Buy these 2 oilfield services stocks for over 40% upside potential, says analyst

Yogi Bera will remind us that predictions are hard, especially about the future – and the jewel of wisdom is more relevant than ever in today’s oil market. As a crude proxy for crude oil prices, gasoline prices at the pump have dropped again this summer and are starting to rise again now. The latest bullish pressure on oil comes from Saudi Arabia, which has announced a 2 million bpd OPEC production cut.

But that’s just one factor. Most of the oil market is being pushed around by unpredictable forces, and OPEC’s role is hardly the greatest. The Middle East is chronically unstable, with unrest in Iran and ongoing conflicts in Iraq and Syria; Western nations are punishing Russia in response to the invasion of Ukraine; supply chain problems, including tanker availability, continue to disrupt transaction patterns; and the global economy, facing recessionary pressures, is increasingly vulnerable to high inflation, which is mainly driven by energy prices.

It’s enough to make your head spin. But if you are trying to predict where the price will go, you are better off betting bullish than bearish right now. Global demand for fossil fuels, particularly oil and gas, continues to be strong – and if that holds, there will continue to be some upward pressure on oil prices.

For investors, an area with the potential to increase product prices presents an opportunity – to find companies that are likely to profit when prices rise. And right now, looking at the oil industry for investment firm BTIG, analyst Gregory Lewis have only seen such an opening in oilfield services (OFS) companies. These are the companies that provide support to exploration & production companies and drilling companies – everything from drilling technology to wastewater removal to specialist engineering expertise in pumps and piping. .

In Lewis’ view, oilfield services companies could offer investors more than 40% upside next year. We have taken the latest data from TipRanks on his two options; combined with Lewis’s comments, that data could shed light on the positions of these companies.

Helix Energy Solutions Group (HLX)

The first oilfield services company in our sights to occupy a position of expertise in its area of expertise – Helix focuses on offshore operations, providing support through the full lifecycle of the fields offshore oil and gas. Helix’s services include undersea robotics, well intervention, undersea trenching and cable burial, and seabed cleaning operations. While Helix has a history of working with the hydrocarbon industry, in recent years the company has expanded its offerings to reach the offshore renewable energy segment.

Helix organizes its activities by both business and geographical segments. The company’s segments include interoperability, robotics and manufacturing facilities; Geographically, the company operates in the deep waters of the Gulf of Mexico and the North Sea, as well as Brazil, West Africa and the Asia-Pacific region.

Earlier this week, the company reported its Q3 22 financial results and showed a sharp increase in the company’s top revenue. For the quarter ended September 30, Helix posted revenue of $272.55 million, up 50% year over year and an impressive 67%. For the first three quarters of the year, Helix reported total revenue of more than $585 million, with an increase of 15%. Helix reported a diluted EPS loss of 12 cents/share for the third quarter, a relatively flat result compared to the 13% loss reported in the previous quarter and much better than the 20% EPS loss reported. reported in the second quarter.

In his article on the stock, analyst Lewis notes the industry strength behind Helix, writing: “We are in the early stages of the current bull cycle for foreign O&G services, with potentially significant returns to foreign O&G services. seems to be tightening faster than usual due to overlapping demand from sea breezes.”

“Our base case assumption is that HLX can capitalize on OFS’s cyclical recovery over the next few years with additional headwinds coming from offshore wind accumulation globally,” Lewis added. .

With this bullish stance, Lewis upgrades HLX from Neutral to Buy and sets a $10 price target that shows a 44% gain in the one-year timeframe. (To see Lewis’s record, click here)

Lewis is hardly the only bull when it comes to Helix; This stock has 4 recent analyst ratings on file and all are positive – for a consensus rating Strong Buy unanimously. Helix shares are priced at $6.94 and their average price target, $8, suggests a 15% gain over the next year. (View HLX stock analysis on TipRanks)

Transocean Ltd. (OIL-SHORE)

We will continue to review oilfield services with Transocean, the world’s leading contractor for offshore drilling services on oil and gas wells. Transocean’s special expertise is in extreme deep water drilling services; for example, the company has activities off the continental shelf in the Gulf of Mexico. Transocean’s drilling fleet – all owned or partially owned by the company – includes 37 offshore mobiles. These include 27 ultra-deep water buoys and 10 extreme environment buoys. The company is working to expand its fleet through the construction of two ultra-deepwater drilling vessels.

In the 4 quarters from 2Q21 to 1Q22, Transocean saw its flagship revenue decline while profit and loss deepened – but that trend looks set to end and 2Q22 sees better news for the company. company. At the top line, Q2 brought in $692 million in revenue, up 18% from Q1 of 22. Year over year, Q2 revenue grew a more modest 5.5%. In terms of profit, the company’s net loss for the second quarter of 2012 was 10 cents per diluted share. This compares favorably to 1Q22’s 26% diluted EPS loss and 2Q21’s 18% net loss.

Transocean ended the second quarter of this year with total assets of $2.28 billion, including $729 million in cash. The company’s net cash from operating activities reached $40 million. While this is down sharply from the previous quarter’s $249 million, it’s a drastic change from the $1 million cash loss reported in the previous quarter. Transocean’s total unrestricted cash and cash equivalents were reported at $1.16 billion as of June 30.

In a key metric that bodes well for Transocean’s future, the company has a contract backlog – i.e. work has been contracted but not yet started – of $6.2 billion.

Checking back with BTIG’s Gregory Lewis, we find that he sees Transocean in a good place to start improving its financial results. Noting that “improving the time of day in the floating market,” Lewis went on to explain that it “will allow the company to recharge its rigs at a higher rate.” The analyst continued, “We note that Norwegian selling interest is also starting to rise (a core part of RIG’s fleet). Bottom line: we believe we are at a stage. The beginning of the ongoing offshore rig bull cycle, which should provide strong cash flow and the opportunity to refinance RIG to improve its balance sheet.”

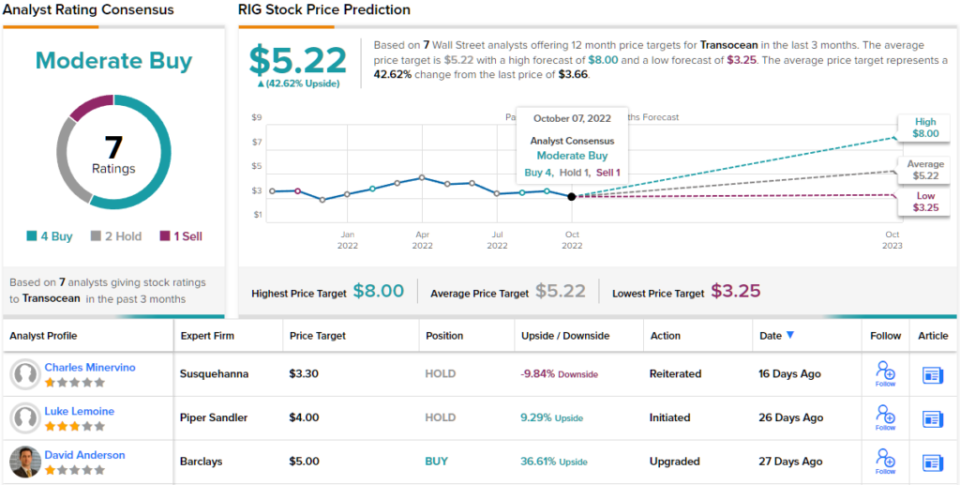

Finally, Lewis rates RIG share a Buy along with an $8 price target, suggesting a potential for a massive 118% upside over the next 12 months.

Overall, this deepwater oilfield services company has received 7 ratings from Street analysts, and these include 4 Buys, 2 Holds and Sells only, giving the stock a bronze rating. favorable Buy just right. The stock has an average target target of $5.22, implying a ~43% gain from its trading price of $3.66. (View RIG stock analysis on TipRanks)

To find good ideas for trading energy stocks with attractive valuations, visit TipRanks’ Best stocks to buya newly launched tool that consolidates all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are those of prominent analysts only. Content is used for informational purposes only. It is very important to do your own analysis before making any investments.