia’s 10-for-1 stock split was announced in May during the company’s most recent earnings call. earnings call, takes effect. But it won’t change much about the company valued at 3 trillion USD or its underlying fundamentals, which, so far, have left investors worried.

“You and I both know that stock splits are cosmetic, at least,” said Paul Meeks, a veteran technology investor and business school professor at The Citadel military university. for existing shareholders”. “Given its investor relations habits, Nvidia is well aware that it has to continue to throw a few bones out there” for investors.

Several other companies have demonstrated the new corporate hierarchy ushered in by the rise of AI as Nvidia has. Of the company Share has increased 3,174% in the past 5 years and 218% in the last year alone. During its epic run, Nvidia Market capitalization skyrocketed overcome your preferences Amazon And Alphabet. Before the 10:1 split, the stock was at a sky-high $1,209.

That price may be too high for most investors, certainly retail investors According to Humayun Sheikh, CEO of startup Fetch.ai, which provides tools specifically for AI developers, the split is aimed at attraction. “The stock split enhances Nvidia’s appeal by making the stock more affordable, thereby expanding the company’s investor base,” he said.

Sheikh also sees the move, at least in part, as due to investor perception, saying it could be “affected by optics” and could accelerate market capitalization gains.

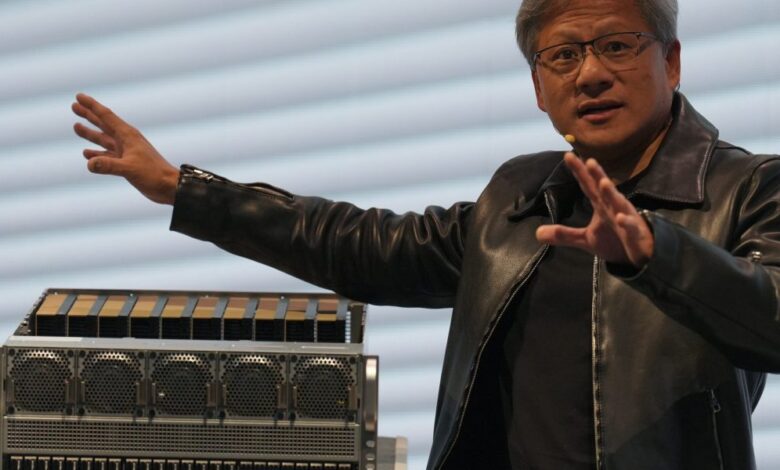

Nvidia’s position is that the company has cornered on the market about providing AI developers with all the chips and computing power they need will not change due to the stock split. In the first quarter, Nvidia Sales increased by 262% annually to 26 billion USD, far exceeding Wall Street’s already lofty expectations.

Nvidia’s stock rally is also a hint of what the AI boom may still bring.

“Nvidia’s price changes over the past year are telling us something about the market, specifically, that perhaps AI is the new general-purpose technology, like the internet or electricity, that will have a big impact on productivity across the economy, and AI companies will therefore benefit greatly,” said NYU business school professor Vasant Dhar.

What could happen with Nvidia’s stock split?

However, investors are looking at several scenarios where things could go south for them following the stock split, even because they admit the odds are very small.

For Meeks, the only thing that can stop Nvidia march to the top is an economy-wide recession, which he considers unlikely because he expects the US to avoid a recession and the Federal Reserve to lower interest rates in early 2025. In fact, he already thinking about Nvidia’s performance if the economy improves.

“It would be difficult for these stocks to lose gains if suddenly we went from favorable high interest rates to back to low interest rates,” Meeks said.

Meanwhile, Sheikh said the retail investors the split is intended to attract are another possible but unlikely concern. Retail investors alone can hold a small amount of Nvidia stock. But overall, they can account for a significant portion of the shares. So any shocks to the system or unexpected changes in their view of the company could still have a notable impact. One need not look further GameStop easy to understand outsized influence Retail investors may be in the market.

Reducing inventory to one-tenth of the price can be a double-edged sword. “This approach could appeal to Robinhood-style investors or meme stock enthusiasts,” Sheikh added. “However, if the story turns against Nvidia and speculative traders start selling, that could negatively impact prices.”

But even if that undesirable scenario were to happen, it wouldn’t change all the market trends that are supporting the chipmaker.

“Nvidia has had a very big run, so any positive impact from the stock split will be small compared to the ‘fundamental’ reasons for its performance,” Dhar said.