Dow futures rise more than 300 points as traders start 2023 on a bullish note

US stock futures rose as investors returned from the holiday to a generally upbeat mood.

How to trade stock index futures?

-

S&P 500 Futures Contract

ES00,

+0.85% up 41 points, or 1.1%, to 3902

-

Dow Jones Industrial Average Futures

YM00,

+0.81% increased by 332 points, or 1%, to 33617

-

Nasdaq 100 futures

NQ00,

+0.91% up 122 points, or 1.1%, to 11144

On Friday, the Dow Jones Industrial Average

DIA,

down 74 points, or 0.22%, to 33147, S&P 500

SPX,

down 10 points, or 0.25%, to 3840 and Nasdaq Composite

CALCULATOR,

fell 12 points, or 0.11%, to 10466. The Nasdaq Composite fell 33.1% in 2022, its biggest one-year percentage drop since 2008.

What is driving the market?

After Wall Street’s benchmark S&P 500 fell nearly 20% in 2022, equity investors seemed determined to start the new trading year on a positive note Tuesday.

Performance in index futures, however, was tough, with the S&P 500 contract hovering in the 55-point range in early-hour action – volatility suggesting uncertainty still pervades the market.

Richard Hunter, head of markets at Interactive Investor, said: “The calendar year may have changed, but the themes remain the same as the US and UK markets reopen next year. 2023.

“Recession concerns will once again be at the top of the agenda, underpinned by high inflation and rising interest rates. On the contrary, this could lead to a rough January as investors look for positive signs that central bank tightening may begin to ease on the back of weak economic data. weak,” added Hunter.

Indeed, the International Monetary Fund greets the new year with a warning that one-third of the global economy will be in recession by 2023A recession is likely to cut corporate profits.

Also, a new burst of dollar strength

DXY,

on Tuesday – a common response to worries about a global recession – is likely to further reduce earnings for US multinationals.

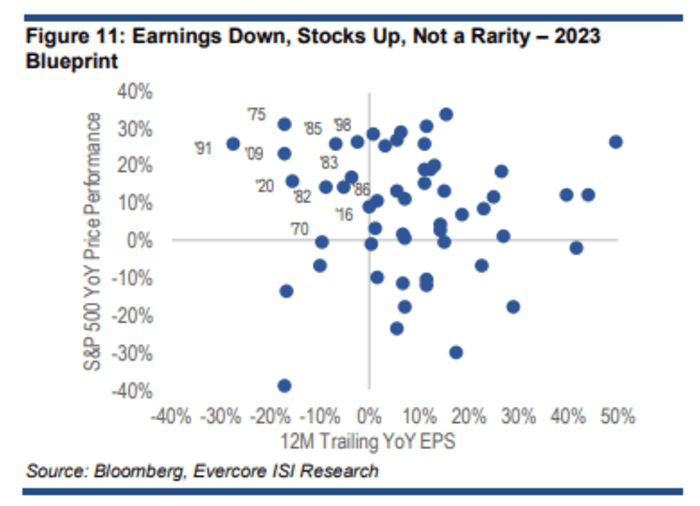

However, Julian Emanuel, strategist at Evercore ISI, said such concerns don’t necessarily mean the stock can’t recover.

“The forecast for an earnings recession in 2023 accompanied by a recession that now seems inevitable, coupled with a S&P 500 price target by the end of 2023 of 4,150, seems unlikely,” he said. in a note to customers.

“However, not only is there a long history of declining earnings/share gains in the years (1970, 1982, and 1985), but there is also a tendency for years to have strong stock/bond yields across different sectors. historically strong tightening cycles (1982, 1985) especially in the years (1995) following ‘devastating devastation’ for 60/40 portfolios, such as the fall of the year 2022.” Emanuel added.

Source: Evercore ISI

US economic updates to be released on Tuesday include the December S&P US manufacturing PMI at 9:45 a.m. and the November construction spending index at 10 a.m., both. always the East.