Deutsche Bank says buy these 2 bearish stocks before they recover

Should investors prepare for a winter of persistent headwinds? Inflation remains high, rising interest rates are squeezing capital and making consumer credit more expensive, and both China’s COVID-19 lockdown and Russia’s war in Ukraine continue to limit global supply chain.

But even if the market is facing severe headwinds, not every stock will react by falling. Two interesting stocks are likely to see significant gains in the near-term, according to analysts at Wall Street giant Deutsche Bank.

switch to TipRanks database, we see that both are rated Buy and both have suffered heavy losses in recent months, severely underperforming the broader markets. Even so, Deutsche Bank analysts believe these stocks still have room to rally in 2023, by 40% or more. Here are the details.

BlackSky Technology (BKSY)

We’ll start with a microsatellite intelligence company, BlackSky. The company owns and operates a leading network of small satellites in low earth orbit and can efficiently and cost-effectively capture images anywhere and anytime. customer request. BlackSky’s services include data processing on the Spectra AI software platform, which can integrate data from third-party sensors for critical insights and analysis. The company’s client base includes US and international government agencies, as well as global commercial organizations and businesses.

BlackSky controls a remarkably small constellation of satellites, and the company can offer many benefits to its customers. These include an average product delivery time of 90 minutes, an average time of 60 minutes for satellite re-visits, and up to 15 satellite re-visits per location per day. In addition, BlackSky can provide direct satellite downlinks for both terrestrial and marine operations.

All of this makes for a solid business in a unique niche. BlackSky capitalized on this to achieve an impressive 113% year-over-year revenue increase in the third quarter of 2022, for a total of $16.9 million. This increase was supported by solid gains in software and image analysis services, which increased their share of total revenue to 89%. While BlackSky, like many cutting-edge tech companies, operated at a net loss, EPS of $0.12 beat Street’s forecast of $0.20.

However, while BlackSky showed some impressive growth numbers this year, including a major contract with the US government’s National Reconnaissance Office (NRO), the loss-making companies did not. back in 2022, and the company’s stock has plummeted. Since the beginning of the year, BKSY has decreased by 62%.

Che BlackSky for Deutsche Bank, analyst Edison Yu note that the company has been struggling recently – but it has also built a lot of momentum to perform in the coming year.

“BlackSky has performed inconsistently but is focused on leveraging its leading Spectra AI software to generate valuable insights that are actionable and backed by defense/government contracts lucrative business that we believe will eventually turn it into an attractive strategic target given its current low valuation… BlackSky is benefiting from higher customer activity related to the Russia conflict/ Ukraine as well as other contracts are getting stronger… BlackSky is growing its sales force and partner network, which will bring in more customers,” commented Yu.

Considering BlackSky’s potential in the future, Yu rates the stock as Buy with a $3 price target to show his belief in a 75% gain in one year. (To see Yu’s achievements, click here)

Now turning to the rest of the Street, other analysts like what they’re seeing as well. 4 Buy and no Hold or Sell add up to form a Strong Buy consensus rating. The stock is currently trading at $1.71 and an average price target of $4.25 suggests a potential ~148% upside over the next 12 months. (View BSKY stock forecast on TipRanks)

Coherent Corporation (COHR)

The second stock we’ll be looking at, Coherent, has a new ticker but has a long history. Until July of this year, the company was called II-VI and held an important position in the silicon semiconductor chip industry. It remains in that field, designing and manufacturing precision equipment for engineering materials and optoelectronic systems. But on July 1 of this year, the company completed its acquisition of Coherent, Inc. and starting September 8, the combined company adopted the Coherent name and began using the COHR code on the NASDAQ. Although the company has used the new brand, new name and new stock code, it will continue to use the II-VI stock history continuously with COHR.

On the business front, the new company added laser technology from Coherent, Inc. into its own high-tech precision machining and optoelectronics. Overall, this combination is expected to bring added value to corporate customers in the chip sector.

During the most recent quarter, Q1 of fiscal year 2023, Coherent saw consecutive revenue jumps, from $887 million in fiscal 2022 Q4 to $1.34 billion in the current period. in. This is an aq/q gain of 51%; Annual revenue growth reached 68%. Strong revenue growth was supported by year-over-year organic sales growth of 20%. Going forward, Coherent can count on a record backlog of $3.05 billion, up 119% from the previous quarter.

Like many other stocks, the stock took a heavy hit in 2022; COHR stock has fallen more than 49% since the start of the year.

However, noting the decline in share prices and the problems that worried investors, Deutsche Bank Sidney Ho take an optimistic stance.

“COHR stock has underperformed in the broader market year-to-date on concerns that growth in the organic business will decelerate and the newly acquired legacy business Coherent is exposed. too much for GDP-based markets, while post-deal leverage is also too high. However, based on the company’s outlook and through our recent work, we believe investors’ concerns are overly pessimistic,” Ho explained.

“We also believe that some of the growth drivers in Comms, silicon carbide (SiC), sensors, cap sales and displays are undervalued by investors, which will likely offset many of the associated risks. to the rest of the business,” added the analyst.

Considering the disconnect between the company’s stock performance and its strong potential, Ho rates COHR as a Future Buy and sets a $50 price target, implying a one-year upside potential of ~ 44%. (To see Ho’s achievements, click here)

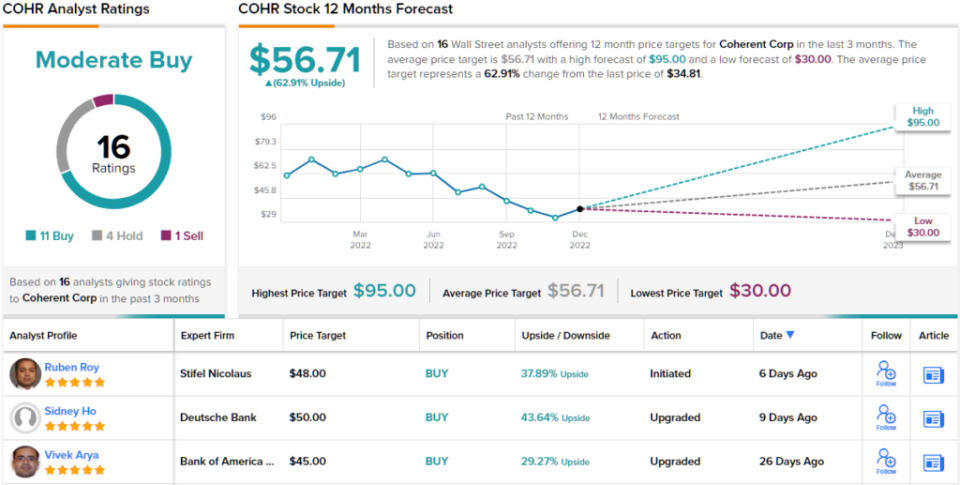

Overall, the chip-related technology company selected 16 recent reviews from Street analysts, and these include 11 Buy, 4 Hold, and 1 Sell, for a bronze rating. favorable Buy just right. The median price target is $56.71, implying a 63% gain from the stock’s current price of $34.81. (View COHR stock forecast on TipRanks)

To find great ideas for trading stocks at attractive valuations, visit TipRanks’ Best stocks to buya newly launched tool that consolidates all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are those of prominent analysts only. Content is used for informational purposes only. It is very important that you do your own analysis before making any investment.