Hedge funds cash in on the Trump-fueled crypto boom

A slew of crypto-focused hedge funds have made big headway in recent weeks as Donald Trump’s election victory fueled a powerful rally that pushed bitcoin above the $100,000 mark.

According to data provider Hedge Fund Research, funds using crypto strategies posted a 46% gain in November, lifting their annual return to 76%. HFR said returns have outpaced the industry as a whole, with the hedge fund average up 10% in the first 11 months of this year.

Brevan Howard Asset Management and Galaxy Digital, the cryptocurrency investment management firm founded by billionaire Mike Novogratz, are among the biggest beneficiaries of the recent rise in digital assets.

The outsized returns of cryptocurrency funds that emerged after Trump’s election victory in November added a new wave of enthusiasm to this year’s rally in bitcoin, the largest cryptocurrency, which has also caused Smaller tokens soared.

Bitcoin has surged 130% this year to around $100,000, helping push the market value of major cryptocurrency tokens from $1.8 trillion to $3.5 trillion, according to FT Wiltshire Digital Asset Dashboard. Crypto markets pulled back from recent highs this week after the Federal Reserve said it will cut interest rates by less than expected next year, hitting risk assets .

Investors are betting that Trump’s crypto-friendly nominees for top government positions will contrast with Joe Biden’s administration, which has generally taken a more skeptical approach.

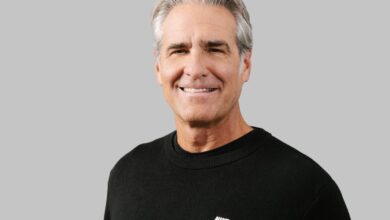

Damien Miller, managing partner at macro hedge fund MP Alpha Capital, said: “Trump’s election is great news for digital assets as it will bring more legal clarity. reason”. “There will be a more friendly and collaborative environment for bitcoin and blockchain.”

According to investors, Brevan Howard’s main cryptocurrency fund rose 33% in November and is now up 51% in the first 11 months of the year. Brevan Howard, worth $35 billion, is one of the largest hedge fund managers with a dedicated cryptocurrency business, launched in 2021.

Galaxy’s hedge fund strategy grew 43% in November and is up 90% in 2024, according to investors. The New York-based group has more than doubled assets under management in the past two years , to 4.8 billion USD, partly thanks to buy up assets from bankrupt crypto companies.

Galaxy and Brevan Howard declined to comment on their performance.

The recent surge in digital assets marks a stunning reversal of fortunes for a sector mired in a deep crisis starting in 2022.

Bitcoin hit a low of around $15,500 when Sam Bankman-Fried’s FTX exchange collapsed in November 2022. Galaxy, which is looking to establish itself as a full-service crypto financial services company , had a net loss of $1 billion that year.

Cryptocurrency industry received an additional shot in January 2024 when the U.S. Securities and Exchange Commission approved 11 exchange-traded bitcoin funds, opening the door to cryptocurrency for new retail and institutional investors. BlackRock, the world’s largest asset manager, said last week it sees “a case for including bitcoin in multi-asset portfolios.”

NextGen Digital Venture, a $120 million crypto investment fund, is up 330% from its launch in March 2023 to the end of November, according to investors. in several bitcoin ETFs, as well as cryptocurrency exchange platform Coinbase and bitcoin investor-turned-software provider MicroStrategy.

“Once the bitcoin ETF is approved, we feel that crypto stocks will become another opportunity for institutional investors because they had access to bitcoin.”

Coinbase is up nearly 60% since the end of 2023, while MicroStrategy is up more than 400%.

Several macro hedge funds – which specialize in trading macroeconomic trends in currencies, commodities, bonds and stocks – have also increased their exposure to digital assets to stay ahead of the market environment. favorable. MP Alpha Capital’s $20 million global macro hedge fund is up more than 30% this year, according to investors.

“We have had good activity in digital assets: bitcoin, ethereum and bitcoin miners,” Miller said.. “Over the past 18 months, our entire thesis has revolved around institutional digital asset adoption and the macro backdrop of looser monetary policy, a weaker dollar and a liquidity-rich environment. Clause.”

Trump has signaled that cryptocurrency regulation is one of his most urgent priorities and has named venture capitalist and Elon Musk confidant David Sacks as his White House chief. king of cryptocurrency.

The change in leadership at the SEC, America’s top securities regulator, has also been welcomed by cryptocurrency enthusiasts.

Gary Gensler, the current chairman, who has branded cryptocurrency a “Wild West” rife with illegality and investor risk, will step down when Trump takes office. He has refused to develop rules for digital assets, arguing that many tokens are securities and that existing securities laws are sufficient guidance.

Gensler will be replaced by cryptocurrency advocate Paul Atkins.

However, some regulators warn that bitcoin’s surge should cause investors to pause and buy stocks. Huang at NextGen Digital Venture said that while he is optimistic about the long-term bullish trend of bitcoin and cryptocurrencies, “no asset rises in a straight line without volatility.”