How investors can learn to live with inflation: BlackRock

Growth stocks may have led the rally in early 2023, but persistently high inflation means that won’t last.

That was the key message from the BlackRock Investment Institute on Monday, like US stocks struggled to recover after consolidating their worst weekly loss of the year last week and as strong economic data pointed to challenges ahead for the Federal Reserve as it works to reduce the cost of living. .

“High inflation has caused a cost-of-living crisis, putting pressure on central banks to tame inflation at all costs,” said the BlackRock Investment team led by Wei Li, director of global investment strategy. , said.

It is important that the team also think “[w]In our view, we will have to live with inflation”, as “the Fed’s recent cycle of excessive rate hikes will come to a halt if inflation does not get back on track to fully return to target.” spend 2%.”

BlackRock Company

BLK,

To be The world’s largest asset manager, which oversees approximately $9 trillion globally. The BlackRock Investment Institute is its research arm.

While the team expects spending patterns to normalize and energy prices to “reduce,” helping to cool inflation, they also find that inflation “is well above policy targets in recent years.” next”.

Read: Confused about what causes inflation? This metric shows what is driving the price up.

On Friday, the Fed’s preferred inflation gauge, Personal Consumption Spending, showed a 5.4% year-on-year price increase in January, up from 5.3% the previous month.

The Federal Reserve raised the benchmark federal funds rate to 4.25%-4.75%, up from nearly 0% a year ago, with another increase expected in late March as Central banks attempt to bring borrowing costs into limited territory.

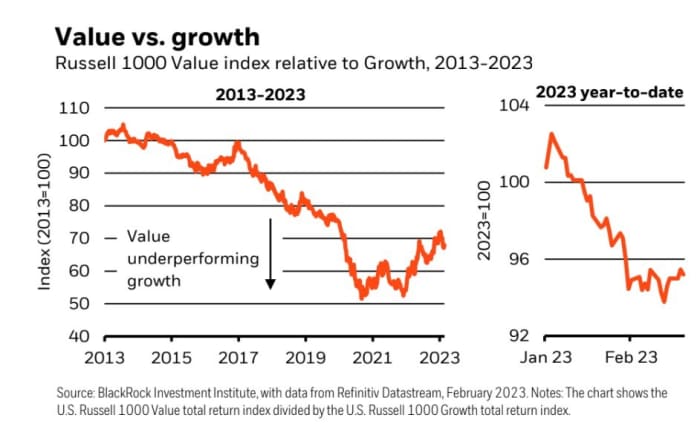

Against this backdrop, the BlackRock team expects higher rates to affect growth stocks

RLG,

reduce the value of future cash flows, but to increase the value of the stock

RUI,

which “could continue to escalate” began last year (see chart) – even as interest rates rise, inflation rises and the US economy slips into recession.

Value stocks are BlackRock’s top pick in the environment of high interest rates, rising inflation, and a recession in the United States.

BlackRock Investment Academy

The Russell 1000 Growth Index is up 7.1% year-to-date through Monday, according to FactSet, while the Russell 1000 Value Index is up 1.4% over the same time period. Nasdaq is heavy on technology

COMPUTER,

up 9.6% and the S&P 500

SPX,

was up 3.7% for the year.

The BlackRock team wrote: “While value has underperformed in the past in recessions because capital-intensive companies have not been able to react quickly to cycles of change, we think that could be different. in this atypical business cycle”. “The value remains attractive after being devalued for so long.”

They also prefer short-term government debt, including Treasuries, where yields on long-term bonds are higher, but not longer-term bonds, especially with the painful sell-off on across the markets last year showed that the value of both stocks and bonds can fall simultaneously.

10-year Treasury bond yield

TMUBMUSD10Y,

at 3.9% on Monday, near 4.2% peak in October, but 2-year forward

TMUBMUSD02Y,

the rate is almost back to its 2007 approximate level of 4.8%.

“Central banks are unlikely to come to the rescue by cutting rates quickly during a recession that they design to bring inflation down to policy targets,” the BlackRock team said of the BlackRock team. their preference for shorter Treasuries. “If anything happens, policy rates could stay higher for longer than the market expects.”