Former FTX user says the failed crypto exchange was a ‘Ponzi scheme’. Here’s How They Work And What We Know About How Sam Bankman-Fried Works

Until recently, Sam Bankman-Fried, or SBF, was cryptocurrency Golden Boyknown for building its crypto exchange FTX into a $32 billion behemoth in just two years.

But the 30-year-old man with messy hair gamer living a lie. SBF, who claims to be a minimalist philanthropistyes used customer’s money to prop up his failing crypto empire and fund lavish lifestyle.

Amidst the broader crypto industry revelations and cuts, FTX and investment web—includes the commercial business of SBF, Alameda Research, as well as more 200 other crypto companies-yes significantly elucidated.

Meanwhile, SBF, former Cryptocurrency “white knight” who was reported value $26.5 billion, says he’s down to the bottom 100,000 USD.

Old FTX client, academicand even loyalty to cryptocurrencies alleged that Bankman-Fried’s now-defunct cryptocurrency exchange was a “Ponzi scheme”, leading to a great flood about civil lawsuits against him and his company. There has not been any ruling on the cases yet.

In spite of allegationsand enrolled by SBF’s mistakeattorney has contacted Luck said it was too early to declare FTX a true “Ponzi scheme” — though it said prosecutors could eventually do so.

“I don’t know if it’s a Ponzi scheme and it’s probably going to take some time,” said Thomas P. Vartanian, executive director at the nonprofit Center for Cybersecurity and FinTech. more we know.

Vartanian, who has represented parties in 30 of the 50 largest financial institution crashes in U.S. history, noted that prosecutors can take years to learn about complex accounting. complex, interconnected and mismanagement of FTX and its subsidiaries.

“They will track the coin, and they will track it down to the penny. And they’re going to find out if we’re dealing with negligence, civil fraud, criminal fraud and whether it’s a Ponzi scheme, a pyramid scheme or whatever.” he said. “But those are facts that I don’t think will be in anyone’s possession for a while – until all the money is tracked.”

However, Vartanian noted that the published filings from FTX’s bankruptcy so far are “pretty devastating.”

“To me, so far, this looks like corporate misconduct,” he said. “And whether it turns into fraud and illegality or a Ponzi scheme is another question.”

But Carlos Martinez, a bankruptcy specialist at the law firm Scura, Wigfield, Heyer, Stevens & Cammarota, has gone a step further.

“I think the legitimate answer would be ‘wait for the investigation’,” he said. “But I think it’s pretty dry. It’s written on the wall that this is—or at least, if it’s not a Ponzi scheme, it certainly works like a Ponzi scheme.”

How Ponzi schemes work

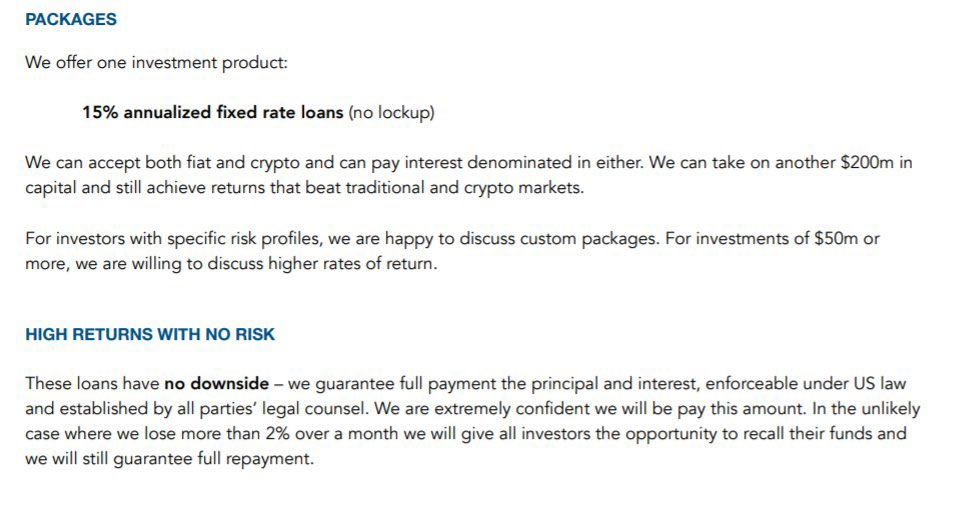

A Ponzi scheme is a scam that attracts investors with the promise of high returns with little or no risk. The point is that Ponzis generates those purported returns using money from new investors, not profitable investments.

The name comes from Charles Ponzi, an Italian con artist who scammed US investors in the 1920s with a clever story and the promise of high returns.

SEC warned about the dangers of Ponzi schemes and their popularity in the crypto world. And some crypto critics, like Nouriel RoubiniProfessor emeritus at New York University’s Stern School of Business and CEO of Roubini Macro Associates, even argued that the entire cryptocurrency ecosystem is the “mother of all Ponzi schemes.”

FTX shares many similarities with previous Ponzi schemes. Sheila Bair, served as president of the Federal Deposit Insurance Corporation (FDIC) from 2006 to 2011, told CNN earlier this month that SBF’s ability to attract regulators and investors is “a lot like Bernie Madoff in a way.”

For more than 20 years, Madoff ran the largest Ponzi scheme in history before his arrest in 2008, stealing $65 billion from about 37,000 individuals. Although the final accounting has not yet been completed, FTX has Debt 50 billion USD to more than 100,000 creditors, bringing SBF’s business close to Madoff’s.

But does SBF run a Ponzi scheme? Or was it corporate fraud like the one that led to the downfall of Enron, the Houston-based company? energy company bankruptcy and the subsequent accounting scandal that rocked the market?

If you ask former Treasury Secretary Larry Summers, Enron resembles FTX more than a purely Ponzi scheme.

“I would compare it to Enron,” Summers told Bloomberg in the first day of this month. “It’s not just a financial error but – certainly from the reports – there are signs of fraud. The naming of the stadium is very early in the company’s history. An explosion of wealth that no one understands where it comes from.”

What we know about how FTX works

Martinez said that whether FTX was a Ponzi scheme is up for debate, but the SBF may also have been involved in what prosecutors have been able to identify as “embezzlement of funds” and “fraud.” island” or even “a complete Ponzi scheme”. Luck.

For example, SBF used at least $4 billion in FTX client funds to support its trading firm, Alameda Research, when crypto prices fell earlier this year, according to CoinDesk. SBF denied that he had implemented a “backdoor” in FTX systems to do this, saying it was “definitely not true” and that he couldn’t even code.

SBF’s media representatives did not respond to a request for comment Luck.

But at The New York Times Dealbook Summit on Wednesday, SBF expressed surprise at the collapse of FTX, saying that: “I have never tried to cheat. I was excited about the prospect of FTX a month ago. I see it as a thriving, growing business. I was shocked by what happened this month. And in rebuilding it, there are things that I wish I had done differently.”

But the former crypto billionaire admitted that “very poorly labeled accounting” has left Alameda “significantly more leveraged” than he anticipated.

FTX faces a wave of lawsuits Its advertising is the same as what happened to Bernie Madoff marketing arm in 2009 after being arrested.

FTX has hired celebrities including NFL star Tom Brady for expensive Super Bowl commercials. And in one stage 2018 For investors (pictured below), it offers clients what it describes as “high returns without risk” and “no downside” loans.

SBF and his team at FTX don’t mind spending either. Discount firm 300 million USD on properties in the Bahamas for senior executives, obtained a $55,000 card at Jimmy Buffet’s MargaritaVille bar and charter a private jet to fly Amazon package to the executive director.

During his prime, Madoff and his colleagues also lived a life of luxury, buying million dollar mansion and luxury jewelry, clothing and watches—some of which are auction to return money to its investors after being arrested.

Finally, before the crash, FTX’s main international exchange held $9 billion in unsecured debt with just $900 million in assets, according to the report. Financial Times. Normally, total liabilities and total assets should match up on the balance sheet, and the disparity shows that FTX was in a deep hole before it collapsed.

While the SBF has insisted that he simply misjudging FTX’s new CEO, John Ray III, who also handled Enron’s collapse, called FTX’s operation a “complete failure of the company’s control” with a “complete lack of information” reliable financial information”.

“From compromised system integrity and faulty regulatory oversight abroad, to centralizing control in the hands of a very small group of inexperienced, inexperienced individuals,” he said. and potentially compromised, this situation is unprecedented.

Whether the SBF is operating a Ponzi scheme through FTX will not be determined until prosecutors have concluded their investigation and a grand jury has drawn up rules on any criminal cases. which they offer. But Vartanian argued that Congress must pass tougher regulations on the crypto industry as soon as possible.

“I think Congress needs to draft new rules to make it clear that the crypto business is taking and using other people’s money, and that means it’s a trust company,” he said. by law.”

This story was originally featured on Fortune.com

More from Fortune: America’s middle class is at the end of an era Sam Bankman-Fried’s Crypto Empire ‘Runs By A Group Of Children In The Bahamas’ Who Dated Each Other The 5 Most Common Mistakes Lottery Winners Make Sick of a new Omicron variant? Be prepared for this symptom