Debt vigilance is back, and even US assets will be in trouble. Here’s what to buy instead, said one veteran fund manager.

Markets are struggling to extend the previous session’s impressive rally. There could be a number of reasons why a worse-than-expected inflation report was finally scrapped with such strength on Thursday.

Bored with the bad: traders end up getting engrossed, just like with the pandemic, to deliver rotten news on a particular topic. Stocks are oversold: at an early Thursday low, the S&P 500 is down nearly 27% for the year and buyers have touched close to 3,500.

Another factor may have occurred. UK government bonds rallied ahead of Friday’s deadline for Bank of England intervention and amid expectations the government will return further to its financed tax cut budget. supported by its debt.

Calmer conditions in gilts in the UK are important. The sell-off there has reverberated across markets, suggesting that bond-warns are making a comeback. Debt is now the problem. They really don’t like it if governments borrow a lot of money when interest rates are skyrocketing.

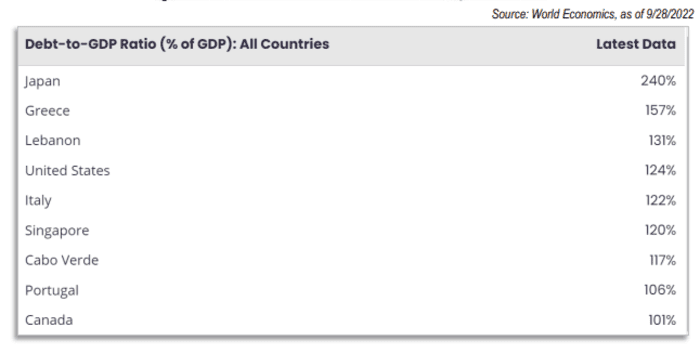

That is the view shared by David Iben, founder and chief investment officer of Kopernik Global Investors. He believes that traders should be aware that not only Europe’s indebted pigs – Portugal, Italy, Greece and Spain – face funding problems, but also other countries. larger countries such as the US and Japan.

Source: Kopernik Global Investors

And he’s come up with a new acronym to make his point, starting by substituting Singapore for Spain, which has been dropped from the top ten list of indebted nations.

“We recommend replacing the outdated PIGS acronym with an updated and more relevant moniker – JIG’S UP. This reflects the countries with the most alarming levels of debt relative to the size of their economies: Japan, Italy, Greece, Singapore, the United States and Portugal,” Iben wrote in a new note.

What does this mean for investors?

“It looks like a four-decade trend of lower interest rates led by central banks and ‘implied put’ to hedge against market losses. As such, it is clear to us that sovereign bonds of JIG’S UP countries should be avoided. This also applies to most stocks. Iben said.

“Debt must be paid off by hard work and austerity (rare in democracies) or defaulted, outright or through devaluation. Democracies choose the latter. The debt level of 124% of GDP is ominous for the US. The dollar may remain ‘strong’ against the yen, but will most likely fall sharply against hard assets,” he added.

Therefore, TINA (no alternative) now applies better to hard assets and stores of value than equity indices, according to Iben and he recommends farmland, gold , energy and other commodities – a trend that will help stock the resource-rich economies.

“We suggest that the recent adjustment in these ‘value stores’ is a godsend. We are eager to buy back many of the energy stocks we have sold over the past year. Precious metal stocks have returned to the 25% maximum in our portfolio. Iben said.

He concludes with this stoic warning: “While meme stock players may have their ‘diamond hands’, hard asset investors may need ‘nerves of steel. Reviewing charts from the 1970s [when the scenario previously occurred]. Fast and clear income. Don’t be swayed at inappropriate times. “

Market

Stocks like to add to last session’s strong rally, with S&P 500 futures

ES00

up 0.3% to 3695. Dollar Index

DXY

up 0.4% to 112.86 even as 10-year Treasury yields

BX: TMUBMUSD10Y

down 5 basis points to 3.898%. US crude oil futures

CL

down 1% to $88.18 a barrel as fears of a global recession persist. Yellow

GC00

down 0.9% to $1,662/ounce and Bitcoin

BTCUSD

added 1.5% to $19,658.

Buzz

US third-quarter earnings season kicks off on Friday. UnitedHealth

UNH

beat the forecast and JP Morgan too

JPM,

with the stock prices of both companies rising.

Wells Fargo

WFC

Revenue was also better than expected, although profits were affected by fees. Still, the report was well-received, and the stock rose nearly 3%.

Morgan Stanley

TEACHER

and Citigroup

OLD

were not treated kindly, with shares of both companies softer on mixed reports.

A rich array of economic data is also in the media for Friday. September US retail sales are due at 8:30 a.m., along with the import price index. University of Michigan sentiment index and 5-year inflation expectations survey for October due at 10 a.m. Business Inventories for August also released at 10 a.m. All Hours East.

Here more Fedspeak. Kansas City Fed President Esther George picks up the mic at 10 a.m. and Fed governor Lisa Cook will be available for comment at 10:30 a.m.

Non-meat shares

FOLLOW

fell more than 9% in pre-purchase action after the vegetarian food producer warned of sales and announced job cuts.

Gold plating productivity for 30 years

BX: TMBMKGB-30Y,

which this week rallied above 5% at the height of a frenzied sell-off, is trading back around 4.27% on hopes building the UK government could cut more than the controversial tax cut budget controversy in the context that finance minister Kwasi Kwarteng will be fired.

Shares in affiliated bank Credit Suisse

CH: CSGN

hovered just above the record low that followed reported that it was in talks to sell its securitized product unit to Mizuho Financial Group

JP: 8411.

The best of the web

How Walmart Convinced Critics That It Can Sell More And Save The World.

Judge arrests Musk for explanation.

China and the West are in a race to drive innovation.

Chart

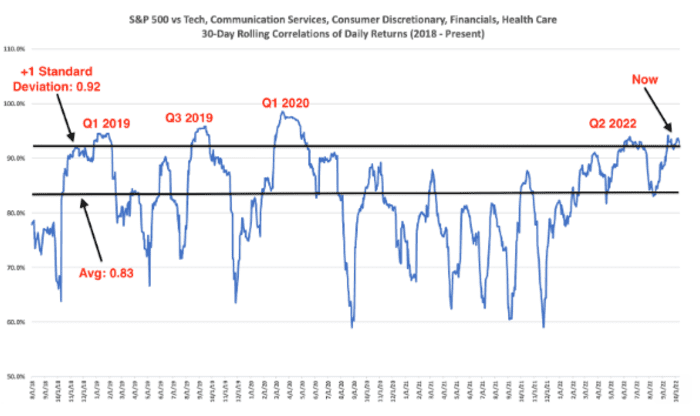

When the stock market is worried about macro issues – like recessions, pandemics, geopolitics – the correlation between stocks tends to increase when everything is sold in roughly equal amounts. . The chart below by Nicholas Colas, co-founder of DataTrek Research, shows the 30-day price correlations between the five largest S&P 500 sectors; Technology, healthcare, finance, media services and consumer discretion. Currently, it is about one standard deviation above the long-term average.

“The good news is that the market is ultimately pricing in whatever macro risk is forcing the correlations to regroup and that’s the bottom. This takes time, as the chart illustrates. But it always happens and then the stock can go up again,” Colas said.

Source: DataTrek.

Top code

These are the most active stock market stocks on MarketWatch as of 6 a.m. ET.

|

Ticker |

Security name |

| TSLA |

Tesla |

| GME |

GameStop |

| AMC |

AMC Entertainment |

| AAPL |

Apple |

| NIO |

NIO |

| BBBY |

Outdoor shower bed |

| APE |

Priority AMC Entertainment |

| INFY |

Infosys |

| AMZN |

Amazon.com |

| DWAC |

Digital World Acquisition Corp. |

Random reading

1,100-year-old Royal Mint sees record profits as turmoil fuels gold demand.

Need to know start early and be updated until the opening bell, but Register here so that it is sent once to your email inbox. The emailed version will be dispatched around 7:30 a.m. Eastern time.

Listen The Best New Ideas Podcast for Money with MarketWatch reporter Charles Passy and economist Stephanie Kelton