Why Not All Chip Companies Are Benefiting From the AI Boom Like Nvidia

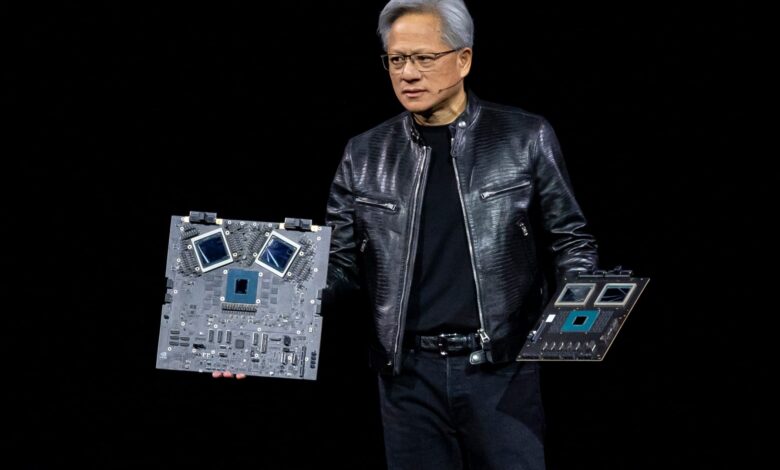

Jensen Huang, co-founder and CEO of Nvidia Corp., introduces the new Blackwell GPU chip at the Nvidia GPU Technology Conference on March 18, 2024.

David Paul Morris/Bloomberg via Getty Images

Earnings reports show that not all chipmakers are benefiting from the artificial intelligence boom, highlighting the complexity of the semiconductor supply chain and the dominance of some companies over others in different parts of the industry.

A slew of semiconductor companies have reported second-quarter financial results, with some beating expectations and others disappointing, showing how the excitement around AI is affecting their earnings.

Current interest in artificial intelligence revolves around two key terms — large language models (LLMs) and generative AI. LLMs require large amounts of computing resources and data to train, and they support generative AI applications like chatbots from Google and OpenAI.

Tech giants training LLMs are not cutting spending. Metadata above Wednesday it is expected “significant” growth in capital spending through 2025 “to support our AI research and product development efforts.” Microsoft speak this week The company’s capital spending increased nearly 80% year over year to $19 billion in the June quarter.

This spending by the tech giants, as they continue to add more computing resources, has become A huge boost for Nvidia because the company’s graphics processing units (GPUs) are used to train these LLMs.

But Nvidia’s competitors AMD Processor has brought its own chip to market, called MI300X AI Chipfor AI purposes and is starting to pay off. AMD said Tuesday that it expects data center GPU revenue to exceed $4.5 billion by 2024, up from the $4 billion the company forecast in April. The chip The company reported earnings and revenue for the second quarter. exceeded market expectations.

Chip and tool companies also appear to be benefiting from the AI boom. TSMCThe world’s largest semiconductor maker said last month that its second-quarter net profit jumped more than 36% from a year earlier as Financial results exceeded market expectations.

Meanwhile ASMLwhich makes the specialized tools needed to produce the world’s most advanced chips, said last month that Q2 net bookings up 24% year after year, highlighting demand from companies like TSMC that make semiconductors. Samsung said sQ2 operating profit jumps 1,458.2% year-on-year.

But not all semiconductor companies are benefiting from the surge in investment in AI as their exposure to the technology is currently negligible.

Qualcomm And Arm saw their stock price fall the following Wednesday. release light guide for the current quarter.

While both companies talk about their importance to AI applications, the reality is that their exposure to the technology is still very limited.

Arm designs the blueprints that many companies rely on to make the chips and semiconductors that are in most of the world’s smartphones. While many electronics manufacturers are talking about AI PhoneThis does not lead to higher fundamental growth for the chip designer.

The British company still gets a large chunk of its revenue from consumer electronics rather than the data centers where AMD and Nvidia have found success. Analysts have previously told CNBC Arm could benefit from AI as more devices begin to incorporate the technology.

Qualcomm chips are found in smartphones like those made by Samsung, and the company still gets the bulk of its revenue from mobile phones. Like Arm, Qualcomm silicon isn’t used in the kind of data centers where LLM training takes place.

The company’s chips will be in Microsoft’s upcoming AI personal computerBut again, this is a long-term move by Qualcomm.