AT&T’s dividend yield is lower than Verizon’s. What that means for stocks.

AT&T Inc. doesn’t seem to be the most beloved name in wireless, and that showed in a milestone that happened last week.

While AT&T shares

T,

rose after the company’s Thursday morning earnings report, showing continued subscriber growth, Verizon

VZ,

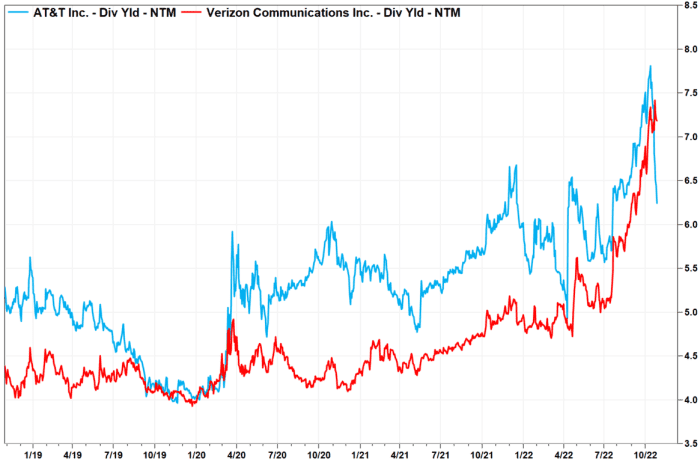

Shares faltered as the wireless rival reported a third straight quarter drop in subscriber numbers on Friday morning. Amid Thursday’s price action, AT&T’s dividend yield fell below Verizon for the first time since March 6, 2020.

AT&T’s dividend yield fell below Verizon’s last week for the first time since March 2020.

FactSet

Rising dividend yields are not always a good sign, as it can signal more negative investor sentiment when stock prices fall. On the other hand, in AT&T’s case, falling yields come as Wall Street grows increasingly warm to the company’s performance and outlook.

Read: AT&T’s ‘much simpler story’ and dividend ‘definitely’ gives stock an upgrade

AT&T’s dividend yield was as high as 7.81% on Oct. 12, but the stock delivered a 6.12% return on Wednesday as the stock rallied 24% over that period. Verizon currently delivers a 7.14% profit.

Morgan Stanley analyst Simon Flannery, who emphasized in a note Wednesday to clients that AT&T’s 17% performance last week delivered a dividend yield “for the first time in several years for the company.” VZ,” writes that AT&T’s latest earnings “look even clearer” due to Verizon’s more mixed results.

“We think AT&T’s current results are good enough as they should provide comfort to investors looking for a relatively defensive name later in the year, while the stock also needs support. from a maintenance dividend yield of > 6%,” continued Flannery.

AT&T’s dividend — and its ability to support it — is of strong interest to investors, and the company sought to reassure investors of its position after recording $3.8 billion in free cash flow. la from resuming operations in the third quarter.

“We expect healthy free cash flow this quarter gives you confidence in our ability to meet our free cash flow target in the $14 billion range for the year, excess to support our $8 billion dividend pledge,” Chief Executive Officer John Stankey said on the company’s earnings call.

Verizon’s earnings call also mentioned dividend commitments, as Chief Financial Officer Matt Ellis noted that the company recently raised its dividend for the 16th year in a row.

“We recognize the importance of dividends to our shareholders, and we intend to continue to put the board in a position to approve the annual increase,” he said.

Tomi Kilgore contributed to this article.