2 ‘perfect 10’ stocks to be grateful for this Thanksgiving

This year has been difficult for investors. The inflation figure may have dropped in October, but it’s still at 7.7% from last October’s 6.2%, and that’s way too high. Interest rates are rising rapidly in response, making capital more expensive and available cash in the run for commodities constrained by tight supply chains and ongoing COVID-related lockdowns in China. Food and energy prices are high, and likely to rise, as Russia’s war in Ukraine puts a major strain on global supplies of natural gas, wheat and cooking oil. It’s no surprise that the stock market is volatile, making it increasingly difficult for investors to predict what will happen next.

But even with all those headwinds, there are stocks we can be grateful for this Thanksgiving season. These are market-proven performers that offer high returns for investors despite all the challenges the market faces in 2022.

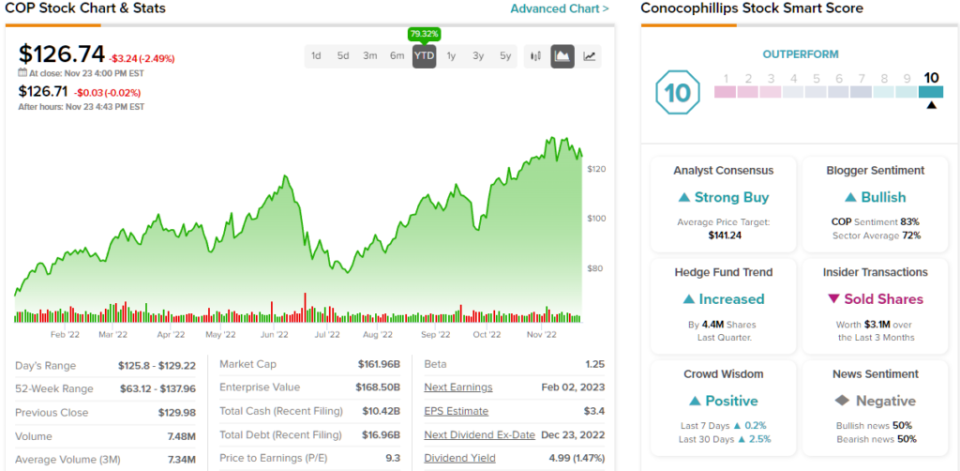

The positive attributes of these winning stocks are reflected in their Intelligence Score. The TipRanks Smart Score takes the data collected on every stock and collates that data against 8 separate categories, each of which is known to correlate positively with the stock’s future performance. The Smart Score gives each stock a score, on a scale of 1 to 10, making it easy to spot a stock’s key opportunity in the coming months at a glance.

In general, stocks that score a ‘perfect 10’ on the Smart Score will show solid results on each of the eight factors, but that’s not a hard and fast rule. When we looked at Smart Score data on two stocks that achieved that goal, we found that they provide investors with a solid foundation and a good mix of strengths. Let’s take a closer look.

ConocoPhillips (cop)

We’ll start in the energy industry, where ConocoPhillips is one of the industry’s oldest names. ConocoPhillips boasts a market capitalization of $158 billion, along with operations in 13 countries and order production of 1.5 million barrels of oil equivalent per day. Annual sales hit $46 billion last year and have surpassed that total this year; revenue in the first 9 months of the year reached 60.5 billion USD.

In the most recently reported quarter, Q3 FY22, revenue came in at $21.14 billion, up 79% year over year. Net income was 4.53 billion USD, growing by 90%; on a per-share basis, adjusted EPS was $3.60, representing a 103% increase from the previous quarter.

In addition to solid financial results, ConocoPhillips ended the quarter with $10.7 billion in cash and liquid assets on hand — after distributing $4.3 billion to shareholders through a $1.5 billion combination. $2.8 billion in dividends and $2.8 billion in share repurchases. During the quarter, the company increased its futures repurchase authorization by $20 billion and announced an 11% increase in quarterly dividend payments.

Against that backdrop, it’s no surprise that COP shares are up 83% year-to-date, outpacing the S&P 500’s 16% year-to-date decline.

Truist 5-star analyst Neal Dingmann It’s impossible not to praise ConocoPhillips, noting that the company has built on a really solid foundation.

“Conoco finds itself in an enviable financial and operating position, with virtually no debt, record production and large, quality inventories. While we’ve received some investor feedback focused on the company’s stock hitting a recent all-time high, we point out that the valuation still looks very reasonable to the stock is trading with a yield of ~15% FCF and an earnings basis of ~4.4x; including 20%+ discounts for the nearest industry players,” said Dingmann.

“Furthermore,” added the analyst, “we believe the company’s three-tier payback program is one of the better in the industry as it brings in more capital to investors than other companies. large companies, but still retain more financing options than some large companies. independent operator. We believe this combination gives investors what they currently want…”

In that context, it’s no surprise that Dingmann rates COP as Buy and his price target of $167 implies that it has a one-year upside potential of ~32%. (To see Dingmann’s achievements, click here)

Dingmann represents the bullish view on the COP, held by 15 of the 18 analysts who recently submitted a rating on the stock. Overall, the stock receives a strong Buy Recommendation from the consensus of analysts. (View COP . stock analysisis on TipRanks)

CECO environment (CECO)

Next, CECO Environment, as a ‘green’ company, researches, develops and installs new technologies in environmental air pollution control technology, energy technology, liquid treatment and purification. The company has found customers in sectors and industries as diverse as aerospace, automotive, brick manufacturing, cement, chemical, fuel refining and even glass manufacturing.

CECO’s revenue has grown fairly steadily – with five consecutive increases since early 2001. In the third quarter of 2022, the previous quarter reported, the company posted its highest revenue of $108.4 million, up 36%. Compared with the last year. Revenue was supported by a 10% increase in business orders to $101.7 million and a company backlog, a key measure of future business and earnings. futures, up 27% to $277.7 million. In a key turning point, net income came in at $1.9 million, up $3.1 million from a $1.2 million net loss in the previous quarter.

Reflecting these sensible metrics, CECO has published full-year 2022 revenue guidance of $410 million or more, forecasting a 25% year-over-year revenue increase.

Overall, investors are happy with CECO throughout the year and this is another stock that has outperformed the broader markets, posting solid share gains even during the pullbacks we’ve seen. throughout the year. CECO stock is up 83% year-to-date.

A look at CECO from Craig-Hallum, analyst Aaron Spychalla impressed by what he saw, noting: “CECO is seeing the benefits of a strategic shift from a business primarily focused on the longer, more cyclical Energy markets. and project-based to a more diversified energy market by product and vertical, with shorter profile cycles and end markets that are benefiting from ESG flows for clean air and Clean water. With solid fundamentals and growing visibility, a combination of company-specific and long-term growth drivers, coupled with a modest valuation, we reiterate our Buy rating. mine.”

A Buy Rating comes with a $17 price target, which suggests 48% growth by the end of next year. (To see Spychalla’s achievements, click here)

Overall, there are five recent analyst ratings for this stock – and they all agree that it’s a buy. This gives CECO stock a Strong Buy rating. (View CECO stock analysis on TipRanks)

Keep up with the Best TipRanks smart score must provide.

deny the responsibility: The opinions expressed in this article are those of prominent analysts only. Content is used for informational purposes only. It is very important that you do your own analysis before making any investment.