India importing inflation, won’t come down in a hurry; how govt can help RBI: TOI Online Economists Survey

After hitting an eight-year high of 7.79% in April this year, inflation has peaked but will still take time before falling below 6%, economists and experts feel. In a survey of 13 economists and policy advisers conducted by Times of India Online, the majority of experts think inflation will stay within the RBI’s safe zone of only 2-6% in the financial year. next.

Are global factors the main driver of inflation in India? How does inflation in India compare to other major global economies? The Times of India online survey gives a deeper insight into what is driving inflation in India, when it is likely to go down and what else needs to be done on the money front. currency and fiscal.

CPI boosting factor: India imports inflation

The majority of economists surveyed by TOI Online believe that India is importing inflation due to global supply chain disruptions and crude oil shocks. The RBI’s Monetary Policy Report for September 2022 also said that the trajectory of the CPI has been affected by the Russia-Ukraine war.

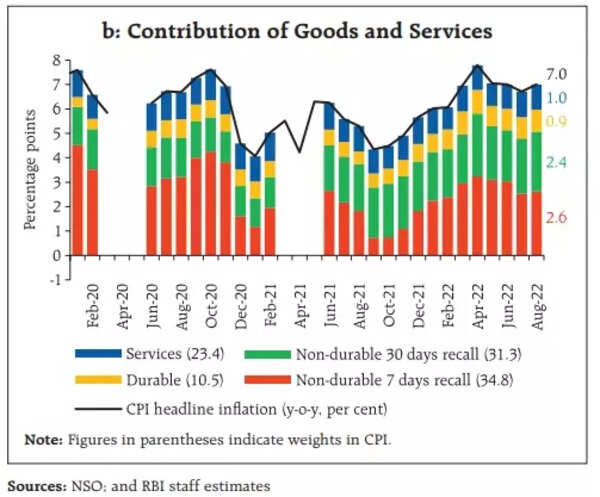

During the period from March to August 2022, commodity inflation contributed 86% of the main inflation rate. The RBI report said that perishables such as perishables along with grains and medicines are the main drivers of commodity inflation.

Contribution of Goods and Services to CPI . Inflation

Food and beverage inflation (with a share of 45.9% in CPI) accelerated to more than 8% in April 2022, driven by global supply shortages and adverse domestic weather conditions. Afterward, food inflation declined but rebounded in August with cereals and vegetables being its main drivers.

CPI fuel inflation increased by more than 11% due to the sharp increase in the price of LPG and subsidized kerosene, which reflects the spike in global energy prices following the conflict in Ukraine. Fuel inflation is now under control due to falling kerosene prices.

It is important to note that the subject line CPI . inflation tested an upper tolerance threshold of 6% January-February 2022, due to adverse baseline effects and sticky core composition.

According to Ranen Banerjee, Partner and Head of Economic Advisory Services India Inflation is being hit hard by import inflation due to the large volume of our imports. Banerjee explains that unlike global economies, monetary interventions to tackle inflation in India are not meant to impact demand (despite collateral damage there). !).

“Monetary intervention necessitates maintaining interest rate differentials between the US/other developed economies and India to address any significant impact on the exchange rate from adverse capital flows leading to to more import inflation as imports are more expensive in rupee terms,” he told TOI while answering the survey.

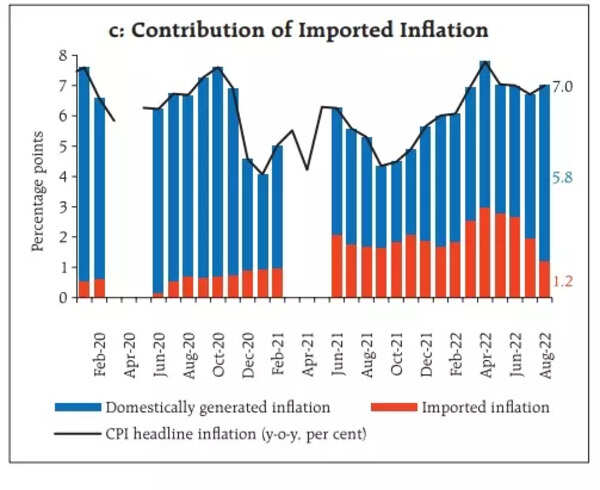

Contribution of import inflation

As shown in the chart, the increase in global commodity prices due to the war contributed to the increased share of imported components’ share of strong inflation in the period from March to June 2022. Thereafter. , the drop in international commodity prices in July-August 2022 has reduced import inflation.

The RBI also noted that higher global inflation and global interest rates impact capital flows, putting downward pressure on the local currency and leading to higher import inflation.

Madan Sabnavis, Chief Economist at Bank of Baroda, said that inflation is being driven by supply-affected food prices and producer inflation, where companies are still in the process of shifting costs. their higher input to consumers. He told TOI.

India versus advanced economies

The International Monetary Fund (IMF) has forecast that global inflation will increase from 4.7% in 2021 to 8.8% in 2022. In fact, CPI inflation in advanced economies is expected. will reach an all-time high.

According to the RBI report, inflation increased across economies as a result of continued cost pressures from rising food and energy prices, rising wage costs and prolonged supply chain bottlenecks caused by the pandemic. as strong domestic demand recovers in some economies plus price pressures. .

This has prompted central banks across economies to tighten monetary policy aggressively. In India too, the RBI has raised the key policy repo rate by 190 basis so far this year.

However, RBI governor Shaktikanta Das in his September policy statement said that India is in a better position than other economies. “Unusual global circumstances causing increased inflationary pressures have impacted both the AEs and EMEs. However, India is better positioned than many of these economies,” he said.

Nikhil Gupta, Chief Economist at Motilal Oswal Financial Services pointed out that while India’s inflation is likely to average ~7% or 1.75 times the medium-term target, it is much lower than the medium-term target. with extreme inflation in advanced economies, at 3x-4x of the target.

Dharmakirti Joshi, Chief Economist at CRISIL notes that in India, inflation is not only lower but also more supply-driven than in some advanced countries. Agreed, Sachchidanand Shukla, Chief Economist of Mahindra Group, who added that unlike in India, an advanced economy like the US is seeing more demand leading to rising inflation.

DK Srivastava, Chief Policy Adviser, EY says that most of the inflation globally as well as in India is due to supply disruptions and cost drivers. The RBI continuously tracks the movement of inflation and increases the repo rate, he noted. “It is also aimed at curbing inflation while minimizing the negative impact on the exchange rate and growth rate,” he added.

CPI Inflation: When does it fall below 6%?

An economist at a prominent housing finance firm thinks the trajectory of inflation will depend largely on how the Russo-Ukrainian war plays out. “Inflation will start to fall when the war ends. That will be the turning point,” the economist said.

Dr. Rupa Rege Nitsure, Group Chief Economist at L&T Financial Services, sees inflation below 6% in FY24. She says this will be driven by falling global commodity prices. (including Brent crude oil prices) and food prices. A favorable statistical base effect would also reduce inflation, she said, adding that there would be a slowing effect from the RBI’s monetary tightening.

A leading economist at an industry body feels that without any new price shocks, CPI inflation will fall below 6% by March 2023. “The share of the food basket in India is very strong. high, close to 50%. A base-year revision from the current 2012 baseline could create new weights for individual baskets,” the economist said.

Incidentally, a report by SBI Ecowrap in September also said that the CPI basket has not changed since 2012 and this could also lead to multiple CPI inflation.

Dr Arun Singh, Chief Global Economist at Dun & Bradstreet doesn’t see an easy path forward for inflation to come down. “CPI will fall below 6% by the start of FY25 as energy prices are expected to remain high and geopolitical risks will keep staples prices up,” he said. high.

“Energy and food both contribute to more than 52% of key inflation. As agriculture depends on the monsoon and requires more than 80% of oil to be imported, India’s inflation dynamics depend on a change in the monsoon. and geopolitical events that impact oil transportation,” he demonstrated.

According to the RBI report, CPI inflation will only gradually come within the target range. The outlook is likely to be significantly uncertain, given the volatile geopolitical situation, spillovers from increased volatility in global financial markets, and adverse climate conditions, the report warned. recurrence,” the report warns.

What more can be done to reduce inflation?

Bank of Baroda’s Sabnavis argues that monetary intervention is only part of the solution. “We need fiscal intervention through tax breaks to bring it down. It’s not just gasoline and diesel but also GST on goods and services,” he said.

Mahindra Group’s Shukla advocates the use of fiscal measures to complement monetary policy. “The previous government reduced import taxes on cooking oil, regulated the import and export of certain items, and taxes on gasoline and diesel were lowered,” he said. “These steps have been used judiciously, so some of these could be reused to control inflation. In addition, gold imports have skyrocketed in quantum terms,” he added. , that’s another area where the government can act financially.”

On the other hand, Nitsure of L&T Financial Services believes that even if the current inflation is caused by supply shocks, monetary policy will be effective in controlling it with lagging.

The broad consensus among economists is that despite adverse global trends, Indian Economy better placed and resilient. With several world economies facing recession and high inflation, there is no doubt that the RBI and the government have a difficult task in sustaining India’s growth while keeping inflation in check. control.