Goldman Sachs says these two LiDAR auto stocks should be on your radar; See at least 90% upside potential

While electric vehicles (EVs) are making headlines in the auto industry, there are two other trends that will grab investors’ attention. These are autonomous and driver-assisted vehicles. They are based on similar technologies – advanced sensing systems, machine learning and AI as well as interactive interfaces for operators – but they perform different roles. However, for investors, these technologies will present many opportunities where rubber meets the road.

Automotive industry experts from investment firm Goldman Sachs have been at the forefront of these new developments in the automotive world and are particularly enthusiastic about LiDAR systems. These are high-tech sensor systems (terms derived from ‘light detection and range’) that use lasers to provide range and velocity information about surrounding objects with precision. as high as possible. LiDAR represents the latest in sensor technology and Goldman analysts Allen Chang writing about it, “We believe we are in the early stages of mass adoption of LiDAR and are modeling global assisted driver license penetration to triple over the next 10 years. This is one of the fastest growing profiles in the electric vehicle supply chain over the next decade.”

We can follow Goldman Sachs’ lead and use TipRanks Platform to get details on two of the company’s LiDAR picks, companies that GS analysts consider to be at the forefront of the LiDAR revolution. Each of these target companies has a Strong Buy composite rating from Wall Street analysts, and Goldman sees them gaining at least 80% over the next year. Let’s take a look at their details, as well as the Goldman commentary.

Hesai Corporation (HSAI)

We will start with the Shanghai-based Hesai Group, the world leader in the development and application of LiDAR systems. The company’s sensor technology is already used in autonomous mobility, of course, but also in trucking, robotics and even factory manufacturing. As of December 31, 2022, Hesai Group has shipped more than 100,000 units of LiDAR, and the company has also built close relationships with leading OEMs in the automotive industry and holds a 60% market share. in the field of automatic mobility – self-driving cars – suitable.

Hesai Corporation has just entered the US public market, after conducting an initial public offering of US custody shares (ADS). The IPO, which ended on February 13, saw the company bring 10 million ADS to market at an opening price of $19 each and raise a total of $190 million. The IPO is China’s biggest initial public offering in the US market since 2021.

Last week, just over a month since its IPO, Hesai released its first quarterly financial results as a publicly traded entity on the US NASDAQ exchange. The report, for Q4 of 22, shows quarterly revenue of $59.3 million, up 56% year over year. This was supported by a whopping 739% year-on-year increase in quarterly LiDAR deliveries, reaching 47,515. Of that total, 43,351 are ADAS (advanced driver assistance systems) and 4,164 are autonomous mobility. Despite these successes, Hesai’s stock has endured a market downturn and is down 42% since trading began.

Still, Goldman’s Allen Chang sees enough reason to support Hesai. Explaining his optimistic view, he wrote: “We highlight three key competitive advantages of Hesai: (1) Technology – Hesai pursues a unique “ASIC” technology that integrates key components to reduce power consumption, simplify production and reduce unit costs; (2) Manufacturing – Hesai owns a world-class LiDAR production facility in Shanghai. Their product design and manufacturing reinforce each other, allowing for faster product iteration. (3) Large domestic market – China leads the way in ADAS and autonomous vehicle adoption, with new car sales penetration rate increasing 10 times from 8% to 84% (2021-30E). This expansion provides the opportunity for Hesai to scale its technology.”

Looking ahead, Chang sees fit to rate the stock as Buy, with a $29 price target implying a strong 123% upside potential over the next year. (To see Chang’s achievements, click here.)

In his short time on the US public market, Hesai has selected 3 analyst recommendations – and all positive, to achieve a Strong Buy consensus rating. The stock has a current trading price of $13.00 and an average price target of $28.50 showing a gain of 119% over 12 months. (See Hesai’s stock forecast at TipRanks.)

innovation technology (INVZ)

Next on our list is Innoviz Technologies, another leader in the worldwide LiDAR market. Innoviz both designs and manufactures high-end solid-state LiDAR sensors, along with the necessary software to connect the sensor hardware to the control computer system. Innoviz has worked with a number of big-name auto companies, including BMW and Volkswagen.

Shares of Innoviz peaked in February of this year and are down 33% from there; Over the past two years, the stock has dropped 65%. During this time, the company suffered a net loss and revenue did not increase. A look at the company’s most recent financial statements shows that the full year 2022 numbers are slightly higher than the year-ago period, that the fourth quarter of 2022 fell short of expectations, and the forward guidance disappointing.

At the quarterly level, the company showed revenue of $1.58 million, below estimates and down nearly 5% year over year. The company’s fourth-quarter EPS, a loss of 25 cents, was below its forecast for a loss of 24 cents. For the full year, top sales grew 10% to 6 million, and the company sold a record number of LiDAR units.

Sentiment worsened further, Innoviz missed guidance on futures sales. The company expects total revenue in 2023 between $12 million and $15 million; while this would represent a double – or more – increase in top-line revenue from the same period last year, by analyst consensus, expected guidance is ~30 millions of dollars.

Five-star analyst Mark Delaney defended the stock for Goldman, who acknowledged the difficulties the company is facing but went on to outline an upbeat outlook: “We believe the fourth-quarter report is increasingly bullish. negative, although we maintain a Buy rating reflecting our positive view of the company’s long-term opportunities. Specifically, we believe the company’s order book remains strong including design wins at 3 automotive OEMs (i.e. BMW, VW and one Asia-based OEM). While production ramping up is happening more slowly than we expected with 2023 revenue guidance below Streets, we believe that as ADAS OEM programs accelerate over the years Next time, the company will see improved results.”

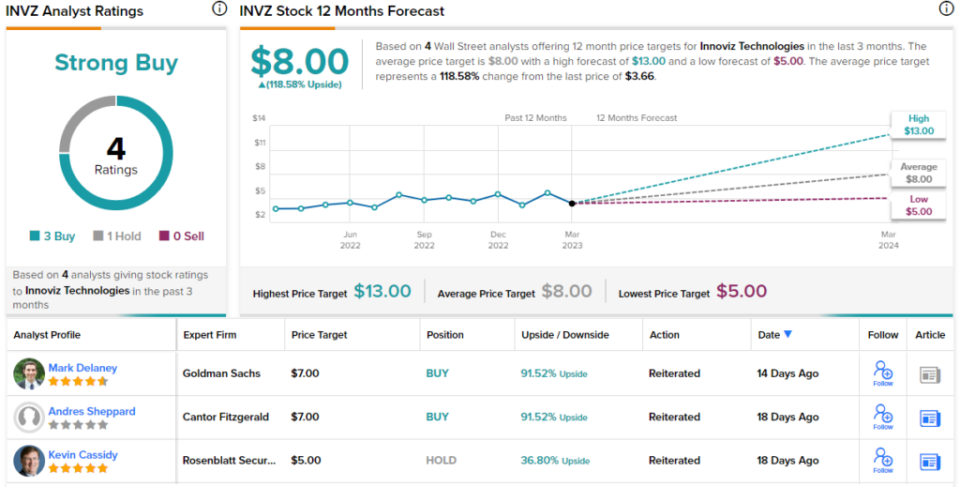

Quantifying his stance, Delaney rates INVZ stock as a Buy and his price target, set at $7, indicates his belief in a 91% upside for 2023. (To view. Delaney’s track record, click here.)

Overall, Innoviz has a Strong Buy from Street consensus rating, based on 4 analyst reviews with a 3 to 1 split that favors Buy over Hold. The stock has an average price target of $8, well above Goldman’s outlook and shows a 118% gain from its trading price of $3.66. (See Innoviz’s stock forecast at TipRanks.)

To find great ideas for trading stocks at attractive valuations, visit TipRanks’ Best stocks to buya newly launched tool that consolidates all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are those of prominent analysts only. Content is used for informational purposes only. It is very important that you do your own analysis before making any investment.