Fundstrat’s Tom Lee says stock market could see ‘fireworks’ through year-end as headwinds have ‘turned upside down’

According to Tom Lee, head of research at Fundstrat Global Advisors, some of the headwinds that plagued the stock market in 2022 have turned into headwinds, setting the stage for a rally in stocks. US stocks at the end of the year.

“The Thanksgiving break is over and now the market is entering the final crucial weeks of 2022,” said Lee, head of research at Fundstrat. ‘close the book’ for the year, but we think the last 5 weeks will be ‘fireworks’.”

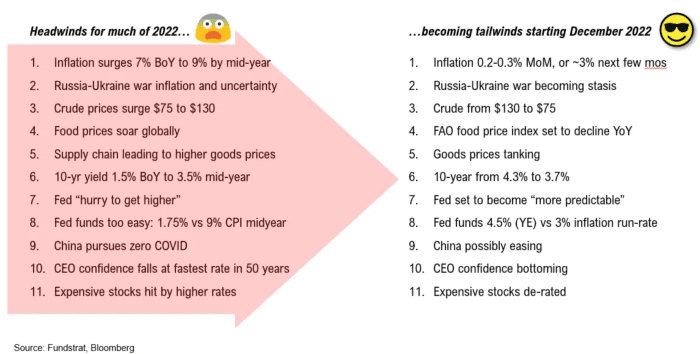

In Lee’s view, 11 headwinds this year helped push the S&P 500 to a 2022 low in October, including soaring oil prices and the Federal Reserve’s rush to raise interest rates. more to combat high inflation, “all has been reversed”. On Monday morning, US oil traded at lowest price 2022 Between Protests in China about the country’s strict rules to limit the spread of COVID-19, restrictions that investors fear will affect consumption and economic growth.

Lee said he sees October’s drop in inflation, as measured by the consumer price index, as a “game changer” for the market, with “sustained equity gains” likely to be the strongest since. year to date. Here are the 2022 headwinds that Lee sees turning into headwinds.

FUND ANNOUNCEMENT NOVEMBER 28, 2022

Lee said that the milder inflation seen in October appeared “reproducible” and that the easing of price pressures was “sufficient” for the economy. Fed slows down rate hikes rapidly, with December likely to be the last increase. Also, “if inflation was ‘as bad as it was in the 1980s,’ I would have thought the midterm elections would be an incumbent massacre,” Lee said of the recent US election.

He said other recent signals point to “a very different path forward for the market,” including volatility “collapse” in the bond market and a relatively large drop in the US dollar. . Lee pointed to a drop in the CBOE’s 20-Year Treasury ETF Volatility Index, saying that he predicts that further declines will support the S&P 500’s spike to 4,400 to 4,500 by year-end.

The S&P 500 ended Friday down 15.5% for the year, but is up more than 12% from its 2022 low close on October 12, according to Dow Jones Market Data.

US stocks trade lower on Monday, with S&P 500

SPX,

fell 0.8% to about 3,995, according to FactSet data. In the bond market, the yield on a 10-year Treasury note

TMUBMUSD10Y,

unchanged at 3.69% around midday Monday, while the two-year yield

TMUBMUSD02Y,

down about 5 basis points to 4.43%.

Lee said U.S. yields have recently seen “severe declines in the bottom 1% of the biggest downward trend in 50 years.” According to his note, the odds are growing that 10-year and 2-year forward yields could exceed their peaks, potentially supporting an expansion of the stock’s price-to-earnings multiples.

Skeptics will say “growth is the problem now” and point to a decline” in the S&P 500’s earnings per share, or EPS, Lee said. But historically, the index has “bottomed 11-12 months before the bottom of EPS,” he said. “So EPS is lagging.”

Also see: Barclays says cash could be ‘real winner’ in 2023 while recommending bonds instead of stocks