Banks are short of more than $1 trillion in capital, says this analyst, who fears the shortfall will only get worse

The new year is just around the corner, and one idea where to invest is in the banking sector, which has high returns thanks to high interest rates, with valuations that aren’t too demanding.

That statement may come as a surprise to those who think the US banking industry is about $2.2 trillion in capital. But he cuts that number in several ways. First, he notes, there is a difference between book equity and tangible equity, the tangible equity used by bank managers to gauge solvency. That’s a narrower definition, excluding items like goodwill and deferred tax assets, bringing the total down to $1.49 trillion from $2.22 trillion.

Then, based on Federal Deposit Insurance Corporation data, he subtracts what is known as other cumulative comprehensive income. “Thanks to QE and now QT, all asset classes have become a negative return proposition for banks as well as non-banks. If the coupon pays less than the sponsorship costs, you lose money,” he said. That reduces capital to $1.23 trillion.

Now to the more controversial part. First, he pointed to market losses on loans and securities created in 2020 and 2021, due to the impact of this year’s Fed rate hikes. That right was enough to push banks into insolvency, with a loss of $1.74 trillion from ticking the market.

Another $794 billion loss occurs if the bank’s holdings of U.S. Treasury securities, mortgage-backed securities, and state and municipal securities are also marketed. Taking it all together, by Whalen’s calculations, banks will have a $1.3 trillion shortfall through the second quarter.

Agreed, and this is very important, banks do not need to mark their assets on the market. So what is anxiety? That exception is not infinite — banks are allowed to ignore market losses as long as they have the ability and intention to do so. “Even if the bank holds these low-yield assets created between 2020-2021 in a portfolio until maturity, cash flow losses and poor returns end up,” Whalen said. may be forced to sell.

He did a similar analysis on JPMorgan Chase

JPM,

which he calls one of the better managed banks. Jamie Dimon’s group ran a $16 billion deficit as of the second quarter — and a $58 billion deficit if the market-adjusted level is 17.5% higher — according to Whalen data.

The bigger question is when that sale might happen. “Selling the property will be slow but lenders may be forced to issue 20-point collateral underwater,” he told MarketWatch in an email. And what was unsustainable now will only get worse. Whalen added: “Higher rates just make the final mess bigger.

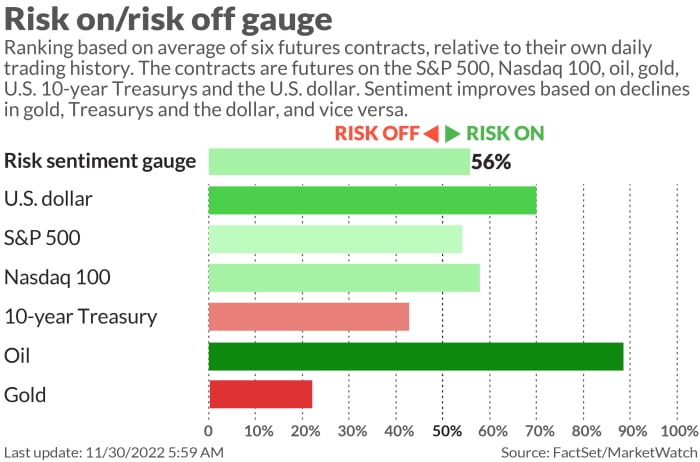

Market

US stock futures

ES00

was only higher in early action. Commodities are on the rise, with gains for oil

CL

and gold

GC00.

Dollar

DXY

lower.

For more market updates plus possible trading ideas for stocks, options and cryptocurrencies, subscribe MarketDiem by Investor’s Business Daily.

rumor

Fed Chairman Jerome Powell is scheduled to speak at 1:30 pm at the Brookings Institution, the current workplace of former Fed Chairman Ben Bernanke. There are also two other Fed speakers, with Governor Michelle Bowman to speak on banks, while Governor Lisa Cook speaks at the Detroit Economic Club.

It’s an important date on the economic calendar that doesn’t even include Powell’s speech. ADP jobs report, second estimate of third-quarter GDP, enhanced trade report for October, Chicago PMI, job openings and pending home sales, all coming soon Dad, with the Beige Book Economic Anecdote coming out at 2 p.m

In the euro area, annual inflation fell to 10% in November from 10.6%.

CrowdStrike Organization

CRWD

fell after the cybersecurity company guided subscriber revenue growth to slow.

network application

NTAP

also fell after the cloud computing company guided earnings much lower than analysts’ estimates.

Horizon therapy

HZNP

recovered after the Irish drugmaker said it was in talks to be bought, with heavyweights including Amgen

AMGN,

Johnson & Johnson

JNJ

and Sanofi

FR:SAN

surround the company.

An Alzheimer’s drug from Biogen

BIIB

and Eisai

JP:4523

Moderately reduced cognitive decline but also accompanied by side effects.

Walt Disney

dis

said its returning CEO, Bob Iger, will initiate organizational and operational changes that could lead to declining fees. It flagged the Disney Media and Entertainment Division, which includes its streaming services, for change.

The best of the web

What? China’s young protesters want.

explain America lacks electric vehicle charging stations.

Full caption of racist Los Angeles city council sound plunged America’s second largest city into turmoil.

top stocks

Here are the most active stocks as of 6 a.m. ET.

|

share |

security name |

| TSLA |

Tesla |

| GME |

game stop |

| NIO |

Nio |

| AMC |

Entertainment AMC |

| MULN |

Mullen car |

| TORTOISE |

alibaba |

| XPEV |

XPeng |

| OTIC |

headphone |

| CRWD |

CrowdStrike Organization |

| ape |

Prioritize entertainment AMC |

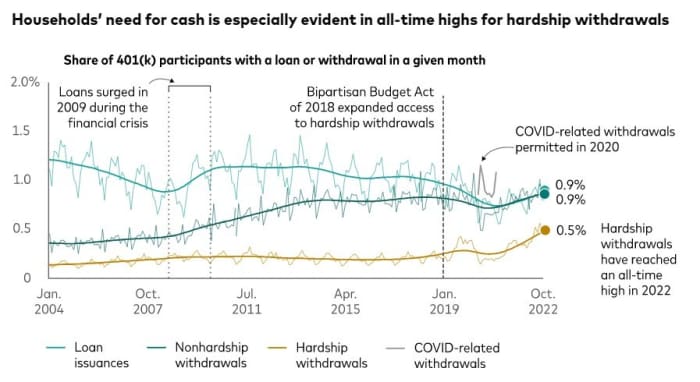

chart

Pioneers

Withdrawal difficulty has reached an all-time high, according to data from Vanguard. Such withdrawals are only permitted for a large and immediate financial need and are subject to income tax and a 10% early withdrawal penalty.

Random reading

This 22-year-old sells human bones for a living.

There’s another World Cup going on in Qatar — for camels.

Lobsta Mickey — giant statue of Mickey Mouse with lobster claws — returned to Boston.

Need to Know starts early and is updated until the opening bell rings, but Register here to send it once to your email inbox. An emailed version will be delivered around 7:30 a.m. Eastern time.

Listen Best new ideas podcast about money with MarketWatch reporter Charles Passy and economist Stephanie Kelton