Billionaire Israel Englander is betting big on these 2 ‘Strong Buy’ stocks

After the early-year rally seemed to hit a roadblock recently, the market seemed uncertain about which direction to head next, making it difficult for investors to navigate the precarious conditions.

In such a scenario, perhaps the best solution for investors is to follow in the footsteps of Wall Street legends – names like Israel Englander.

The chairman and CEO of Millennium Management founded the hedge fund in 1989 with $35 million, and now the company has nearly $53 billion in operations, so he knows a thing or two about investing. private. Recently, Englander has been busy replenishing his portfolio with some big purchases, and we’ve been tracking his two recent purchases.

Are these options right for the Street’s stock gurus? Turns out they definitely do. According to TipRanks database, both are rated as Strong Buy by consensus analysts. So let’s see why these names are being praised right now.

Dexcom Corporation (DXCM)

The first British-backed stock we’ll look at is medical device maker Dexcom. This San Diego, California-based company makes continuous blood sugar monitoring (CGM) systems for use by diabetics. The company’s solutions include the Dexcom G6 and newer Dexcom G7 wearables, a small wearable sensor that sends real-time glucose readings to the user’s smartphone every 5 minutes. and the FDA recently approved it for use by people with all types of diabetes two years of age and older. age or older. The company touts the product as the most accurate CGM product on the market.

Diabetes is not only a chronic disease but also an increasingly common disease. Dexcom products are becoming more and more popular thanks to the steady sales that the company achieves.

This is again evident in its latest quarterly report – for the fourth quarter of 2022. Dexcom posted revenue of $815.2 million, up 16.8% year-over-year and in line with expectations. Street. There is a concluding span on the bottom line which is adj. EPS of $0.34 is well above the $0.28 forecast. The company is also consistent with its previous guidance for 2023, which requires 15%-20% growth on revenue and a gross margin of 62%-63%.

Englander clearly sees much to like here. In Q4, he increased his stake in the company to over 200% with the purchase of 2,658,077 shares. He currently holds a total of 3,890,649 shares, with the current share price worth $431.9 million.

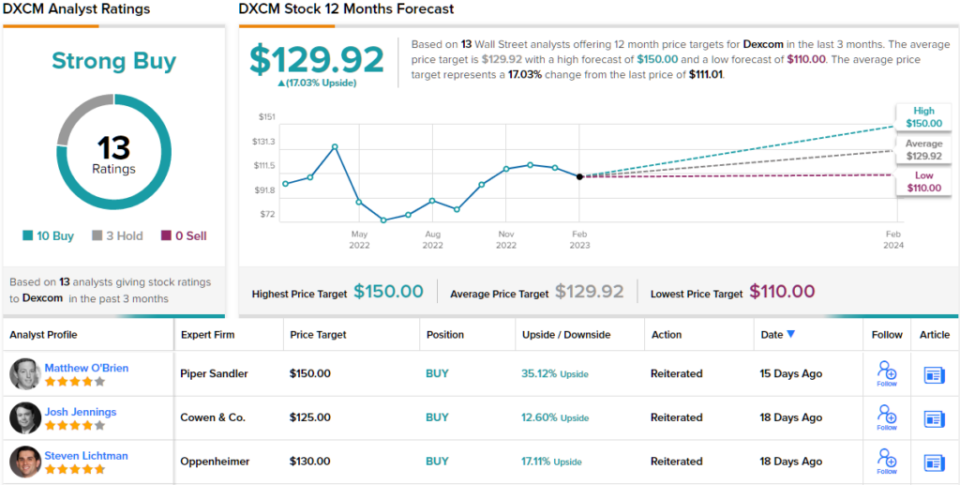

Reflecting British confidence, Piper Sandler analyst Matt O’Brien says Dexcom is the “favorite name for 2023” and highlights a number of reasons to get involved.

“Although DXCM has continued to trade sideways since November following strong Q3 earnings, we think there is still room for significant upside from the domestic G7 rollout, continued OUS expansion, and the base base. basic opportunity (Basal-IQ Tech uses Dexcom G6 . sensor) guide. Better-than-expected volume and strong GM leverage give DXCM the opportunity in our view to become a pulse and raise the story as we move through 2023,” O’Brien said. review.

Therefore, it is not surprising that O’Brien rates DXCM at Overweight (i.e. Buy), supported by a $150 price target. This target offers a potential upside to 35%. (To see O’Brien’s achievements, click here)

Most agree with O’Brien’s argument. Based on 10 Buys vs 3 Holds, this stock is rated Strong Buy consensus. With an average target of $129.92, the stock should move 17% higher next year. (See DXCM stock forecast)

SBA Communications (SBAC)

For our next British endorsed name is SBA Communications (SBAC), a real estate investment trust (REIT) but a sole fund there. The Boca Raton, Florida-based company owns and operates wireless communications infrastructure and is in fact one of the largest providers of communication tower space in the United States, as well as having operations in the United States. operating in Central America, Brazil, Africa and the Philippines. Its main focus is towards leasing antenna space on its communications sites to a wide range of wireless carriers, including Verizon, AT&T and T-Mobile.

SBAC’s strong position is reflected in the company’s steadily increasing revenue and profit over the past few quarters. In the most recently reported quarter, for Q4 of year 22, revenue grew 15.3% year-over-year to $686.1 million, beating Street expectations of $4.81 million. . However, while net income increased significantly from $48.9 million in Q4 2011 to $102.6 million and resulted in $0.94 per share, the figure was still lower. $1.11 level expected by analysts.

Englander enters the bracket here through a significant increase in his holdings in Q4. He purchased 594,994 shares during the quarter, increasing his stake by nearly 300% and now holds a total of 797,089 shares, valued at $206 million today.

Englander is clearly bullish on SBAC’s future, and so is Raymond James analyst Ric Prentiss, writing: “SBAC is our current favorite tower stock due to: 1) greater exposure to towers in America; 2) Higher quality AFFO; 3) longer runway for strong dividend growth (the company currently pays a quarterly cash dividend of $0.85/share); and 4) proven ability to allocate capital by opportunity including share buybacks.”

Based on that assessment, Prentiss rates the SBAC as a Strong Buy and sets a price target at $334. If that number is met, investors will see a return of ~29% a year from now. (To see Prentiss’ achievements, click here)

Now let’s move on to the rest of the Street, where SBAC gets a lot of support. With the exception of two skeptics, all 10 other recent analyst reviews have been positive, making the consensus view here to be Strong Buy. The stock is expected to rise ~27% next year, with an average target of $328.82. (See SBAC stock forecast)

To find great ideas for trading stocks at attractive valuations, visit TipRanks’ Best stocks to buya newly launched tool that consolidates all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are those of the featured analyst only. Content is used for informational purposes only. It is very important that you do your own analysis before making any investment.