AT&T stock has best week since 2000: ‘There is at least one reasonable case for optimism’

Shares of AT&T Inc. recorded its best weekly performance since 2000 after the telecom company offered some reassurance to Wall Street with its latest earnings report.

AT&T’s stock

T,

Recently, an analyst at Cowen & Co. wrote ahead of the company’s Thursday earnings report, and the stock suffered its biggest quarterly drop in 20 years in the third quarter. But investors – and at least one Wall Street analyst – appear to be more interested in stocks after AT&T’s most recent reportThis not only shows continued subscriber traction, but also offers a bit more optimism about the company’s cash flow picture.

Stocks ended the week up 14.1% to post their biggest weekly percentage gain since March 2020 when they rallied more than 28%, according to Dow Jones Market Data.

“We are upgrading AT&T after more than 15 years of underperformance when it has now demonstrated its ability to focus on its core business rather than acquiring loosely related companies at high valuations. in the market,” Truist Securities analyst Greg Miller wrote Friday as he upgraded his rating. to buy from hold and hold steady my $21 price target.

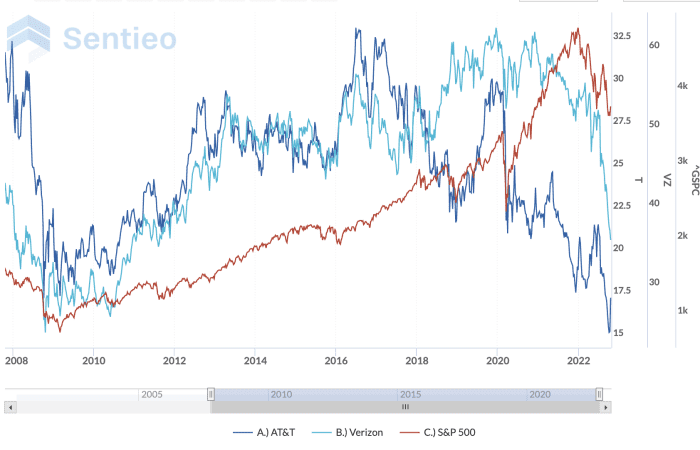

AT&T stock has lagged Verizon as well as the S&P 500 over a 15-year period.

Sentieo / AlphaSense

Miller said that while AT&T investors had previously been “disappointed” about what turned out to be a false start to business innovations, he thinks things could be different now, because ” AT&T’s focus has returned to its core competence of connectivity (wireless and wireless). ”

He also believes that “the trend over the past few quarters is increasingly likely to continue to the point where the company has the potential to generate $17.8 billion in revenue.” [free-cash flow] in 2023 and $19.6 billion out of [free-cash flow] in 2024.”

For the bulls still holding on to AT&T despite recent pressures, the report serves as a vindication.

“We believe this quarter has provided evidence that management is on track to deliver on its business plan, meeting or exceeding most operational and financial targets,” wrote Deutsche Bank analyst Bryan Kraft. and at the same time improve business efficiency”. raised his price target to $23.

“AT&T’s strong three-quarter performance contrasts with growing investor skepticism after AT&T downgraded its FCF 2022 guidance last quarter, highlighting inflation concerns for most of the year so far, and characterize 2022 as a ‘year-end weighted year’ despite macroeconomic uncertainty,” Kraft continued in its Thursday note to clients.

Raymond James analyst Frank Louthan IV weighed in with a similarly positive view.

“The current strategy is delivering better results than anticipated, and we believe the Street should realize this,” he wrote. “Additionally, the business health misperception from the Q2 call seems to have reset as the company shows good results and shows consumer demand is flat.”

Louthan rates the stock in the better, though he lowered his price target on Friday from $26 to $24.

A crowd of Wall Street analysts think AT&T stock hasn’t been a bullish group in general lately – only 10 out of 30 people tracked by FactSet rate the stock as a buy – but even skeptics is also willing to give the telecom giant some credit after it reports its latest earnings.

AT&T added a network of 708,000 postpaid phone subscribers in the third quarter, building on a similar increase earlier in the year. The increase was particularly noticeable when rival Verizon Communications Inc.

VZ,

deliver it Third quarter in a row consumers lost postpaid phone subscriptions a day later.

AT&T also posted an increase in average wireless revenue per user, showing that the company was successful in luring customers to switch to higher-priced plans and also realizing some benefit from the price increase. recent for certain packages.

MoffettNathanson analyst Craig Moffett writes: “There is at least a reasonable case for optimism.

He said that the latest numbers “clearly offer more good news than bad” although he sees “an area of concern” around each bright spot and concrete reasons to remain cautious on cash flow. free.

“Remember, AT&T just paying out dividends comfortably is not enough,” he wrote. “AT&T must show a clear path to write off debt on their balance sheets, lest the credit rating agencies lose patience with much higher leverage ratios than ‘normally’ allow.” ‘ for a company with AT&T BBB (S&P) / Baa2 (Moody’s) credit. Rating.”

Oppenheimer’s Timothy Horan added that AT&T “did a better job of streamlining distribution and repurchasing targeting to reduce customer acquisition costs, which has contributed to profitability.” However, he noted that the company has “a few years of major investments ahead of which it may need partners.”

See more: AT&T is said to be in talks to form a joint venture focused on fiber optics

Horan left his performance rating unchanged on the stock while saying he prefers Verizon and T-Mobile US Inc.

TMUS,

for a chance to get fixed wireless access.