Dollar and Bitcoin skyrocketed when Trump was elected president

Getty Images

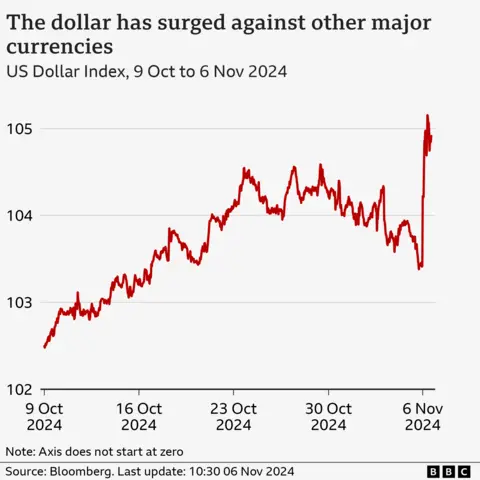

Getty ImagesThe US dollar has risen as Donald Trump is now predicted to win the presidency and will return to the White House.

Investors are betting that Trump’s tax cuts and tax hikes will push up inflation and slow the pace of interest rate cuts.

Higher interest rates mean investors will receive higher returns on the savings and investments they hold in dollars.

Bitcoin has also hit a record high, following Trump’s campaign promise to make the United States the “bitcoin and cryptocurrency capital of the world.”

Markets and currencies around the world fluctuated strongly after US election news:

- The FTSE 100 index, which includes the biggest UK-listed companies, rose 1% on Wednesday afternoon

- The British pound fell 1.41% against the US dollar to its lowest level since August

- The euro fell 2.24% against the US dollar to its lowest level since June

- The dollar rose about 1.4% against a variety of currencies, including the British pound, euro and Japanese yen

- In Japan, the benchmark Nikkei 225 stock index ended up 2.6%, while Australia’s ASX 200 index closed 0.8% higher.

- In mainland China, the Shanghai Composite index ended 0.1% lower, while Hong Kong’s Hang Seng fell about 2.23%.

- Major US stock indexes are expected to jump when trading opens

Why is Bitcoin price increasing?

The value of Bitcoin has also increased by $6,000 (£4,645) to a record high of $75,371.69, surpassing the previous high of $73,797.98 seen in March this year.

Trump’s stance on cryptocurrency stands in stark contrast to that of the Biden administration, which has led a sweeping crackdown on cryptocurrency companies in recent years.

Trump has suggested that he will fire Gary Gensler, the chairman of the Securities and Exchange Commission, who has received backlash online from digital currency advocates.

This is because Mr. Gensler’s agency introduced new environmental disclosure regulations that have been paused, as well as legal action against cryptocurrency companies.

Trump also said he plans to put billionaire Elon Musk in charge of auditing government waste.

Mr. Musk has long been an advocate of cryptocurrency, and his company Tesla is also famous invest 1.5 billion USD in Bitcoin in 2021although the price of digital coins can be very volatile.

Tesla’s Frankfurt-listed shares rose more than 14% at the open on Wednesday. Mr. Musk, Tesla’s largest shareholder, supported Trump throughout his campaign.

However, experts predict a chaotic day elsewhere in financial markets as a response to global uncertainty and Trump’s potential plans for the economy.

Yields on US bonds, the amount the government promises to pay debt buyers, also jumped on Wednesday.

A bond is basically an IOU can be traded on financial markets, and governments often sell bonds to investors when they want to borrow money.

Analysts say this could be due to traders’ expectations that some of Trump’s economic measures could lead to higher prices.

For example, Donald Trump has said that he will significantly increase trade tariffs, especially on China, if he becomes the next US president.

Tariff impact

Some economists have warned that Trump’s proposals on trade would be a “shock” to the UK economy.

Ahmet Kaya, chief economist at the National Institute of Economic and Social Research (Niesr), said it could be “one of the hardest hit countries” under such plans.

It is estimated that economic growth in the UK will slow to 0.4% in 2025, down from a forecast of 1.2%.

“Trump’s global trade policies are causing particular concern in Asia, given the strong protectionist foundation on which the tariffs rest,” said Katrina Ell, director of economic research at Moody’s Analytics. Stronger measures against imports into the US have been committed.”

Trump’s more isolationist stance on foreign policy also raises questions about his willingness to defend Taiwan against potential aggression from China.

The self-governing island is a major manufacturer of computer chips, vital to the technology that drives the global economy.

Trump’s tax cuts have been widely welcomed by large corporations in the US.

“We should see pro-business policies and tax cuts, which in turn could spur inflation and cut interest rates at least,” said Jun Bei Liu, portfolio manager at Tribeca Investment Partners. than”.

Investors also have other important issues to focus on this week.

On Thursday, the US Federal Reserve will announce its latest decision on interest rates.

Comments from the head of the central bank, Jerome Powell, will be closely watched around the world.