A weak forecast has led Walmart to cut prices in recent weeks. Has it become a buy?

Shares of Walmart (NYSE:WMT) has stumbled since the retailer’s latest earnings report, as investors struggled to dismiss concerns about the company’s cautious forecast. Still, the stock still has fans in the Wall Street community who see lasting, even with the current unstable economic situation.

Does the recent earnings-inspired pullback present an opportunity to buy one of the biggest players in retail?

Recent earnings

Walmart (WMT) is now trading 3% lower for the year and has been feeling selling pressure since releasing quarterly results in late February. The company topped the estimate with its holiday quarterly earningsbut it sets cautious guidance for next year.

Specifically, WMT delivered Q4 non-GAAP EPS of $1.71, $0.20 higher than estimates. At the same time, it posted revenue of $164.05 billion, well ahead of the $5.38 billion estimate.

Coming soon, company forecast net sales growth of 2.5% to 3.0% in fixed currency. Meanwhile, the company forecast full-year earnings of $5.90-6.05 per share, lower than the $6.51 per share analysts had expected.

Since providing that quarterly update, the retailer’s stock has fallen about 5%, and the stock recently hit levels not seen since November.

The bigger picture, the stock is up 13% over the past 9 months but trading 1% lower in the one-year time frame. To refer to the S&P 500 (SP500) was 4.4% lower over a one-year period.

Is WMT a Buy?

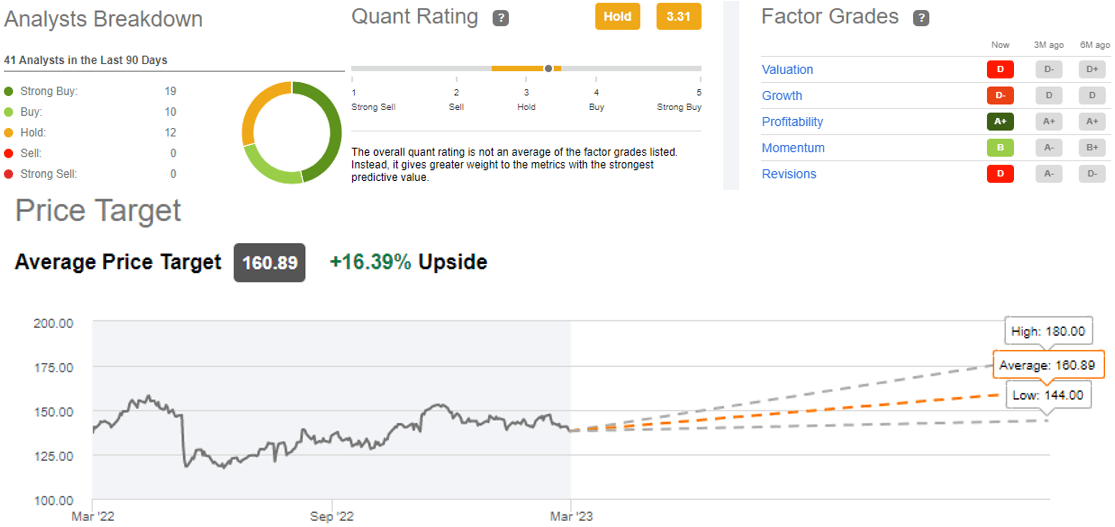

Even with the conservative forecast, the Wall Street community remains optimistic about Walmart’s (WMT) long-term outlook. Based on Alpha data search, 19 of 41 analysts surveyed classify the stock as Strong Buy. Meanwhile, 10 others consider the company a Buy, meaning 70% of analysts have an optimistic view. The remaining 12 analysts consider WMT a Hold.

Currently, WMT trades around $138/share. This compares to an average price target of $160.89. Meanwhile, the high-level target is located at $180 and the low-level target is at $144.

Alpha Quantitative Rating Search system has a more conservative view of stocks, tagging Walmart (WMT) with a Hold rating. It provides a sort of A+ factor to a company’s profitability, as well as a B-grade stock for momentum. However, these bullish signals have been counterproductive by D and D- for the stock’s valuation and growth.

Here is the breakdown of the data above:

What do others say?

Looking for collaborators Alpha ANG Traders who took the opposite view of Walmart (WMT), specifying the stock as a Sell. The company stated: “Walmart has seen aggressive insider selling which appears to be accelerating this year.” ANG traders went on to add: “WMT also saw a drop in store numbers both in the US and internationally.”

On the other side of the debate, SA contributor Brian Gilmartin sees stocks as a Buy. “The inventory-to-sales ratio of Walmart Inc. had the best quarter in the last eight quarters – back to normal.” Gilmartin added: “Walmart is now in a position to be able to fix external issues caused by Covid, supply chain issues, etc. by 2023.”

Other methods

For investors who aren’t sure about Walmart specifically but still want exposure to the retail giant, exchange-traded funds represent an alternative investment vehicle. Currently, Walmart is held by 254 different funds. See below the top five weighted attributions for retailers:

- QRAFT AI-Enhanced US Momentum Momentum ETF (AMOM) has a holding rate of 7.83%.

- iShares US Consumer Focus ETF (IEDI) has a holding rate of 7.47%.

- Fidelity MSCI Consumer Staples Index ETF (FSTA) has a holding rate of 7.43%.

- Vanguard Consumer Staples ETF (VDC) has a holding rate of 7.31%.

- VanEck Retail ETF (RTH CARD) holds 6.38%.

In addition to ETFs, other potential investment options outside of Walmart include some of its competitors such as Costco Wholesale Corporation (VALUE), BJ’s Wholesale Club (BJ) and Target (TGT).

In Walmart-related news, CEO Doug McMillon plans to keep his place atop the Arkansas-based retail giant in the coming weeks. at least 3 more years.