Ether (ETH) 15% Down Since Ethereum Consolidated As Traders Take Profits

Ethereum has undergone a massive network upgrade known as consolidation that proponents say will make transactions much more energy efficient. Following the consolidation, the price of ether fell after a strong rally prior to the event.

Jakub Porzycki | Nurphoto | beautiful pictures

Ether has fallen more than bitcoin since the underlying technology of the cryptocurrency, the Ethereum network, underwent a major upgrade called consolidation.

Ethereum is a blockchain technology that allows developers to build apps efficiently. Ether is the native cryptocurrency that runs on Ethereum.

related investment news

Consolidation is an upgrade to Ethereum, changing the authentication mechanism for transactions from one proof-of-work method to proof-of-stake. Proponents say this will make validating transactions on Ethereum much more energy efficient and has been eagerly awaited by the crypto community.

Despite the successful upgrade, the ether dropped even more bitcoin.

As of September 15, the day the consolidation was completed, to around 4:30 a.m. ET on Tuesday, ether is down about 15%. Bitcoin has dropped about 3% in the same period.

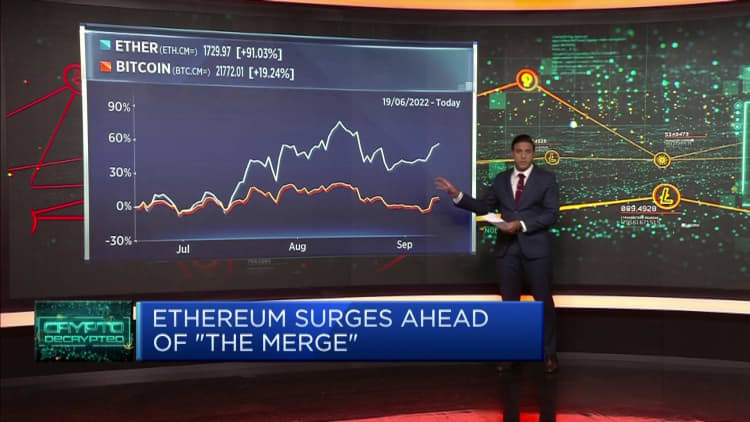

Before upgrading the network, ether price almost doubled from year low in Juneoutpacing the rise of bitcoin.

Vijay Ayyar, vice president of international and corporate development at crypto exchange Luno, said that the consolidation has been “priced in” for ether and that “the actual event is a ‘sell the news’ situation.” .”

According to Ayyar, traders are also moving investments from ether and other alternative cryptocurrencies to bitcoin, “because of the expectation that Bitcoin will perform better a few months from here.”

Investors are also wondering if ether’s regulatory position may change following the consolidation after US Securities and Exchange Commission Chairman Gary Gensler indicated last week that the cryptocurrency works. Activity on the proof-of-stake model, applicable to Ethereum, can be classified as Protected. That would put it in the sights of regulators.

Gensler’s, whose comments have been reported by some news store, without specifically naming ether. The proof-of-stake model involves investors “staking” or locking up their ether and making a profit in doing so.

“For Ethereum, there is another concern: PoS (proof-of-stake) cryptocurrency could be under the hood,” said Yuya Hasegawa, crypto market analyst at Japanese crypto exchange Bitbank. SEC oversight.

The rate of increase is still being noticed

Crypto investors are also one step ahead Expected rate hike from US Federal Reserve this week.

Central banks around the world have been raising interest rates to deal with rampant inflation. But that has hurt risky assets like stocks. Cryptocurrencies have a strong correlation with the US stock market, especially the heavy tech market Nasdaq. With stocks continuing to come under pressure, cryptocurrencies are also feeling the heat.

Inflation in the US in August was higher than expected, affecting stocks and cryptocurrencies.

“From a macro perspective, inflation has edged higher and thus caused a sell-off across all markets, but ethereum and altcoins have sold off more, as they are in the riskier part of the money spectrum. electronics,” Ayyar said.

Bitcoin has been trading in a range of about $18,000 to $25,000 since June, where investors are buying, according to Ayyar.

But any “change in the macro environment in terms of unexpected inflation in interest rates, is certainly cause for concern,” he said, adding that if bitcoin falls below $18,000, the cryptocurrency could test as low as $14,000.