250-year history is telling investors to bet on Treasury bonds in 2023, Bank of America says

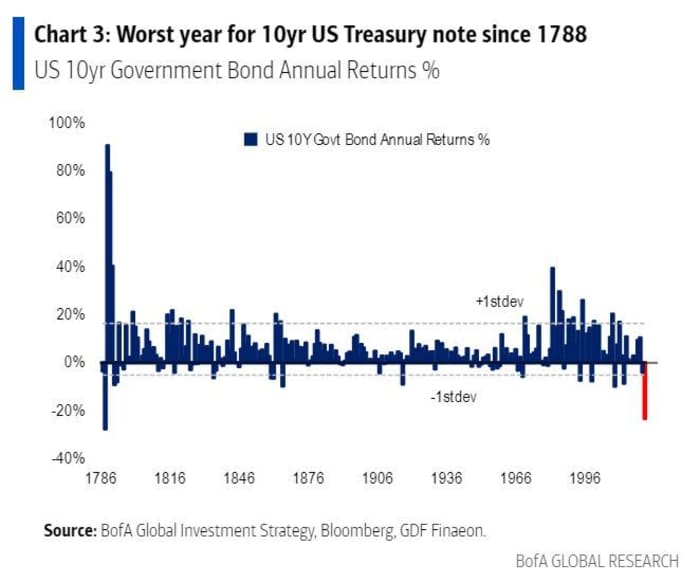

Benchmark US Treasuries are facing their worst annual returns since 1788, but are likely to surge in the new year, along with volatility in equities.

That’s according to a team of strategists at Bank of America led by Michael Hartnett, who examined 250-year history to conclude that bonds are headed for positive returns in 2023, as the market pivots away from “inflation shock” and interest rate shock. ‘” With expectations of a recession.

Chart from strategists showing 10-year Treasuries

TMUBMUSD10Y,

has lost 23% year-to-date so far and is set for the second consecutive annual loss. Hartnett said the last time investors saw such consecutive losses was from 1958 to 1959. Additionally, the asset class has never experienced three consecutive years of losses, and the last time. It most recently suffered a loss of more than 5%, followed by a positive profit in 1861, according to the bank.

Bank of America

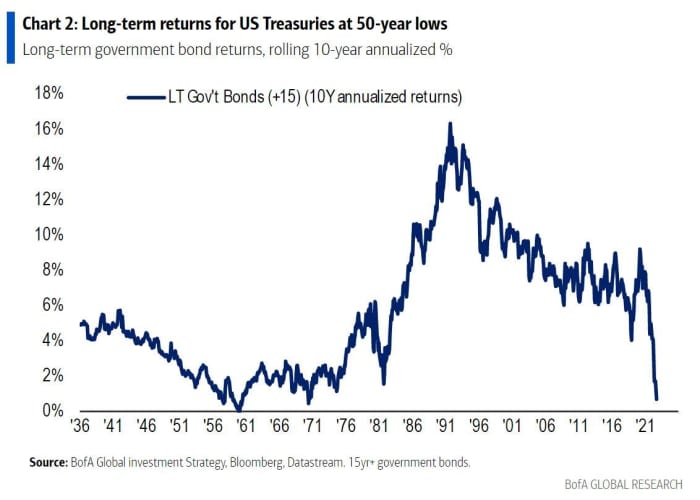

His next chart shows that long-term returns for US Treasuries have fallen to a 50-year low of 0.7%, from a peak of 9.7% during the pandemic lows in January. March 2020 for the stock market.

BofA

The market has seen 243 rate hikes globally this year, which Hartnett said amounted to once per trading day, but the bond market is now starting to pivot, due to the “blink” policy. eyes” from the Bank of England, Royal Australian Bank and Bank of Canada. .

Strategists said they see a “recession shock” to the markets ahead, which should lead to new high credit spreads, new lows for equities, possibly in the first quarter. first of next year. That’s even as stocks are setting up a rally in the fourth quarter as investors plummet in prices.

“The recession trade is always long bonds, short stocks,” he said, providing the chart below.

BofA

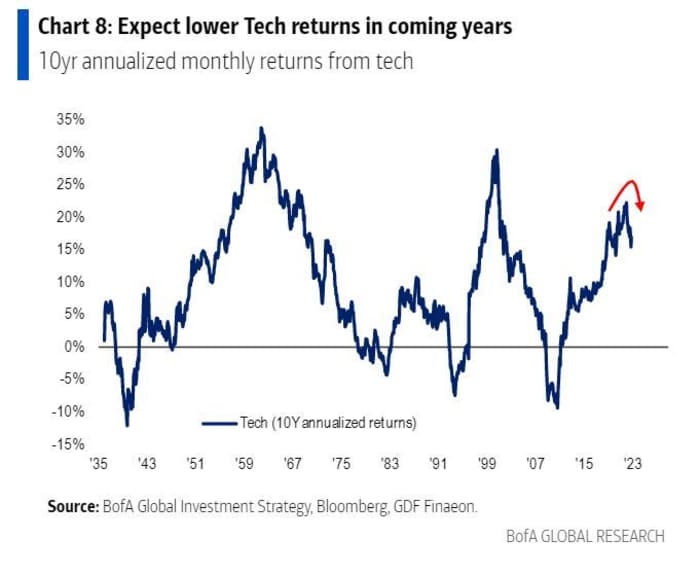

Recently, Big Tech has been through a period of income squeeze, with a new disappointment from Amazon.com

AMZN,

after Microsoft

MSFT,

Alphabet

GOOGL,

Meta . Platform

META,

and Snap

SNAP,

dismal income.

Idea: Facebook and Google became tech giants by ignoring Wall Street. Now it could lead to their downfall

Hartnett said those losses are just beginning, providing the following chart:

BofA

Idea: The cloud boom has come at its most stormy, and it’s costing investors billions of dollars.