BlackRock, Invesco Get Overweight Rating in New Coverage at Wells Fargo (NYSE:BLK)

David Tran/ Editing iStock via Getty Images

Wells Fargo analyst Finian O’Shea begins covering traditional wealth managers with an Overweight rating on BlackRock (NYSE:BLK) and Invesco (NYSE:IVZ), due to their operational diversification and capital flow strength.

“With the current obscured vision In terms of market trends, we prefer the reliability of proven sustainable practices to stock calls focused on hypothetical market rallies and/or large outflow improvements. players are currently experiencing flow challenges,” O’ Shea wrote in a note to clients.

T. Rowe Price (NASDAQ:TRICK) is rated Balanced, and Franklin Resources (NYSE:WHARF) and Janus Henderson Corporation (NYSE:JHG) is rated Underweight.

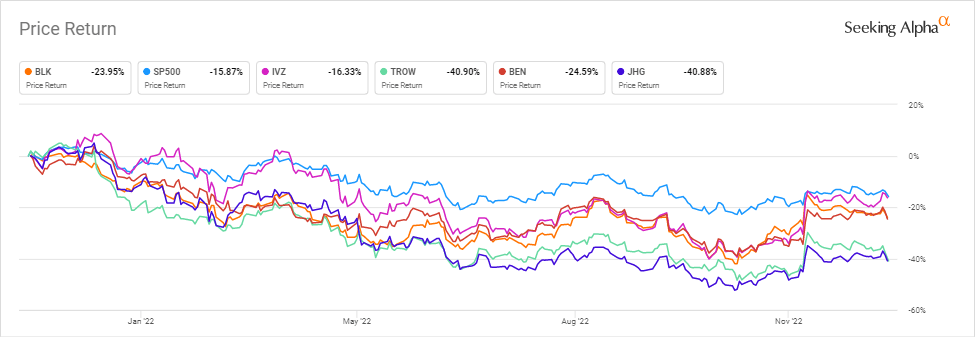

All stocks lagged the S&P 500 in time past year as seen in this chart.

BlackRock Watch Company (BLK) is “clearly positive prominence for above-average and low volatility, high confidence organic growth,” while “Invesco’s (IVZ) improved the most in 2021 and was relatively stable during 9M22 market volatility.”

The Rating system SA Quant all five stocks are Holds, while Wall Street’s average rating is Sell for T. Rowe (TRICK) and Franklin Resources (WHARF).

There are opposing views, explains SA contributor Cory Cramer why has he recently made a profit in BlackRock (BLK).