10 dividend aristocratic stocks that analysts expect to grow by as much as 54% by 2023

Stocks of companies that consistently increase their dividends have performed better in this year’s bear market.

Here’s a display of which stocks are analysts’ favorites for the coming year in Dividend Noble’s expanded list. Next is the list of Nobles with the highest dividend yield.

First, let’s define this group of stocks.

Resist when interest rates rise

S&P 500 dividend aristocracy index

XX:SP50DIV

made up of 63 stocks in the S&P 500 benchmark

SPX

has increased its regular dividend for at least 25 consecutive years. That’s the only requirement – it makes no difference whether the stock’s current yield is high or low. The index is equally weighted and tracked by the ProShares S&P 500 Dividend Aristocrats ETF.

NOBL.

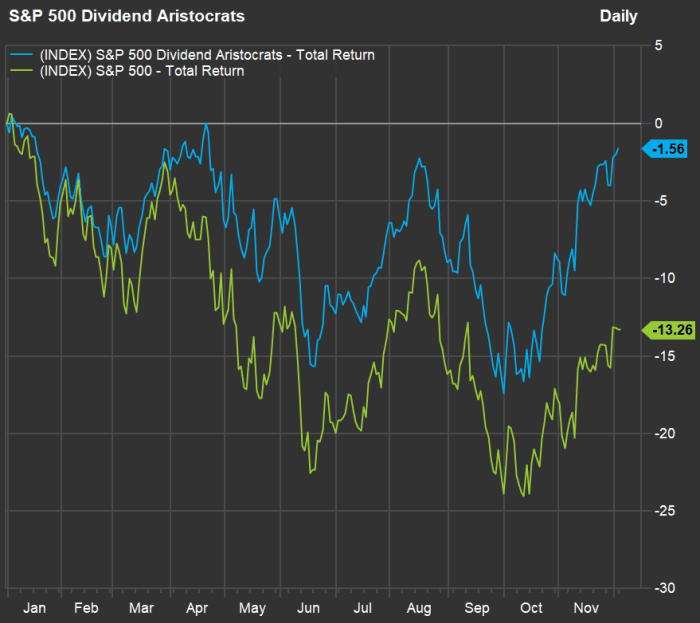

Here’s how the S&P 500 Dividend Aristocrat Index has performed against the S&P 500 this year through December 2 with reinvested dividends:

Datasets

Investors have gotten comfortable with Aristocrats during the stock’s widespread decline this year. But the outstanding performance is also reflected in the long-term returns of the indices:

| Table of contents | 3 years | 5 years | 10 years | 15 years | 20 years | 25 years | 30 years |

|

S&P 500 dividend aristocrat |

11.5% |

11.4% |

13.4% |

11.5% |

11.5% |

10.2% |

11.45% |

|

S&P 500 |

11.2% |

11.0% |

13.3% |

9.2% |

9.8% |

7.9% |

9.91% |

|

Source: FactSet |

|||||||

The S&P 500 Dividend Aristocrat Index has outperformed the S&P 500 in all periods across the board. But the best performance was over a period of 15 years or so, which was the factor that caused the 2008-2009 financial crisis and/or the inversion of the dot-com bubble in the two years to October 2018. 2002.

Investing in NOBLs is an easy way to go with this group, but you may also be interested in individual nobles for long-term growth or income investment.

Analysts’ favorite dividend aristocrat for 2023

For a broad range of dividend-paying Aristocrat stocks, we’ve expanded our group of companies by looking at two other Noble indexes maintained by the S&P Dow Jones Index:

-

The S&P 400 Dividend Aristocrat Index features 45 stocks of companies that have increased their dividends for at least 15 consecutive years, drawn from the full S&P Mid Cap 400 Index

BETWEEN.It is tracked by the ProShares S&P MidCap 400 Dividend Aristocrats ETF

REGISTER. -

S&P High Yield Dividend Nobility Index

XX:SPHYDAmade up of 119 stocks in the 1500 S&P Composite Index

XX:SP1500has increased its dividend for at least 20 consecutive years. It is tracked by the SPDR S&P Dividend ETF

SDY.The S&P Composite 1500 itself is made up of the S&P 500, S&P Mid Cap 400, and S&P 600 Small Cap Index.

SML.So, the S&P High Yield Dividend Aristocrat Index includes all stocks in the S&P 500 Dividend Aristocrat Index. But it excludes some in the S&P 400 Dividend Aristocrat Index. The high-yielding dividend aristocracy indexes are confusing because yields aren’t necessarily high — they range from 0.31% to 6.91%.

All together, removing duplicates, there are 134 companies in the three Dividend Aristocrat indexes.

To sift through the enthusiasm of analysts working for brokerages, we narrowed the list down to 119 included by at least five analysts polled by FactSet.

Of the 119 Dividend Nobles, 10 have a “buy” majority or equivalent rating and a 12-month upside potential of at least 10%, based on consensus estimates:

| Company | share | Share a “buy” rating | December 2 closing price | Consensus price target | Potential upside in 12 months | dividend yield |

|

Perrigo Co., Ltd |

PRGO |

100% |

$31.94 |

$49.25 |

54% |

3.26% |

|

Carlisle Corporation |

CSL |

75% |

$259.73 |

$348.33 |

34% |

1.16% |

|

Regal Rexnord Corporation |

RRX |

eighty six% |

$126.00 |

$159.57 |

27% |

1.11% |

|

ABM Industrial Corporation |

ABM |

eighty six% |

$46.29 |

$58.00 |

25% |

1.69% |

|

L3Harris Technology Company |

LHX |

52% |

$230.00 |

$269.37 |

17% |

1.95% |

|

Albemarle Corporation |

ALB |

56% |

$284.28 |

$317.49 |

twelfth% |

0.56% |

|

Lowe’s Co., Ltd |

SHORT |

56% |

$214.84 |

$239.87 |

twelfth% |

1.95% |

|

Essential utility company |

WRG |

sixty four% |

$48.32 |

$53.56 |

11% |

2.38% |

|

Exxon Mobil Corporation |

XOM |

56% |

$109.86 |

$120.59 |

ten% |

3.31% |

|

NextEra Energy Inc. |

NEE |

70% |

$85.20 |

$93.43 |

ten% |

2.00% |

|

Source: FactSet |

||||||

None of the dividend yields on the list are particularly high.

Some investors favor a high dividend yield for current income. Going back to the full list of 134 companies in the three dividend aristocracy indexes, here are the 10 companies with the highest dividend yields:

| Company | share | dividend yield | Share a “buy” rating |

|

Telephone and Data Systems Inc. |

TDS |

6.91% |

20% |

|

VF Group |

VFC |

6.14% |

33% |

|

Leggett & Platt Inc. |

FOOT |

4.98% |

25% |

|

National Retail Assets Inc. |

NNN |

4.76% |

40% |

|

Real estate income company |

Umbrella |

4.73% |

50% |

|

Company 3M |

MMM |

4.69% |

5% |

|

Walgreens Boots Alliance Inc. |

WBA |

4.63% |

17% |

|

International Business Machines Corp. |

IBM |

4.44% |

33% |

|

Tay Bac Joint Stock Company |

northwest |

4.33% |

33% |

|

Franklin Resource Co |

WHARF |

4.26% |

0% |

|

Source: FactSet |

|||

A high dividend yield can be important if you’re looking to generate current income, but it doesn’t necessarily correlate with high total long-term returns.

None of the stocks on this second-highest-yielding aristocrat list have a majority “buy” or equivalent rating, so price targets are not included in the table.

But you can click on the banners for more information about any of the companies or indexes in this article.

You should also read Tomi Kilgore’s detailed guide to loads of free information on the MarketWatch quotes page.

Do not miss: 20 dividend-paying stocks with high yields are becoming more attractive today